The cloud is coming of age. Fortune 500 companies like Coca-Cola and General Mills that once exclusively managed their own data centers are starting to migrate to the cloud. They’ve found that outsourcing vital IT infrastructure can be a reliable, cost-effective strategy.

The data center industry is projected to double by 2021 from its capacity in 2015, according to real estate consultant JLL. An expected explosion in Internet of Things applications will lead to even more bits and bytes being collected, stored, and analyzed. Factor in what JLL calls “American consumers’ insatiable thirst for digital content,” and you have explosive demand for data storage.

One new mini-trend: Cloud providers are spreading capacity near NFL cities, says Scott Ruch, AIA, Executive Managing Principal and Critical Facilities Sector Leader with Corgan, referring to large cities with National Football League teams.

New migrants to the cloud are also building their data centers to their large metro areas in order to sleep better knowing vital infrastructure is easily accessible near corporate offices. “They want the ability to check in on those facilities,” Ruch says. But rural areas with temperate climates (for more cost-efficient cooling) and low utility rates are still in the mix.

In Europe, some countries now require sensitive data to be housed within their borders. These regulations have complicated data center location decisions, in some cases forcing companies to build out sites in several countries rather than building one consolidated facility.

Data centers are getting cheaper to build. Five to 10 years ago, the average cost was $15-20 million per megawatt, Ruch says. Today, it’s $7-15 million. Customers are spending more wisely on risk mitigation. Shells to be used in high-risk hurricane and tornado zones must still be built to withstand 170-mph winds, but outside of those zones, less costly 120-mph-resistant structures will do.

UPS system design has been upgraded such that most facilities use block-redundant designs, which provide about 20% backup power redundancy, rather than more expensive two-end systems, with 100% redundancy. The smaller backup capacity is usually adequate for the mega-facilities being built by the big providers: if one site goes down completely, they can switch to another data center, Ruch says. Most of the big cloud providers have enough system-wide capacity to weather a short, single-site shutdown.

ALSO SEE: BD+C Giants 300 data centers rankings

Top 25 data center architecture firms

Top 30 data center engineering firms

Top 35 data center construction firms

RECYCLING OLDER DATA CENTERS

Many legacy data centers are becoming obsolete. As a result, a niche market in salvaged equipment has surfaced, says Jonathan Clay, President and CEO, The Blue River Group. Chillers, raised flooring, and backup generators can be reused, he says. Some older equipment is finding its way to Asia, Africa, and Mexico. “There’s no reason to put it in a landfill,” says Clay.

Data centers are also making significant strides in energy efficiency. Most cloud providers today aim for a power usage effectiveness rating of 1.25 or less, Ruch says, well ahead of the 1.5 to 1.6 PUE range of the last decade.

Indirect/direct evaporative cooling, known as IDEC, which uses outside ambient air for cooling purposes, has been refined to the point where even air temperatures in the low 80s can be suitable. Pinpoint cooling can be directed to specific racks rather than to the entire space, says Clay. Alternating hot racks with cool racks can also reduce the overall cooling burden. Removing the chassis from servers makes cooling more effective, too.

Some data centers track and publish their PUEs—some as low as 1.1—online and in real time, according to published reports. Big players like Google, Facebook, and Intel are leading the way. Salesforce recently said it has achieved net-zero greenhouse gas emissions and is now providing a carbon-neutral cloud for all customers.

These are encouraging developments. But with demand for storage capacity rising as fast as you can say YouTube, will data center providers be able to keep up?

SEE ALL 2017 GIANTS 300 RANKINGS

Related Stories

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Giants 400 | Oct 17, 2023

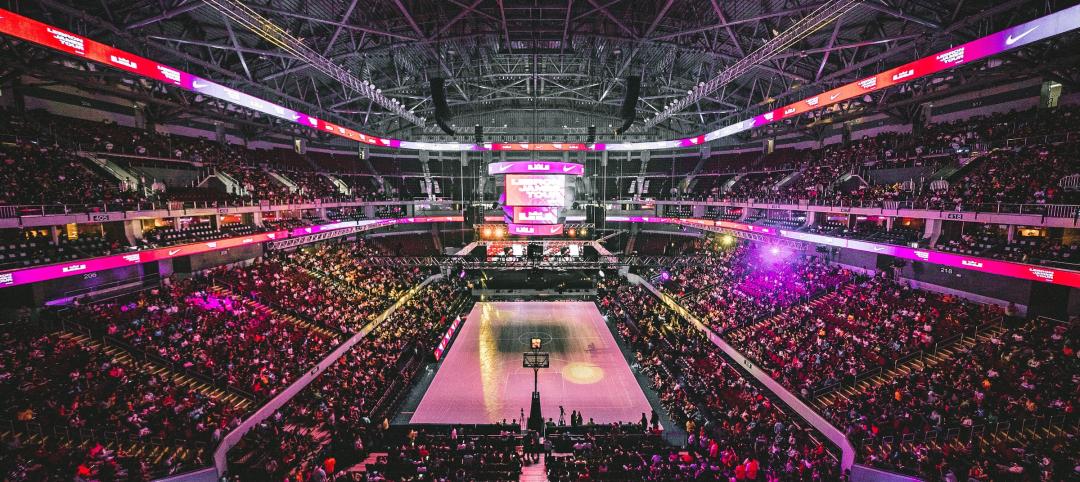

Top 70 Sports Facility Construction Firms for 2023

AECOM, Turner Construction, Clark Group, Mortenson head BD+C's ranking of the nation's largest sports facility contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 17, 2023

Top 70 Sports Facility Engineering Firms for 2023

Alfa Tech Consulting Engineers, ME Engineers, AECOM, and Henderson Engineers top BD+C's ranking of the nation's largest sports facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 17, 2023

Top 130 Sports Facility Architecture Firms for 2023

Populous, Gensler, HOK, and HKS head BD+C's ranking of the nation's largest sports facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 11, 2023

Top 100 Industrial Construction Firms for 2023

ARCO Construction, Clayco, Walbridge, and Gray Construction top the ranking of the nation's largest industrial facility sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 11, 2023

Top 90 Industrial Sector Engineering Firms for 2023

Jacobs, IPS, CRB Group, and Burns & McDonnell head the ranking of the nation's largest industrial facility sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 11, 2023

Top 100 Industrial Sector Architecture Firms for 2023

Ware Malcomb, Arcadis, Stantec, and Gresham Smith top the ranking of the nation's largest industrial facility sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 5, 2023

Top 115 Healthcare Construction Firms for 2023

Turner Construction, Brasfield & Gorrie, JE Dunn Construction, DPR Construction, and McCarthy Holdings top BD+C's ranking of the nation's largest healthcare sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.

Giants 400 | Oct 5, 2023

Top 90 Healthcare Engineering Firms for 2023

Jacobs, WSP, IMEG, BR+A, and Affiliated Engineers head BD+C's ranking of the nation's largest healthcare sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.