Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

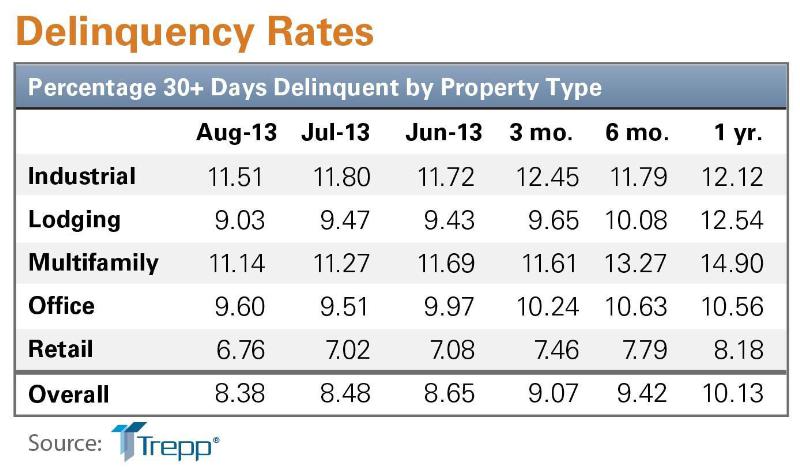

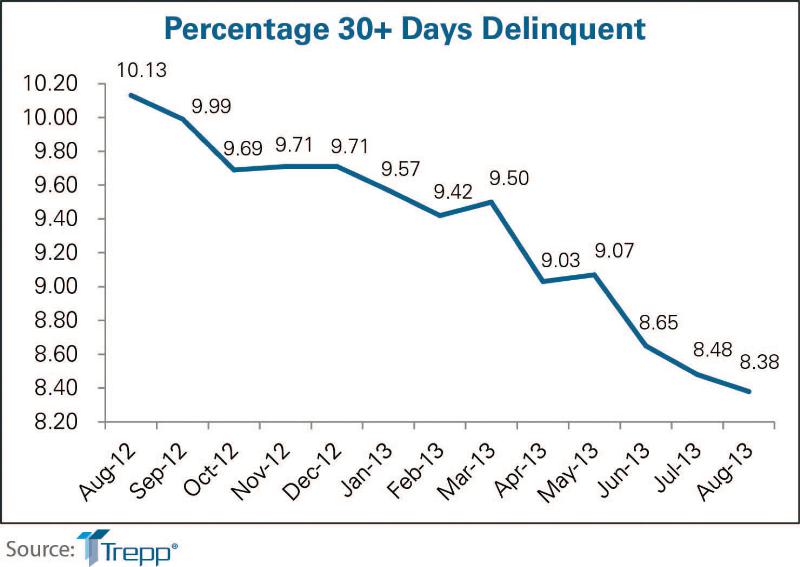

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Nov 27, 2013

Exclusive survey: Revenues increased at nearly half of AEC firms in 2013

Forty-six percent of the respondents to an exclusive BD+C survey of AEC professionals reported that revenues had increased this year compared to 2012, with another 24.2% saying cash flow had stayed the same.

| Nov 27, 2013

Wonder walls: 13 choices for the building envelope

BD+C editors present a roundup of the latest technologies and applications in exterior wall systems, from a tapered metal wall installation in Oklahoma to a textured precast concrete solution in North Carolina.

| Nov 27, 2013

University reconstruction projects: The 5 keys to success

This AIA CES Discovery course discusses the environmental, economic, and market pressures affecting facility planning for universities and colleges, and outlines current approaches to renovations for critical academic spaces.

| Nov 26, 2013

7 ways to make your firm more successful

Like all professional services businesses, AEC firms are challenged to effectively manage people. And even though people can be rather unpredictable, a firm’s success doesn’t have to be. Here are seven ways to make your firm more successful in the face of market variability and uncertainty.

| Nov 26, 2013

Design-build downsized: Applying the design-build method in an era of smaller projects

Any project can benefit from the collaborative spirit and cooperative relationships embodied by design-build. But is there a point of diminishing return where the design-build project delivery model just doesn't make sense for small projects? Design-build expert Lisa Cooley debates the issue.

| Nov 25, 2013

Electronic plan review: Coming soon to a city near you?

With all the effort AEC professionals put into leveraging technology to communicate digitally on projects, it is a shame that there is often one major road block that becomes the paper in their otherwise “paperless” project: the local city planning and permitting department.

| Nov 22, 2013

Kieran Timberlake, PE International develop BIM tool for green building life cycle assessment

Kieran Timberlake and PE International have developed Tally, an analysis tool to help BIM users keep better score of their projects’ complete environmental footprints.

| Nov 20, 2013

Architecture Billings Index slows in October; project inquiries stay strong

Following three months of accelerating demand for design services, the Architecture Billings Index reflected a somewhat slower pace of growth in October. The October ABI score was 51.6, down from a mark of 54.3 in September.

| Nov 19, 2013

Pediatric design in an adult hospital setting

Freestanding pediatric facilities have operational and physical characteristics that differ from those of adult facilities.

| Nov 18, 2013

6 checkpoints when designing a pediatric healthcare unit

As more time and money is devoted to neonatal and pediatric research, evidence-based design is playing an increasingly crucial role in the development of healthcare facilities for children. Here are six important factors AEC firms should consider when designing pediatric healthcare facilities.