Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

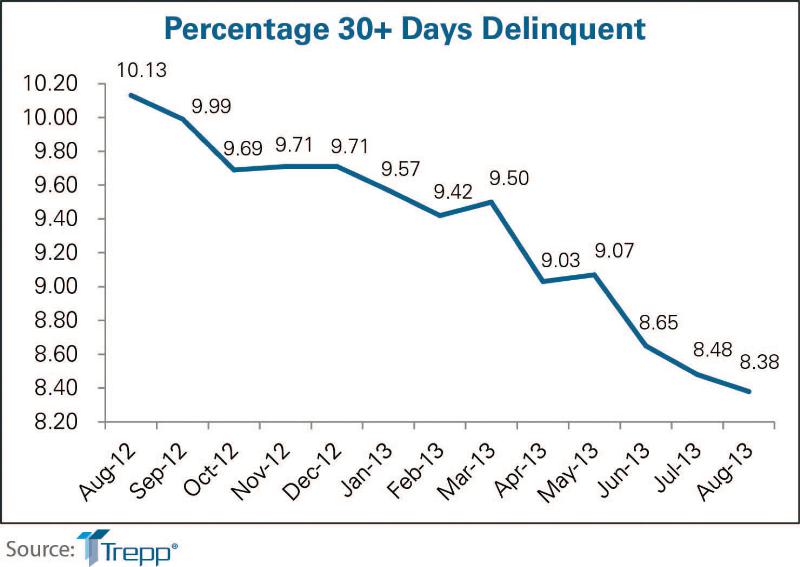

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

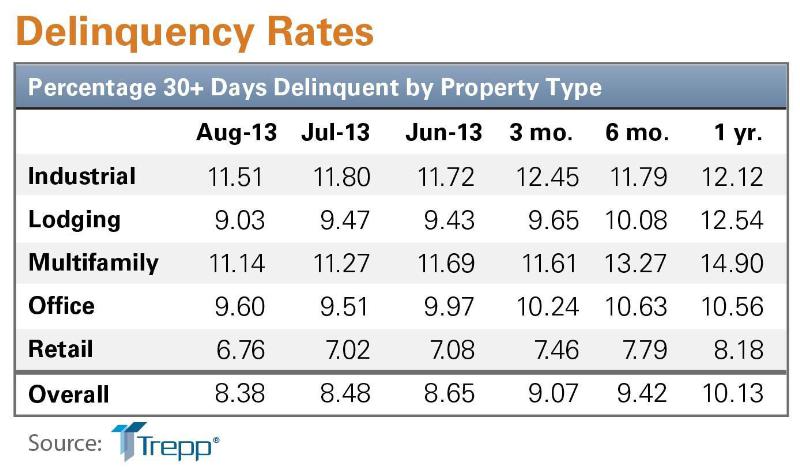

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| May 3, 2013

SMPS Foundation accepting applications for Ron Garikes Student Scholarship

The SMPS Foundation is now accepting scholarship applications from eligible students majoring in marketing, communications, or public relations who are planning a career in professional services marketing in the architecture, engineering, and construction industry.

| May 3, 2013

Another edible city? Artist creates model city with chewing gum

French artist Jeremy Laffon pieced together a model city with thousands of sticks of mint-green chewing gum.

| May 2, 2013

First look: UC-Davis art museum by SO-IL and Bohlin Cywinski Jackson

The University of California, Davis has selected emerging New York-based practice SO-IL to design a new campus’ art museum, which is envisioned to be a “regional center of experimentation, participation and learning.”

| May 2, 2013

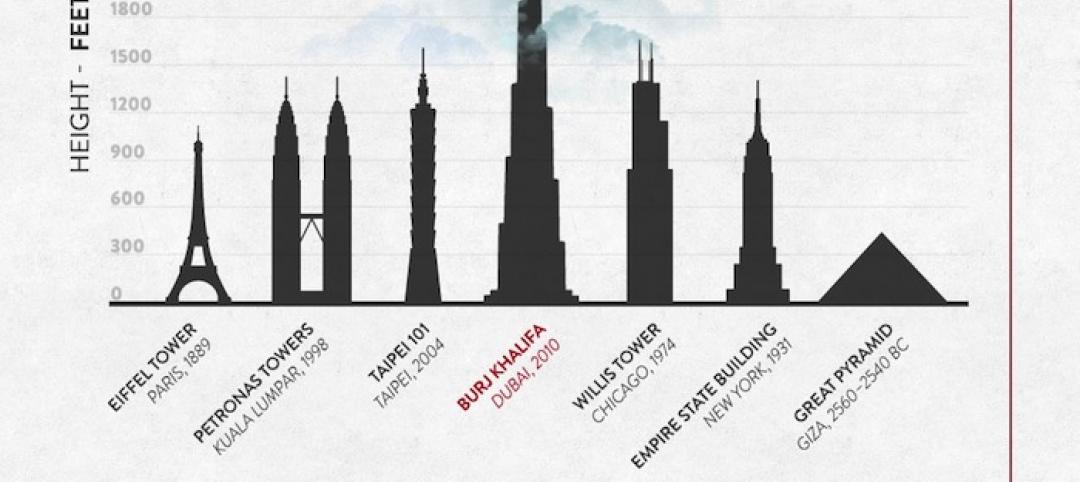

A snapshot of the world's amazing construction feats (in one flashy infographic)

From the Great Pyramids of Giza to the U.S. Interstate Highway System, this infographic outlines interesting facts about some of the world's most notable construction projects.

| May 2, 2013

Holl-designed Campbell Sports Center completed at Columbia

Steven Holl Architects celebrates the completion of the Campbell Sports Center, Columbia University’s new training and teaching facility.

| May 2, 2013

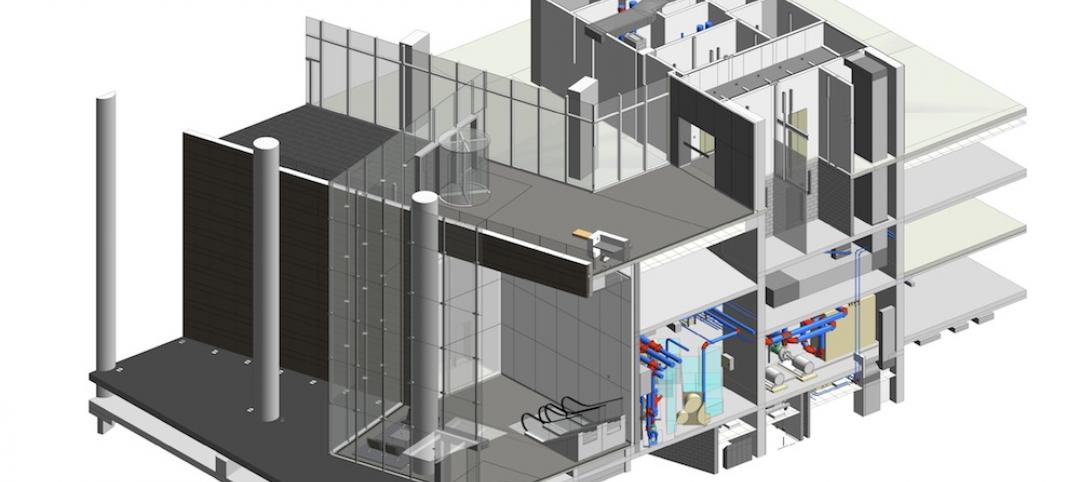

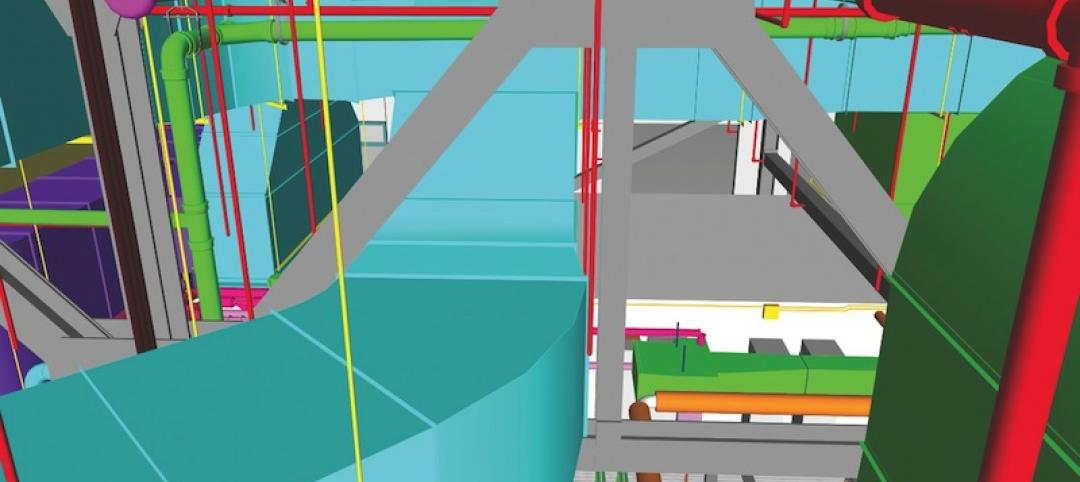

BIM group proposes uniform standards for how complete plans need to be

A nationwide group of Building Information Modeling users, known as the BIMForum, is seeking industry input on a proposed set of standards establishing how complete Building Information Models (BIMs) need to be for different stages of the design and construction process.

| May 2, 2013

New web community aims to revitalize abandoned buildings

Italian innovators Andrea Sesta and Daniela Galvani hope to create a worldwide database of abandoned facilities, ripe for redevelopment, with their [im]possible living internet community.