Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

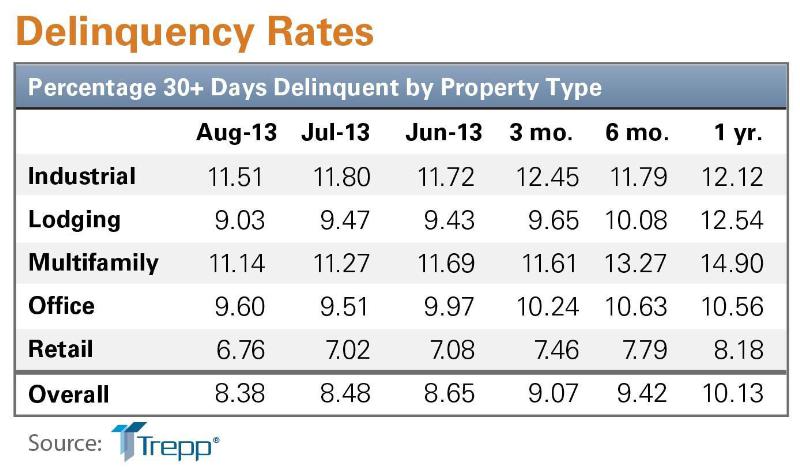

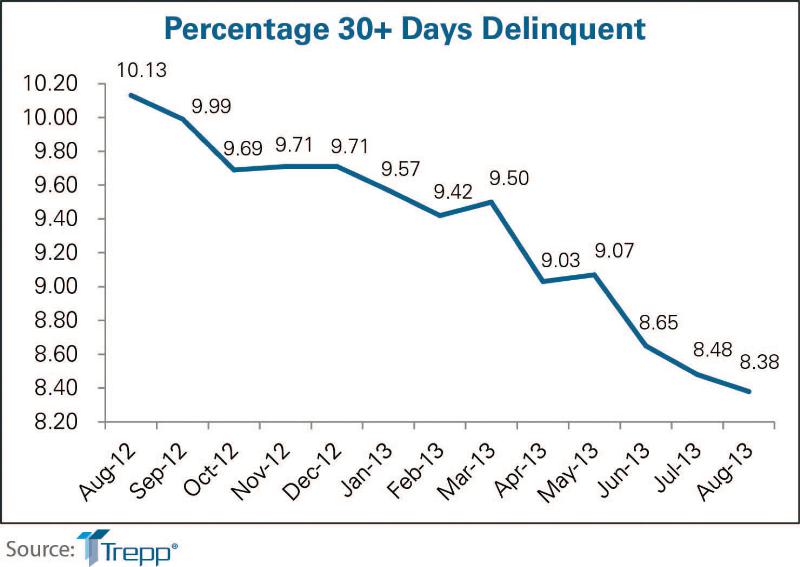

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Sep 19, 2012

HGA Architects & Engineers moves offices in San Francisco

HGA’s San Francisco office has grown by nearly 25% in the past two years, adding shared expertise to the 120-person California practice, which includes the Sacramento and Los Angeles offices.

| Sep 19, 2012

Sasaki opens office in Shanghai

Office supports firm’s present and future work in China, throughout Asia.

| Sep 18, 2012

MBMA partners with ORNL for whole building energy efficiency study

The results are intended to advance energy efficiency solutions for new and retrofit applications.

| Sep 18, 2012

MKK opens office in North Dakota

MKK is currently working on seven projects in North Dakota, including a hotel, restaurant, truck stop, office building, and apartment complex.

| Sep 18, 2012

Firestone Building Products launches new website

Deep product information and innovative customer support tools are highlights.

| Sep 13, 2012

Leo A Daly Company promotes Kraskiewicz to senior vice president

Kraskiewicz, who most recently served as chief operations officer for the Leo A Daly division, will guide brand management, business development, operations and financial performance for 18 offices worldwide.

| Sep 13, 2012

Acentech adds audiovisual expertise to Trevose, Penn. office

Artese focuses on advising, overseeing, and maintaining the client’s vision for the project from the initial kick-off meeting to the final commissioning of the completed systems.

| Sep 13, 2012

Margulies Perruzzi Architects completes office design for Pioneer Investments

MPA updated the office design and additional support space consisting of five floors at Pioneer’s Boston office located at 60 State Street.

| Sep 12, 2012

Harvesting new ways to eliminate waste at the USDA

After installing 20 high-speed, energy-efficient hand dryers in restrooms throughout the USDA headquarters; the USDA reports seeing an immediate 50% reduction in the use of paper towels.

| Sep 11, 2012

RTKL appoints Lance Hosey as Chief Sustainability Officer and Senior Vice President

Author and authority on green design to spearhead RTKL Performance-driven DesignSM initiative.