Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

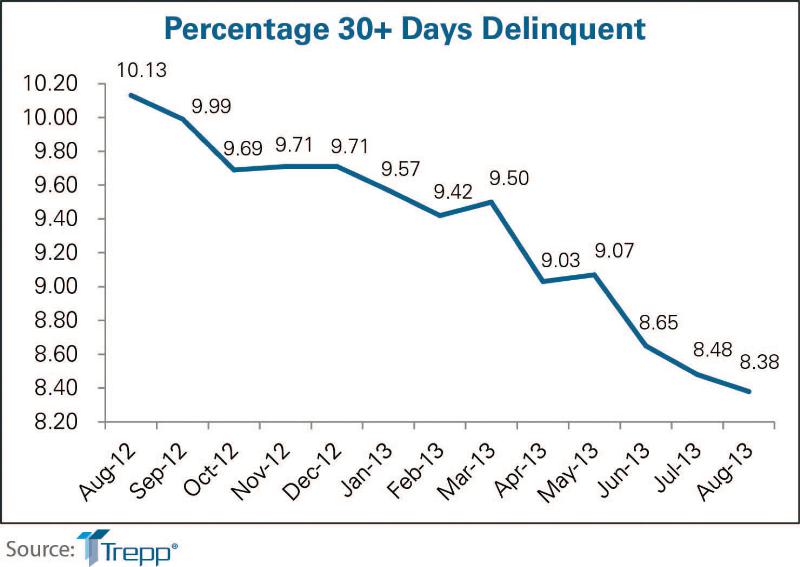

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

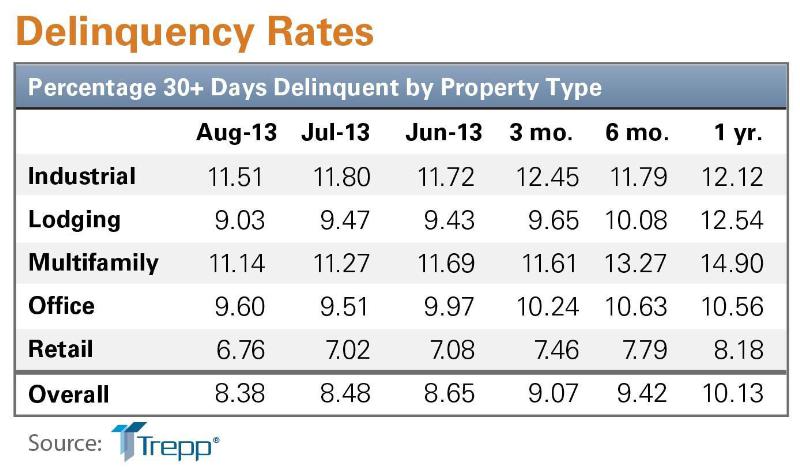

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Mar 21, 2012

ABI remains positive for fourth straight month

Highest spike in inquiries for new projects since 2007.

| Mar 21, 2012

Iowa’s Mercy Medical Center’s new Emergency Department constructed using Lean design

New Emergency Department features a "racetrack" design with a central nurses' station encircled by 19 private patient examination rooms and 2 trauma treatment rooms.

| Mar 21, 2012

Clary, Hendrickson named regional directors for HDR Architecture

New directors will be responsible for expanding and strengthening the firm throughout the central region.

| Mar 20, 2012

FMI releases 2012 first quarter construction outlook

The last time construction put in place was at this level was 2000-2001.

| Mar 20, 2012

Ceco Building Systems names Romans marketing director

Romans joins Ceco Building Systems with over 15 years in marketing and customer service.

| Mar 20, 2012

UT Arlington launches David Dillon Center for Texas Architecture

Symposium about Texas architecture planned for April.

| Mar 20, 2012

Stanford’s Knight Management Center Awarded LEED Platinum

The 360,000-sf facility underscores what is taught in many of the school’s electives such as Environmental Entrepreneurship and Environmental Science for Managers and Policy Makers, as well as in core classes covering sustainability across the functions of business.

| Mar 20, 2012

New office designs at San Diego’s Sunroad Corporate Center

Traditional office space being transformed into a modern work environment, complete with private offices, high-tech conference rooms, a break room, and an art gallery, as well as standard facilities and amenities.

| Mar 19, 2012

Obama’s positioned to out-regulate Bush in second term

Proposed ozone rule would cost $19 billion to $90 billion in 2020, according to the White House.

| Mar 19, 2012

Skanska promotes Saunders to VP/GM of Bayshore Concrete Products

During his more than 13 years with Bayshore, Saunders has provided products for Victory Bridge in New Jersey, Route 52 Causeway in Ocean City, N.J., and for numerous piers at Naval Station Norfolk and the Norfolk Naval Shipyard.