Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

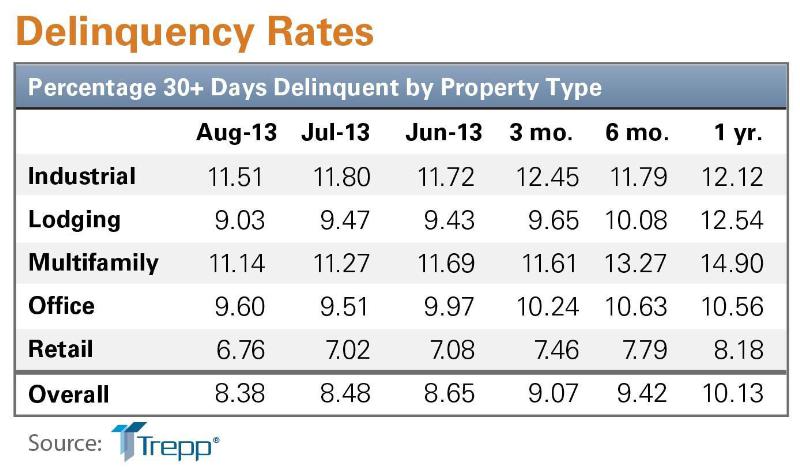

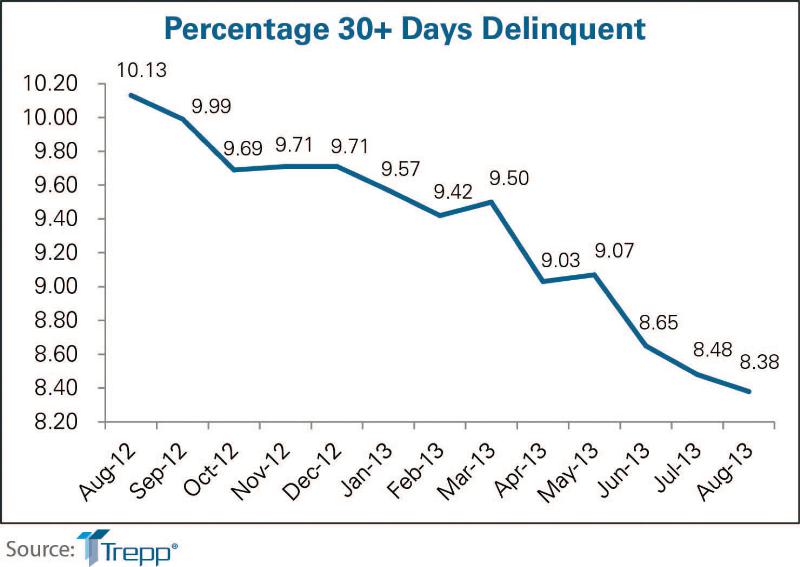

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Dec 20, 2011

Third annual Gingerbread Build-off winners announced

Nine awards were handed out acknowledging the most unique and creative gingerbread structures completed.

| Dec 20, 2011

BCA’s Best Practices in New Construction available online

This publicly available document is applicable to most building types and distills the long list of guidelines, and longer list of tasks, into easy-to-navigate activities that represent the ideal commissioning process.

| Dec 20, 2011

Aragon Construction leading build-out of foursquare office

The modern, minimalist build-out will have elements of the foursquare “badges” in different aspects of the space, using glass, steel, and vibrantly painted gypsum board.

| Dec 20, 2011

HOAR Construction opens Austin, Texas office

Major projects in central Texas spur firm’s growth.

| Dec 19, 2011

HGA renovates Rowing Center at Cornell University

Renovation provides state-of-the-art waterfront facility.

| Dec 19, 2011

Chicago’s Aqua Tower wins international design award

Aqua was named both regional and international winner of the International Property Award as Best Residential High-Rise Development.

| Dec 19, 2011

Summit Design+Build selected as GC for Chicago recon project

The 130,000 square foot building is being completely renovated.

| Dec 19, 2011

USGBC welcomes new board directors?

Board responsible for articulating and upholding the vision, values, mission of organization.

| Dec 19, 2011

Davis Construction breaks ground on new NIAID property

The new offices will total 490,998 square feet in a 10-story building with two wings of 25,000 square feet each.

| Dec 19, 2011

Survey: Job growth driving demand for office and industrial real estate in Southern California

Annual USC Lusk Center for Real Estate forecast reveals signs of slow market recovery.