Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

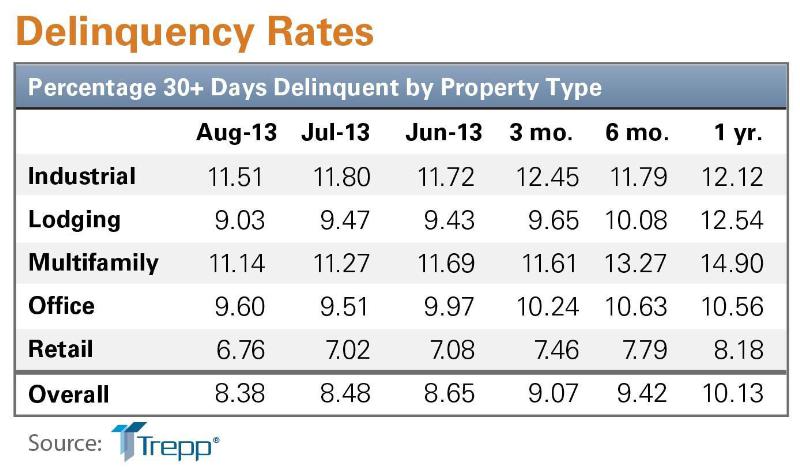

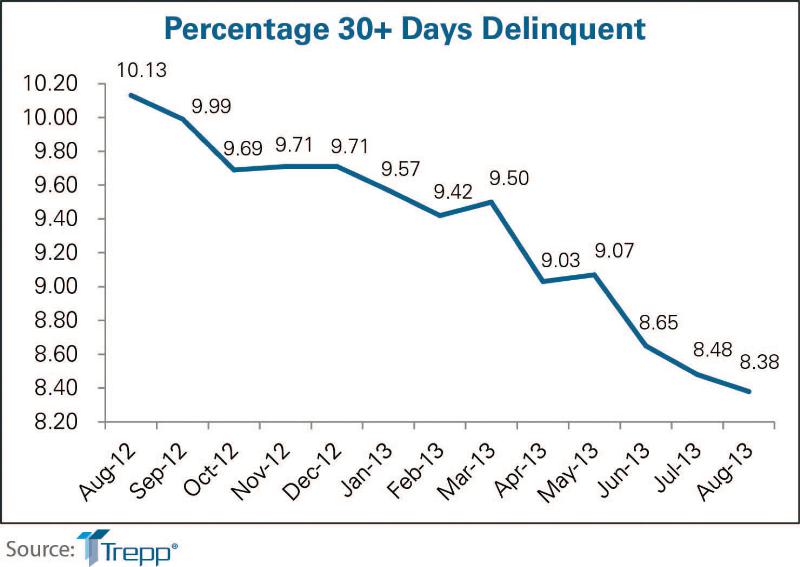

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Aug 11, 2010

Wisconsin becomes the first state to require BIM on public projects

As of July 1, the Wisconsin Division of State Facilities will require all state projects with a total budget of $5 million or more and all new construction with a budget of $2.5 million or more to have their designs begin with a Building Information Model. The new guidelines and standards require A/E services in a design-bid-build project delivery format to use BIM and 3D software from initial ...

| Aug 11, 2010

Opening night close for Kent State performing arts center

The curtain opens on the Tuscarawas Performing Arts Center at Kent State University in early 2010, giving the New Philadelphia, Ohio, school a 1,100-seat multipurpose theater. The team of Legat & Kingscott of Columbus, Ohio, and Schorr Architects of Dublin, Ohio, designed the 50,000-sf facility with a curving metal and glass façade to create a sense of movement and activity.

| Aug 11, 2010

Residence hall designed specifically for freshman

Hardin Construction Company's Austin, Texas, office is serving as GC for the $50 million freshman housing complex at the University of Houston. Designed by HADP Architecture, Austin, the seven-story, 300,000-sf facility will be located on the university's central campus and have 1,172 beds, residential advisor offices, a social lounge, a computer lab, multipurpose rooms, a fitness center, and a...

| Aug 11, 2010

News Briefs: GBCI begins testing for new LEED professional credentials... Architects rank durability over 'green' in product attributes... ABI falls slightly in April, but shows market improvement

News Briefs: GBCI begins testing for new LEED professional credentials... Architects rank durability over 'green' in product attributes... ABI falls slightly in April, but shows market improvement

| Aug 11, 2010

Luxury Hotel required faceted design

Goettsch Partners, Chicago, designed a new five-star, 214-room hotel for the King Abdullah Financial District (KAFD) in Riyadh, Saudi Arabia. The design-build project, with Saudi Oger Ltd. as contractor and Rayadah Investment Co. as developer, has a three-story podium supporting a 17-story glass tower with a nine-story opening that allows light to penetrate the mass of the building.

| Aug 11, 2010

Three Schools checking into L.A.'s Ambassador Hotel site

Pasadena-based Gonzalez Goodale Architects is designing three new schools for Los Angeles Unified School District's Central Wilshire District. The $400 million campus, located on the site of the former Ambassador Hotel, will house a K-5 elementary school, a middle school, a high school, a shared recreation facility (including soccer field, 25-meter swimming pool, two gymnasiums), and a new publ...

| Aug 11, 2010

New Jersey's high-tech landscaping facility

Designed to enhance the use of science and technology in Bergen County Special Services' landscaping programs, the new single-story facility at the technical school's Paramus campus will have 7,950 sf of classroom space, a 1,000-sf greenhouse (able to replicate different environments, such as rainforest, desert, forest, and tundra), and 5,000 sf of outside landscaping and gardening space.

| Aug 11, 2010

U.S. firm designing massive Taiwan project

MulvannyG2 Architecture is designing one of Taipei, Taiwan's largest urban redevelopment projects. The Bellevue, Wash., firm is working with developer The Global Team Group to create Aquapearl, a mixed-use complex that's part of the Taipei government's "Good Looking Taipei 2010" initiative to spur redevelopment of the city's Songjian District.