Optimism is high among the giant engineering and engineering/architecture (EA) firms, as the economy continues to stabilize and promising new technologies, services, and programs provide opportunities to bolster profits and revenue.

Profitability among engineering and architecture firms reached a six-year high in 2015, according to AEC industry consultant PSMJ Resources. In its newly released 2015 PSMJ A/E Financial Performance Benchmark Survey Report (www.BDCnetwork.com/PSMJreport2015), which polled 328 firms across the U.S. and Canada, the group reported that the median AE firm operating profit margins on net revenue (before incentive/bonus payments and taxes) reached 14.3% this year, up from an all-time low of 9.3% in 2012 and just 90 basis points from the pre-recession high-water mark of 15.2%. Profitability has climbed every year since 2012—11.4% in 2013 and 13.0% in 2014—an indication that backlogs are starting to fill up, according to PSMJ.

Revenues are on the rise as well, according to data from BD+C’s annual Giants 300 report. Of the 92 engineering firms that participated in the report, 63 companies (69% of the group) reported higher YOY revenue, and only 24 firms saw a decrease in revenue (five companies reported flat revenue).

The vast majority of engineering firms are decidedly bullish on revenue growth for 2015. Of the 75 firms that provided a revenue projection for this year, 70 firms (93%) are forecasting higher revenue compared to 2014, and 27 companies (36%) said they are on pace to achieve double-digit revenue growth in 2015.

TOP ENGINEERING FIRMS

2014 Engineering Revenue ($)

1. Fluor $729,650,000

2. WSP | Parsons Brinckerhoff $239,435,952

3. Arup $144,879,099

4. Vanderweil Engineers $104,653,700

5. Affiliated Engineers $101,735,000

6. Syska Hennessy Group $100,406,189

7. KPFF Consulting Engineers $100,272,200

8. Henderson Engineers $77,486,099

9. Simpson Gumpertz & Heger $76,939,000

10. Jensen Hughes $72,022,905

TOP ENGINEERING/ARCHITECTURE FIRMS

2014 Eng/Arch Revenue ($)

1. Jacobs* $5,969,540,000

2. AECOM $769,040,000

3. Thornton Tomasetti $166,420,458

4. Burns & McDonnell $144,794,135

5. SSOE Group $126,948,481

6. Leidos $107,962,000

7. Woolpert $96,889,806

8. Wiss, Janney, Elstner Associates $88,482,200

9. Dewberry $86,962,679

10. CRB $80,841,300

ENGINEERING GIANTS SPONSORED BY:

What’s driving the growth? Market expansion and niche market opportunities were the growth drivers cited most often by firms, according to the Giants report. Other opportunities include (in order of importance): adding new services (e.g., commissioning, energy modeling), the improving economy, merger/acquisition deals, and operational efficiencies.

The firms with the highest profit margins and largest revenue growth are the ones that can deliver higher value to clients and command higher fees, says Frank A. Stasiowski, FAIA, Founder and CEO of PSMJ. “Just because the median [profit margin] has reached 14.3%, that doesn’t mean it should be an acceptable profit margin at all for an AE firm,” he adds. Firms that outperform the median profit margin “think differently about project delivery, about marketing strategy, about value.”

To deliver greater value to its clients, Smith Seckman Reid (SSR, www.ssr-inc.com) reorganized its operations around three business units—Facilities, Commissioning/Energy Consulting, and Infrastructure—which are interconnected to allow for a seamless exchange of production capabilities, thought leadership, and business development approaches. The move also encourages selling the firm’s services across its 12 office locations, which had led to increased sales and higher profitability. By the end of 2014, SSR’s backlog was up 13.2%, and its net operating cash flow was up 700%.

“The recession created a more competitive environment with lower fees and higher expectations,” says Rob Barrick, PE, LEED AP, President and CEO of SSR. “We undertook this reorganization three years ago to simplify our business, focus on projects rather than profit centers, and better leverage our resources and talent no matter where they reside in the organization.”

Ross & Baruzzini (www.rossbar.com) nearly doubled its profit margin on projects during the past year by implementing weekly project profitability reports for all design team members. The standardized report provides budget data on the original project multiplier, earned-at-completion project multiplier, and individual discipline budget status based on the original project multiplier.

“We believe that, through greater awareness of a project’s financial performance across the breadth of the project team, accountability is enhanced, which directly leads to better results,” says Bill Overturf, SVP and COO at Ross & Baruzzini.

Here’s a recap of other innovations and business moves reported by the engineering and EA giants as part of the Giants 300 survey:

Thornton Tomasetti (www.thorntontomasetti.com) created an internal innovation suggestion box to help spark ideas for advancing the AEC industry. Among the program’s early successes are a series of mobile apps to assist with project management and research into adapting NASA mass damping technology for the building construction industry.

Over the last three years, KLH Engineers (www.klhengrs.com) has invested $1,500 per employee in training—both hard skills and soft skills, such as communications and client service. The ultimate goal is to provide client service with a personal touch.

Wick Fisher White (www.wfweng.com) increased its commissioning revenue by 11% last year by focusing marketing efforts on thought-leadership practices, like lunch-and-learns and speaking opportunities.

In the midst of a growth spurt, Syska Hennessy Group (www.syska.com) launched SENSE (Syska Employee Network of Support and Education), a system of structures and processes for developing staff, sharing technical knowledge, and fostering communication and culture across all levels of the company. Geared for employees with two to 12 years of experience, the program uses interdepartmental activities, including one-on-one meetings between mid-level and upper-level team members, networking, and professional development events, “to promote team bonding and a community spirit, connecting more junior-level employees to the rest of the company,” says Syska Co-president Cyrus Izzo.

RAISING THE BAR ON TECHNOLOGY

Dozens of firms reported technology innovations and implementations. TLC Engineering for Architecture’s IT team (www.tlc-engineers.com) devised a way to provide its designers with high-performance, BIM-optimized computers without breaking the bank. Through the use of virtual machines, multiple “dumb” computers access a high-speed server, providing TLC’s designers with the necessary speed to handle complex BIM/VDC models.

Henderson Engineers (www.hei-eng.com) consolidated access to all of its design tools, training documents, and design standards into a searchable wiki interface. “By linking to internally created documents, as well as external websites, we have expanded our design tools beyond the borders of our office without asking users to differentiate between content sources,” says Rich Smith, PE, LEED AP, the firm’s President and CEO. Smith says that by standardizing policies and documents, Henderson’s designers have more time available for creativity on projects.

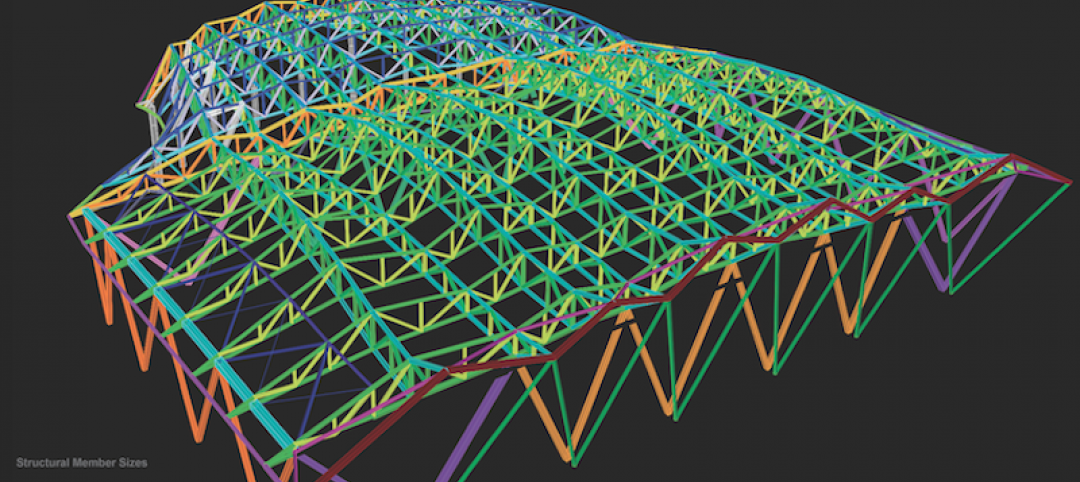

Magnusson Klemencic Associates (www.mka.com) developed a series of data transfer protocols to help streamline the transfer of structural element data between structural steel analysis programs and BIM models. The protocols allow MKA’s designers to pull complete and detailed structural information directly into Revit, saving multiple weeks of tedious modeling effort. The firm also created a custom tool for generating analysis models for complicated repetitive structures. The tool enables rapid turnaround of design iterations, significantly increasing the number of architectural options that can be evaluated.

H.F. Lenz Company (www.hflenz.com) is developing an ultra-efficient and sustainable technology for cooling computer equipment. The method uses applied physics to realize the previously unexploited cooling potential inherent in fast-moving gas flows. Outdoor air is utilized as the fluid stream and is channeled through patented heat exchangers that provide conductive cooling to the IT components. It eliminates the need for water or refrigerants, is energy efficient, and requires less space than conventional cooling technologies.

RETURN TO THE GIANTS 300 LANDING PAGE

Related Stories

Giants 400 | Sep 22, 2017

Top 30 hotel engineering firms

NV5 Global, WSP, and DeSimone Consulting Engineers top BD+C’s ranking of the nation’s largest hotel sector engineering and EA firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 22, 2017

Top 60 hotel architecture firms

Gensler, WATG and Wimberly Interiors, and HKS top BD+C’s ranking of the nation’s largest hotel sector architecture and AE firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 20, 2017

Bubble? What bubble?: Apartment and condo construction simply can't keep up with demand

Since the current multifamily boom took off in 2010, most activity has focused on large urban areas.

Giants 400 | Sep 18, 2017

Top 40 multifamily engineering firms

WSP, AECOM, and Thronton Tomasetti top BD+C’s ranking of the nation’s largest multifamily sector engineering and EA firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 14, 2017

Top 95 multifamily architecture firms

Humphreys & Partners Architects, KTGY, and Perkins Eastman top BD+C’s ranking of the nation’s largest multifamily sector architecture and AE firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 13, 2017

Top 75 retail construction firms

The Whiting-Turner Contracting Co., PCL Construction Enterprises, and Shawmut Design and Construction top BD+C’s ranking of the nation’s largest retail sector contractor and construction management firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 13, 2017

Retailers look beyond the sale: Brick-and-mortar retailers are raising their game to lure plugged-in consumers to their stores

Just two months ago, Credit Suisse forecasted that 20-25% of malls will close by 2022.

Giants 400 | Sep 12, 2017

Top 40 retail engineering firms

WSP, Henderson Engineers, and Core States Group top BD+C’s ranking of the nation’s largest retail sector engineering and EA firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 11, 2017

Top 65 retail architecture firms

CallisonRTKL, Jacobs, and Gensler top BD+C’s ranking of the nation’s largest retail sector architecture and AE firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Sep 7, 2017

Top 95 university construction firms

Turner Construction Co., The Whiting-Turner Contracting Co., and Barton Malow top BD+C’s ranking of the nation’s largest university sector contractor and construction management firms, as reported in the 2017 Giants 300 Report.