In the United States, the environment where outpatient healthcare is being delivered is as dynamic and diverse as the more high profile office and retail markets. Unlike its real estate sector counterparts, unique local, state, and federal healthcare regulations significantly impact the size, type, and location where physicians provide patient care.

While there is no right or wrong product type/location, and we do not propose a “new” trend in healthcare real estate, this article will evaluate two influencers which are increasingly affecting physician real estate decisions. In addition, we will explore what health systems should understand about the provider groups who support their business model.

Let’s consider a typical two- to three-provider private medical practice to understand the thought process behind their next potential real estate decision. Prior to 1989, and federal Stark Laws, the real estate market for medical space evolved almost entirely from a campus-based environment. Providers were offered lucrative lease terms to keep them close and hospital admissions high. However, with Anti-Kickback Laws and the Affordable Care Act (ACA) now controlling the market, even the most sophisticated practices are presented with new challenges.

Before the economics of a real estate decision are contemplated, the practice must answer three questions: own vs. lease; on-campus vs. off-campus; retail vs. office.

Own vs. Lease

In the past 15 years, we have observed more private practices seeking ways to invest in real estate as a means to supplement declining practice revenues. Increasingly popular ownership options include build-to-suit or traditional general partnership real estate investment for multi-tenant use. However, this requires significant capital with cooperative and compatible partners.

Most practices prefer to use spare capital for other things such as equipment, personnel, or software upgrades. These factors are why we still see the majority of private practices make the decision to lease clinical space. Leasing offers the most flexibility, has the lowest initial occupancy cost, and the least amount of capital risk over the occupancy period. Faced with uncertain actual outcomes of the ACA, a premium is placed on flexibility.

Campus vs. Off Campus

Many articles have been published about the physician exodus from the hospital campus into an off-campus environment. This trend has been clearly demonstrated for emergency care, urgent care, primary care, internal medicine, diagnostics, and imaging. However, we have yet to see specialty practices follow suit. For many specialists, the hospital campus still offers a safe and welcoming environment where providers are treated well and remain in touch with hospital administration and fellow referring physicians. Additionally, many specialists need proximity to the hospital for convenient access to the suite of services and benefits they offer.

Retail vs. Office

Lately, more articles about the “retailization” of healthcare have been written than any other healthcare real estate topic. This trend is increasing and becoming more evident each year. But not all private practices benefit from the retail environment.

Patients like the convenience and proximity of retail, but feel less comfortable with the quality of care as the level of specialty increases. Most patients are not comfortable seeing an oncologist or cardiologist in a retail environment. Especially for older patients, storefront retail space can have the effect of cheapening the practice and diminishing the credibility of the provider.

Economic Considerations

Although real estate averages only 10% of the operating expense for a typical practice, physicians are increasingly concerned about the rising cost of real estate. As we discuss later, the ACA includes provisions for reductions in Medicare/Medicaid reimbursements. It’s this downward pressure on revenue and upward pressure on expenses that have physicians thinking much harder and looking more closely at their real estate expense.

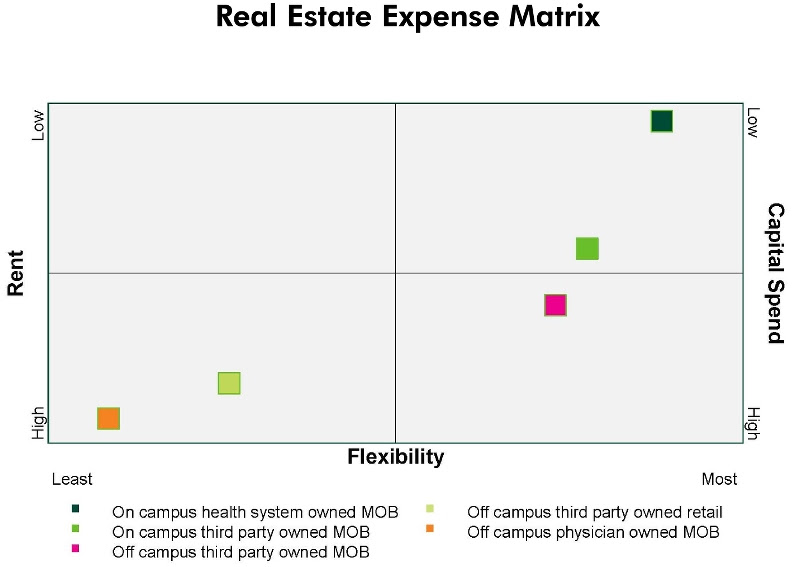

Economic Comparison – Real Estate Expense Matrix ranked by overall affordability*

*assumes Class "A" alternatives in each product category

Matrix Conclusions:

• Health system owned assets offer the most flexible and affordable lease terms since they don’t develop real estate tied exclusively to return on investment (ROI).

• Retail alternatives are very expensive and medical practices face challenges being accepted in the traditional tenant retail mix.

• Practices seeking access to patients off campus must weigh the increased expense against the opportunity to increase revenues through access to larger patient populations.

• Physician owned assets are expensive, risky and in some cases fail to achieve the desired return on investment initially sought.

ACA IMPACT ON REAL ESTATE

There are no regulations contained in the ACA aimed directly at the commercial real estate business. However, physicians are reacting in advance of the ACA’s total impact which, when fully implemented, forces a shift in the physician-patient relationship in the clinical environment.

The ACA is an extensive and wide ranging law with thousands of pages outlining detailed regulations and guidelines. However, out of those details, we observe several core principles and notable effects figuring into real estate decisions for private practice physicians:

1. Emphasis on quality care

2. Changing Medicare / Medicaid reimbursement rates

3. Expanded insured patient population

Emphasis on Patient Satisfaction

According to Medical Group Management Association (MGMA) 2014 Physician Compensation and Production Survey, doctors are beginning to see more of their compensation based on “patient satisfaction and quality measures”. 3 percent of primary care physicians’ compensation was based on quality, while two percent of specialist physician pay was based on these measures. Keybridge, a medical revenue cycling firm, writes that Medicare is accelerating plans to link part of physicians’ pay to their quality of care. These changes would affect nearly 500,000 physicians working in groups. Beginning this year, the federal health law requires large physician groups to start being bonused or penalized based on their performance. By 2017, all doctors who treat Medicare patients will become part of the program.

The effects of “patient satisfaction and quality” on real estate are as follows:

• Waiting room size will increase - undersized waiting rooms are being met with patient dissatisfaction

• Number of exam rooms will increase – more exam rooms give the perception of reduced wait times

• Move toward off-campus location - convenient and accessible location(s) benefit the practice

• Increased emphasis on facility quality - patients perceive that the quality of the interior and exterior of the building equate to quality of care

Changing Medicare / Medicaid Reimbursement Rates

According to The Second Annual Practice Profitability Index: 2014 Edition, sponsored by CareCloud, in partnership with QuantiaMD, 60% of physicians see declining reimbursement rates as the top issue negatively affecting practice profitability. A January 2015 Forbes magazine article stated “Doctors who still accept Medicare patients could see an average reduction of 21.2 percent in Medicare reimbursement rates, according the Department of Health and Human Services (HHS). And a new Urban Institute study claims primary care physicians who still take Medicaid patients could see an average reduction of 42.8 percent.”

Despite the annual “doc fix” legislation passed again in April maintaining reimbursement rates for 2015, the Republican lead legislature is likely to seek a permanent fix which sets the reimbursement rates for the future. We might not see numbers like 21.2 or 42.8 percent, but meaningful reductions appear inevitable.

The effects of changing reimbursement rates on real estate are as follows:

• Private practices will be forced to cut expenses and real estate will be viewed as a good place to start

• Requests for shorter term leases (flexibility)

• Reduction in the size (rentable square foot) of practice offices – if practice has a sizable Medicare/Medicaid population

Expanded Insured Patient Population

According to statistics provided by obamacarefacts.com, over 11.7 million are estimated to have enrolled in the Marketplaces during 2015 open enrollment (Nov 2014 to Feb 2015). This includes 4.5 million who re-enrolled from 2014. As of March 2015, HHS reported a total of 16.4 million covered due to the ACA between the Marketplace, Medicaid expansion, young adults staying on their parents plan, and other coverage provisions. While some will debate the actual figures, no one disputes that the insured patient population has increased by some meaningful number. It’s this key provision of the ACA that physicians are counting on to mitigate the effects of declining revenue. As a result, practice mergers, acquisitions, and newly formed large group practices are an increasingly popular means to accommodate increased patient volumes.

The effects of expanded insured patient populations on real estate are as follows:

• Existing large practices will begin using satellite offices in strategic locations to support their main clinical practice

• Expanding hours of operation (most easily accommodated in retail) corresponding to patients schedule

CONCLUSION

The physician real estate market is dynamic and certainly not one size fits all. It’s clear to most observers that declining revenues and increasing expenses are a reality for many physicians in the post ACA environment. Health systems and real estate investors each have their own obstacles, but need to clearly understand the new challenges facing physician practices. Real estate sponsors providing alternatives that seek to “meet physicians where they are” by controlling expense and offering flexibility will have the most success working with today’s private medical practice.

About the Author: Nelson Udstuen serves as Vice President and Regional Director for the CBRE Healthcare Services Group. His responsibilities include oversight of healthcare related business while working directly with health systems, large physician groups and top healthcare private equity clients to consistently deliver best-in-class service. Nelson brings 20 years of experience to the commercial and corporate real estate market. Throughout his career, he has completed over 700 transactions on behalf of his clients. Nelson Udstuen received a Master of Science in Real Estate Development and a Bachelor of Landscape Architecture from Texas A&M University.

Related Stories

Healthcare Facilities | May 28, 2024

Healthcare design: How to improve the parking experience for patients and families

Parking is likely a patient’s—and their families—first and last touch with a healthcare facility. As such, the arrival and departure parking experience can have a profound impact on their experience with the healthcare facility, writes Beth Bryan, PE, PTOE, PTP, STP2, Principal, Project Manager, Walter P Moore.

MFPRO+ News | May 21, 2024

Baker Barrios Architects announces new leadership roles for multifamily, healthcare design

Baker Barrios Architects announced two new additions to its leadership: Chris Powers, RA, AIA, NCARB, EDAC, as Associate Principal and Director (Healthcare); and Mark Kluemper, AIA, NCARB, as Associate Principal and Technical Director (Multifamily).

Healthcare Facilities | May 21, 2024

A collaborative delivery contract adds a new wrinkle to construction management

The setup combines traditional pact structures with a different risk-sharing approach.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Sponsored | Healthcare Facilities | May 3, 2024

Advancing Healthcare: Medical Office Buildings at the Forefront of Access and Safety

This article explores the pivotal shift from traditional hospital settings to Medical Office Buildings (MOBs), focusing on how these facilities enhance patient access. Discover the key drivers of this transformation, including technological advancements, demographic trends, and a growing emphasis on integrated, patient-centered care. Learn how MOBs are not only adapting to modern healthcare demands but are also leveraging modern access control and safety innovations.

Architects | May 2, 2024

Emerging considerations in inclusive design

Design elements that consider a diverse population of users make lives better. When it comes to wayfinding, some factors will remain consistent—including accessibility and legibility.

Healthcare Facilities | Apr 16, 2024

Mexico’s ‘premier private academic health center’ under design

The design and construction contract for what is envisioned to be “the premier private academic health center in Mexico and Latin America” was recently awarded to The Beck Group. The TecSalud Health Sciences Campus will be located at Tec De Monterrey’s flagship healthcare facility, Zambrano Hellion Hospital, in Monterrey, Mexico.

Healthcare Facilities | Apr 11, 2024

The just cause in behavioral health design: Make it right

NAC Architecture shares strategies for approaching behavioral health design collaboratively and thoughtfully, rather than simply applying a set of blanket rules.

Healthcare Facilities | Apr 3, 2024

Foster + Partners, CannonDesign unveil design for Mayo Clinic campus expansion

A redesign of the Mayo Clinic’s downtown campus in Rochester, Minn., centers around two new clinical high-rise buildings. The two nine-story structures will reach a height of 221 feet, with the potential to expand to 420 feet.

Products and Materials | Mar 31, 2024

Top building products for March 2024

BD+C Editors break down March's top 15 building products, from multifamily-focused electronic locks to recyclable plastic panels.