Nearly half of the respondents (46.1%) to an exclusive Building Design+Construction survey of AEC professionals reported that revenues had increased this year compared to 2012, with another 24.2% saying cash flow had stayed the same.

The majority (56.8%) of respondents—architects, engineers, contractors, building owners, and others in the commercial, industrial, multifamily, and institutional field—said their firms will bump up revenues next year, with 31.4% saying business will stay the same and only 11.8% predicting it will decline. A majority (55.5%) rated the health of their firms as good (35.6%) or very good (19.9%).

As has been the case in recent years, the overwhelming majority (71.2%) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in 2014.

Competition from other firms went up as a factor for the third year in a row, to 47.6% (44.9% in 2012, 40.1% in 2011). Nearly four in five respondents (79.3%) described the current business climate for their firms as “very” to “intensely” competitive; that’s up somewhat from 73.4% in 2012 and 74.8% in 2011. But “having insufficient capital funding for projects” declined slightly, to 24.1% of respondents, down from 29.7% in 2012 and 34.5% in 2011.

AEC respondents to this third annual survey of BD+C subscribers were still worried about the economy. On the other hand, “avoiding layoffs” (17.6%), “avoiding benefit reductions” (16.4%), and “keeping staff motivated” (14.6%) were of less concern.

DATA CENTERS CONTINUE THEIR SURGE INTO 2014

Asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak,” respondents gave data centers high marks. (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• Data centers and mission-critical facilities continued to show strength, with the majority (56.0%) of respondents in the good/excellent category, compared to 52.1% last year and 45.2% the year before.

• Healthcare continued its leadership as the most highly desirable sector, with more than three in five respondents (62.5%) giving it a good to excellent rating, up from 58.8% last year.

• The apartment boom registered with AEC professionals, who gave multifamily housing a 56.1% good/excellent rating.

• Industrial/warehouse facilities keep moving up in the AEC psyche, registering a 33.0% interest level on the good/excellent scale, a significant climb from last year’s 25.5%.

• Retail commercial construction also showed vitality. Nearly a third of respondents (31.4%) came out on the good/excellent side for the coming year, well up from last year’s 19.9% rating.

• Nearly two-thirds of those surveyed (66.0%) said senior and assisted-living facilities look like good/excellent prospects for their firms, significantly up from last year’s healthy 50.5%. Hello, baby boomers!

• College and university facilities got the nod from 44.8% of respondents on the good to excellent scale, up from 37.8% last year.

As for government/military projects, the survey was taken before the full impact of the sequestration was known. The sector was rated good to excellent by 33.7% of respondents, much along the lines of last year’s 36.1% of respondents, down slightly from the previous year’s 41.1%.

While the construction of new office buildings drew tepid response (26.9%) in the good/excellent scale, that was still up significantly from last year’s 15.6% rating. However, a solid majority (52.1%) of respondents said office fitouts and interior renovations look good to excellent for 2014. That was likely a statistically significant leap from last year’s 35.7% who said office interiors would be a strong sector.

Respondents said their firms will likely use multiple strategies to stay ahead of the game in 2014. Only a small percentage (3.2%) said they think their companies will open a new office in the U.S. or Canada, while 4.5% said their firms might open an international office.

In fact, reconstruction, historic preservation, and renovations accounted for at least 25% of work for more than a third (38.5%) of respondents, up slightly from the 34.6% of respondents’ firms in 2012 and roughly the same as in 2011 (36.3%).

K-12 schools perked up a bit, with 30.9% saying the sector looks good to excellent for 2014, compared with 22.9% last year and 23.2% the year before.

TAKING ON THE DEMANDS OF BIM/VDC TECHNOLOGY

What about BIM? Is its promise holding true? Somewhat surprisingly, more than one in five respondents (22.7%) said their firms do not use building information modeling, about what was recorded over the previous two years.

Remarkably, precisely the same percentage of respondents (26.8%) said their firms used BIM in the majority of projects based on dollar value as in the last two annual surveys. Nearly two in five (39.8%) said their firms’ use of BIM will rise in the coming year; similarly, two-fifths (42.2%) of respondents said their companies will be investing more in technology in 2014.

As for social media, LinkedIn remained the top choice of respondents, at 53.1%, but that was a steep decline from last year’s 85.1% for LinkedIn. Facebook also took a hit, dropping to 32.5% in popularity, versus 49.5% last year, while Twitter dropped from 21.1% last year to 13.4%. Once again, a big chunk of respondents (31.3%) said they did not use social media channels.

Of the 400 who gave their professional description, 45.0% were architects; 8.0%, engineers; 28.8%, contractors; 9.8%, building owners, developers, or facility managers; and 8.6%, consultants or “other.” The margin of error was 4.8% at the 95% confidence level.

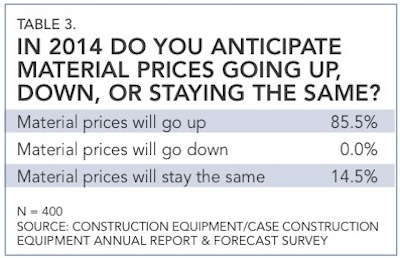

Respondents overwhelmingly said they expect prices of materials to rise in the coming year, with no respondents saying they expect such prices to fall.

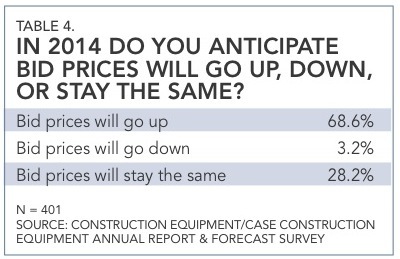

More than two-thirds of respondents (68.6%) said they expect bid prices to go up next year. Survey results have a margin of error of 4.8%.

For more on AEC firms' financial performance, see BD+C's 2013 Giants 300 Report.

Related Stories

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.

MFPRO+ News | Oct 22, 2024

Project financing tempers robust demand for multifamily housing

AEC Giants with multifamily practices report that the sector has been struggling over the past year, despite the high demand for housing, especially affordable products.

Performing Arts Centers | Oct 21, 2024

The New Jersey Performing Arts Center breaks ground on $336 million redevelopment of its 12-acre campus

In Newark, N.J., the New Jersey Performing Arts Center (NJPAC) has broken grown on the three-year, $336 million redevelopment of its 12-acre campus. The project will provide downtown Newark 350 mixed-income residential units, along with shops, restaurants, outdoor gathering spaces, and an education and community center with professional rehearsal spaces.

Office Buildings | Oct 21, 2024

3 surprises impacting the return to the office

This blog series exploring Gensler's Workplace Survey shows the top three surprises uncovered in the return to the office.

Healthcare Facilities | Oct 18, 2024

7 design lessons for future-proofing academic medical centers

HOK’s Paul Strohm and Scott Rawlings and Indiana University Health’s Jim Mladucky share strategies for planning and designing academic medical centers that remain impactful for generations to come.

Sports and Recreational Facilities | Oct 17, 2024

In the NIL era, colleges and universities are stepping up their sports facilities game

NIL policies have raised expectations among student-athletes about the quality of sports training and performing facilities, in ways that present new opportunities for AEC firms.

Codes and Standards | Oct 17, 2024

Austin, Texas, adopts AI-driven building permit software

After a successful pilot program, Austin has adopted AI-driven building permit software to speed up the building permitting process.

Resiliency | Oct 17, 2024

U.S. is reducing floodplain development in most areas

The perception that the U.S. has not been able to curb development in flood-prone areas is mostly inaccurate, according to new research from climate adaptation experts. A national survey of floodplain development between 2001 and 2019 found that fewer structures were built in floodplains than might be expected if cities were building at random.

Seismic Design | Oct 17, 2024

Calif. governor signs limited extension to hospital seismic retrofit mandate

Some California hospitals will have three additional years to comply with the state’s seismic retrofit mandate, after Gov. Gavin Newsom signed a bill extending the 2030 deadline.

MFPRO+ News | Oct 16, 2024

One-third of young adults say hurricanes like Helene and Milton will impact where they choose to live

Nearly one-third of U.S. residents between 18 and 34 years old say they are reconsidering where they want to move after seeing the damage wrought by Hurricane Helene, according to a Redfin report. About 15% of those over age 35 echoed their younger cohort’s sentiment.