Nearly half of the respondents (46.1%) to an exclusive Building Design+Construction survey of AEC professionals reported that revenues had increased this year compared to 2012, with another 24.2% saying cash flow had stayed the same.

The majority (56.8%) of respondents—architects, engineers, contractors, building owners, and others in the commercial, industrial, multifamily, and institutional field—said their firms will bump up revenues next year, with 31.4% saying business will stay the same and only 11.8% predicting it will decline. A majority (55.5%) rated the health of their firms as good (35.6%) or very good (19.9%).

As has been the case in recent years, the overwhelming majority (71.2%) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in 2014.

Competition from other firms went up as a factor for the third year in a row, to 47.6% (44.9% in 2012, 40.1% in 2011). Nearly four in five respondents (79.3%) described the current business climate for their firms as “very” to “intensely” competitive; that’s up somewhat from 73.4% in 2012 and 74.8% in 2011. But “having insufficient capital funding for projects” declined slightly, to 24.1% of respondents, down from 29.7% in 2012 and 34.5% in 2011.

AEC respondents to this third annual survey of BD+C subscribers were still worried about the economy. On the other hand, “avoiding layoffs” (17.6%), “avoiding benefit reductions” (16.4%), and “keeping staff motivated” (14.6%) were of less concern.

DATA CENTERS CONTINUE THEIR SURGE INTO 2014

Asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak,” respondents gave data centers high marks. (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• Data centers and mission-critical facilities continued to show strength, with the majority (56.0%) of respondents in the good/excellent category, compared to 52.1% last year and 45.2% the year before.

• Healthcare continued its leadership as the most highly desirable sector, with more than three in five respondents (62.5%) giving it a good to excellent rating, up from 58.8% last year.

• The apartment boom registered with AEC professionals, who gave multifamily housing a 56.1% good/excellent rating.

• Industrial/warehouse facilities keep moving up in the AEC psyche, registering a 33.0% interest level on the good/excellent scale, a significant climb from last year’s 25.5%.

• Retail commercial construction also showed vitality. Nearly a third of respondents (31.4%) came out on the good/excellent side for the coming year, well up from last year’s 19.9% rating.

• Nearly two-thirds of those surveyed (66.0%) said senior and assisted-living facilities look like good/excellent prospects for their firms, significantly up from last year’s healthy 50.5%. Hello, baby boomers!

• College and university facilities got the nod from 44.8% of respondents on the good to excellent scale, up from 37.8% last year.

As for government/military projects, the survey was taken before the full impact of the sequestration was known. The sector was rated good to excellent by 33.7% of respondents, much along the lines of last year’s 36.1% of respondents, down slightly from the previous year’s 41.1%.

While the construction of new office buildings drew tepid response (26.9%) in the good/excellent scale, that was still up significantly from last year’s 15.6% rating. However, a solid majority (52.1%) of respondents said office fitouts and interior renovations look good to excellent for 2014. That was likely a statistically significant leap from last year’s 35.7% who said office interiors would be a strong sector.

Respondents said their firms will likely use multiple strategies to stay ahead of the game in 2014. Only a small percentage (3.2%) said they think their companies will open a new office in the U.S. or Canada, while 4.5% said their firms might open an international office.

In fact, reconstruction, historic preservation, and renovations accounted for at least 25% of work for more than a third (38.5%) of respondents, up slightly from the 34.6% of respondents’ firms in 2012 and roughly the same as in 2011 (36.3%).

K-12 schools perked up a bit, with 30.9% saying the sector looks good to excellent for 2014, compared with 22.9% last year and 23.2% the year before.

TAKING ON THE DEMANDS OF BIM/VDC TECHNOLOGY

What about BIM? Is its promise holding true? Somewhat surprisingly, more than one in five respondents (22.7%) said their firms do not use building information modeling, about what was recorded over the previous two years.

Remarkably, precisely the same percentage of respondents (26.8%) said their firms used BIM in the majority of projects based on dollar value as in the last two annual surveys. Nearly two in five (39.8%) said their firms’ use of BIM will rise in the coming year; similarly, two-fifths (42.2%) of respondents said their companies will be investing more in technology in 2014.

As for social media, LinkedIn remained the top choice of respondents, at 53.1%, but that was a steep decline from last year’s 85.1% for LinkedIn. Facebook also took a hit, dropping to 32.5% in popularity, versus 49.5% last year, while Twitter dropped from 21.1% last year to 13.4%. Once again, a big chunk of respondents (31.3%) said they did not use social media channels.

Of the 400 who gave their professional description, 45.0% were architects; 8.0%, engineers; 28.8%, contractors; 9.8%, building owners, developers, or facility managers; and 8.6%, consultants or “other.” The margin of error was 4.8% at the 95% confidence level.

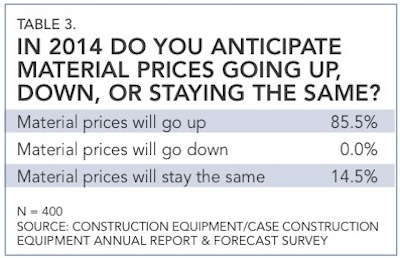

Respondents overwhelmingly said they expect prices of materials to rise in the coming year, with no respondents saying they expect such prices to fall.

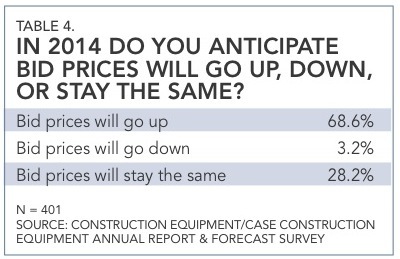

More than two-thirds of respondents (68.6%) said they expect bid prices to go up next year. Survey results have a margin of error of 4.8%.

For more on AEC firms' financial performance, see BD+C's 2013 Giants 300 Report.

Related Stories

Building Team | Oct 27, 2022

Who are you? Four archetypes shaping workspaces

The new lifestyle of work requires new thinking about the locations where people work, what their workflow looks like, and how they are performing their best work.

Codes and Standards | Oct 27, 2022

Florida’s Surfside-inspired safety law puts pressure on condo associations

A Florida law intended to prevent tragedies like the Surfside condominium collapse will place a huge financial burden on condo associations and strain architecture and engineering resources in the state.

University Buildings | Oct 27, 2022

The Collaboratory Building will expand the University of Florida’s School of Design, Construction, and Planning

Design firm Brooks + Scarpa recently broke ground on a new addition to the University of Florida’s School of Design, Construction, and Planning (DCP).

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Data Centers | Oct 25, 2022

Virginia county moves to restrict the growth of new server farms

Loudoun County, Va., home to the largest data center cluster in the world known as Data Center Alley, recently took steps to prohibit the growth of new server farms in certain parts of the county.

Museums | Oct 25, 2022

Seattle Aquarium’s new Ocean Pavilion emphasizes human connection to oceans

Seattle Aquarium’s new Ocean Pavilion, currently under construction, features several exhibits that examine the human connection with the Earth’s oceans.

Energy-Efficient Design | Oct 24, 2022

Roadmap shows how federal buildings can reach zero embodied carbon emissions by 2050

The Rocky Mountain Institute (RMI) has released a roadmap that it says charts a path for federal buildings projects to achieve zero embodied carbon emissions by 2050.

Higher Education | Oct 24, 2022

Wellesley College science complex modernizes facility while preserving architectural heritage

A recently completed expansion and renovation of Wellesley College’s science complex yielded a modernized structure for 21st century STEM education while preserving important historical features.

Transportation & Parking Facilities | Oct 20, 2022

How to comply with NYC Local Law 126 parking garage inspection rules

Effective January 1, 2022, New York City requires garage owners to retain a specially designated professional engineer to conduct an assessment and file a report at least once every six years. Hoffmann Architects + Engineers offers tips and best practices on how to comply with NYC Local Law 126 parking garage inspection rules.

Architects | Oct 20, 2022

Michael Graves Architecture acquires Jose Carballo Architectural Group

Michael Graves Architecture (MG), an award-winning global leader in planning, architecture, and interior design based in Princeton, NJ, announces the acquisition of Jose Carballo Architectural Group (JCAG), a New Jersey-based architecture firm.