The enthusiasm that surged through the U.S. engineering industry following the election of Donald Trump has moderated, according the latest survey of engineering firm leaders by the American Council of Engineering Companies (ACEC).

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0. The decline is minimal and the score remains decidedly positive, but is in contrast to the 4th quarter 2016 EBI in which, fueled by Trump’s promises of lower taxes, infrastructure investment, and regulatory reform, the score jumped 5.1 points—the largest quarterly increase in the survey’s three-year history.

Now however, with the Administration slow to implement any of these polices, engineering firm leader confidence seems to have plateaued.

The EBI is a leading indicator of America’s economic health based on the business performance and projections of U.S. engineering firms that develop the nation’s transportation, water, energy and industrial infrastructure. The EBI is a diffusion index. The index mean is 50, with scores above 50 indicating business expansion, and scores below 50 indicating contraction. The Q1/17 survey was conducted March 23 to April 24 of 378 U.S. engineering firm leaders.

When comparing today’s market conditions to six months ago, the EBI score climbed 3.2 point to 66.8; while current backlog compared to six months ago was up a strong 5.1 points to 67.1. Additionally, short-term (six-month) expectations for profitability increased 3.5 points to 72.5 points.

Other EBI results however, clearly reflect engineering leader marketplace ambiguity. Market expectations for one year from today fell 2.6 points to 69.5; profitability expectations for the same period were flat (72.9); but looking out three years, expectations fell 2.4 points, and anticipated backlog fell 1.1 points to 70.4.

Concerns about long-term marketplace health resulted in significant declines in nine of the 12 primary public and private sector engineering markets.

For more information about the Q1/17 EBI, go to www.acec.org.

Related Stories

Giants 400 | Oct 30, 2023

Top 100 K-12 School Construction Firms for 2023

CORE Construction, Gilbane, Balfour Beatty, Skanska USA, and Adolfson & Peterson top BD+C's ranking of the nation's largest K-12 school building contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 80 K-12 School Engineering Firms for 2023

AECOM, CMTA, Jacobs, WSP, and IMEG head BD+C's ranking of the nation's largest K-12 school building engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Giants 400 | Oct 23, 2023

Top 75 Multifamily Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Olsson, and Langan head the ranking of the nation's largest multifamily housing sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Warehouses | Oct 19, 2023

JLL report outlines 'tremendous potential' for multi-story warehouses

A new category of buildings, multi-story warehouses, is beginning to take hold in the U.S. and their potential is strong. A handful of such facilities, also called “urban logistics buildings” have been built over the past five years, notes a new report by JLL.

Building Materials | Oct 19, 2023

New white papers offer best choices in drywall, flooring, and insulation for embodied carbon and health impacts

“Embodied Carbon and Material Health in Insulation” and “Embodied Carbon and Material Health in Gypsum Drywall and Flooring,” by architecture and design firm Perkins&Will in partnership with the Healthy Building Network, advise on how to select the best low-carbon products with the least impact on human health.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.

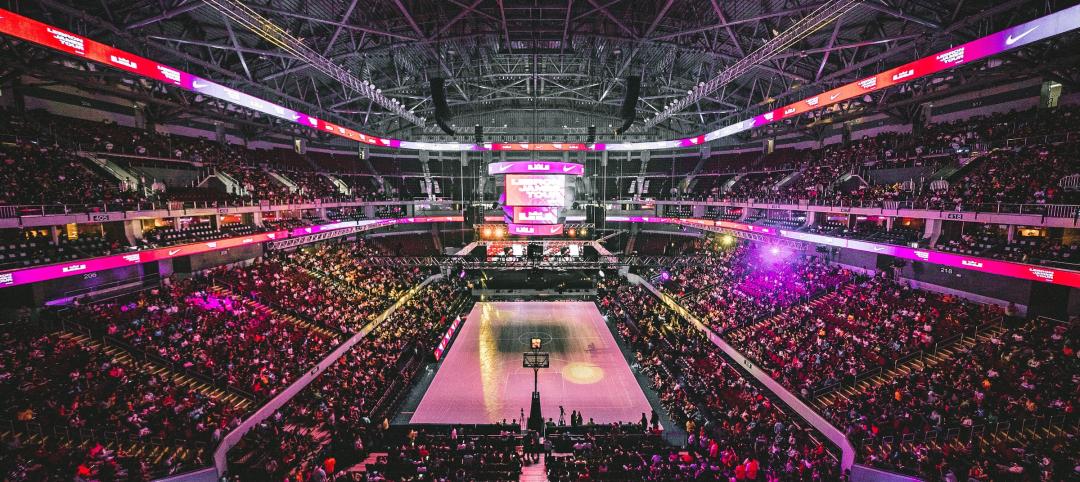

Giants 400 | Oct 17, 2023

Top 70 Sports Facility Engineering Firms for 2023

Alfa Tech Consulting Engineers, ME Engineers, AECOM, and Henderson Engineers top BD+C's ranking of the nation's largest sports facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.