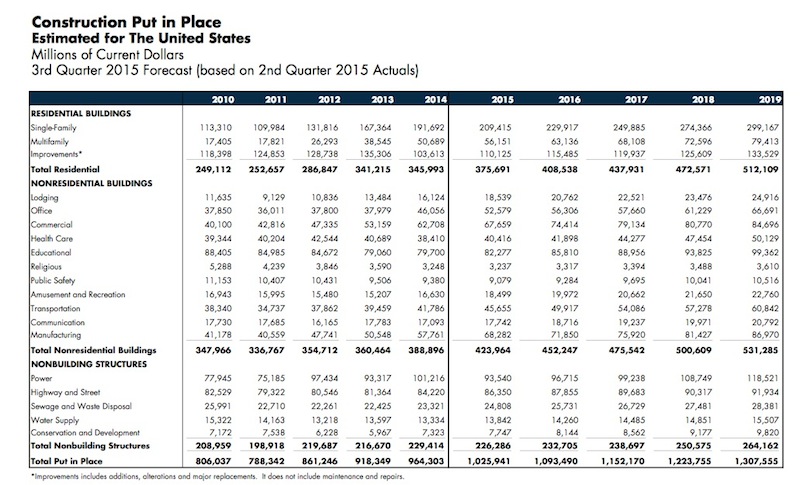

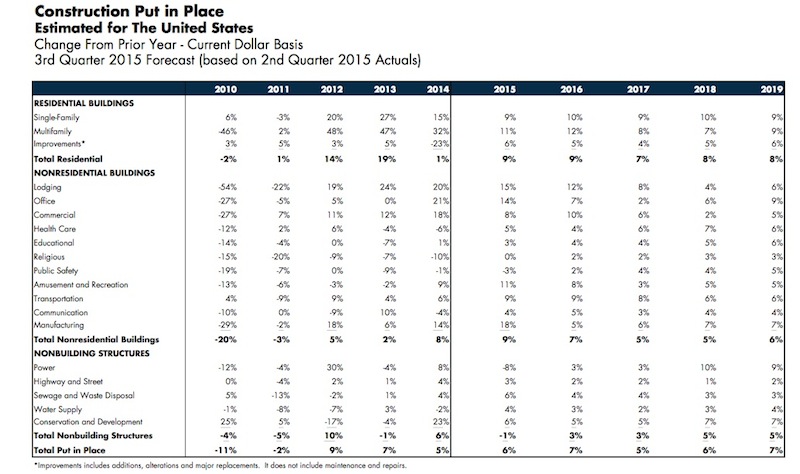

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

| Jan 4, 2012

Skanska acquires Industrial Contractors

Industrial Contractors Inc. is a contractor in the commercial, industrial and power markets of the Midwest. The company employs 2,400 people and in 2011 the revenues are estimated to be approximately $500 million.

| Jan 4, 2012

HDR to design North America’s first fully digital hospital

Humber River is the first hospital in North America to fully integrate and automate all of its processes; everything is done digitally.

| Jan 4, 2012

New LEED Silver complex provides space for education and research

The academic-style facility supports education/training and research functions, and contains classrooms, auditoriums, laboratories, administrative offices and library facilities, as well as spaces for operating highly sophisticated training equipment.

| Jan 3, 2012

Gilbane awarded $88M Contract for Ohio elementary school construction

The new award, which comprises the construction of five new elementary schools and demolition of 11 older facilities, is the latest K-12 building program managed by Gilbane for the Ohio School Facilities Commission since 1998.

| Jan 3, 2012

AIA's ABI November Index reaches 52.0

The Architecture Billings Index (ABI) reached its first positive mark since August.

| Jan 3, 2012

Callison acquires Barteluce Architects & Associates

This acquisition will grow Callison’s New York team to over 75 architects.

| Jan 3, 2012

VDK Architects merges with Harley Ellis Devereaux

Harley Ellis Devereaux will relocate the employees in its current Berkeley, Calif., office to the new Oakland office location effective January 3, 2012.

| Jan 3, 2012

Weingarten, Callan appointed to BD+C Editorial Board

Building Design+Construction has named two new members to its editorial board. Both are past recipients of BD+C’s “40 Under 40” honor.

| Jan 3, 2012

New Chicago hospital prepared for pandemic, CBR terror threat

At a cost of $654 million, the 14-story, 830,000-sf medical center, designed by a Perkins+Will team led by design principal Ralph Johnson, FAIA, LEED AP, is distinguished in its ability to handle disasters.

| Jan 3, 2012

BIM: not just for new buildings

Ohio State University Medical Center is converting 55 Medical Center buildings from AutoCAD to BIM to improve quality and speed of decision making related to facility use, renovations, maintenance, and more.