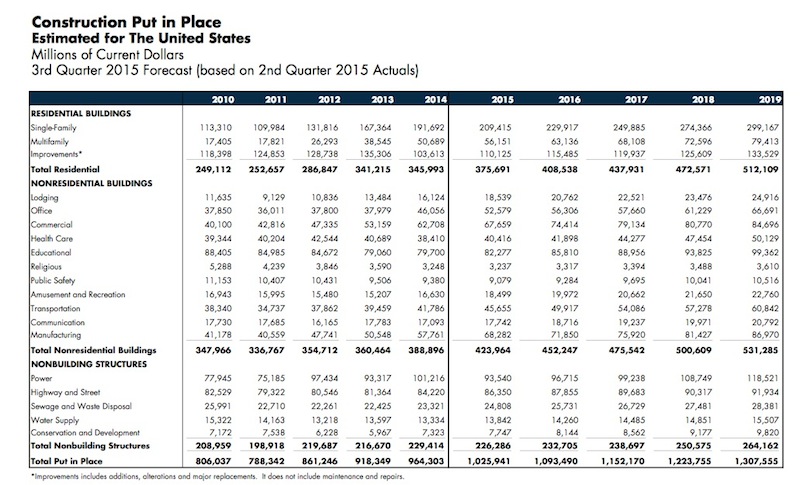

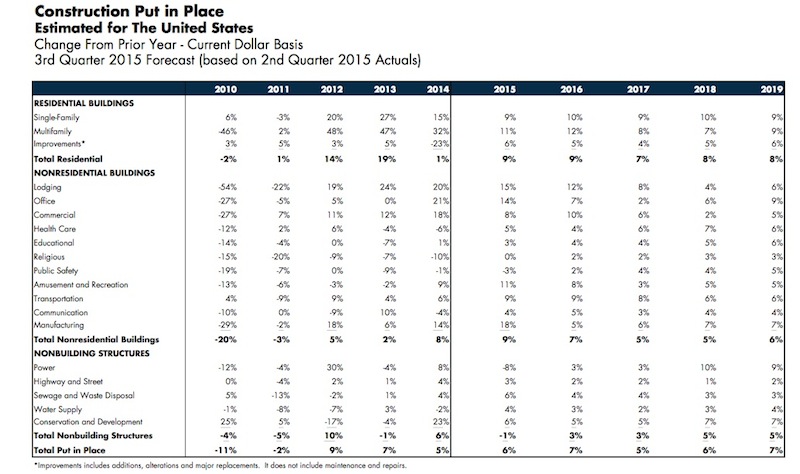

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

| Nov 2, 2011

Jacobs announces acquisition of KlingStubbins

Jacobs Engineering Group Inc. announced that it has acquired KlingStubbins. Officials did not disclose the terms of the agreement. Jacobs' acquisition of KlingStubbins, which has approximately 500 employees located in the United States and Asia, particularly enhances the Company's capabilities in design. KlingStubbins provides professional services in planning, architecture, engineering and interiors.

| Nov 1, 2011

Perkins Eastman opens office in San Francisco

Located at 23 Geary Street in the One Kearny building, the 8,100 sf office will accommodate a growing staff of 45.

| Nov 1, 2011

Sasaki expands national sports design studio

Sasaki has also added Stephen Sefton to the sports design studio as senior associate.

| Nov 1, 2011

Holcim awards winners for North America announced

A socio-architectural project to create regional food-gathering nodes and a logistics network in Canada's high arctic territory won the top prize for North America of $100,000.

| Oct 27, 2011

iProspect selects VLK Architects for new office design

Company growth prompted iProspect to make the decision to move to a new space.

| Oct 26, 2011

Metl-Span selected for re-roof project

School remained in session during the renovation and it was important to minimize the disruption as much as possible.

| Oct 26, 2011

Shawmut Design and Construction awarded Tag Heuer build in Aventura, Fla.

New store features 1,200 sf fit out at Aventura Mall.

| Oct 25, 2011

HKS Science & Technology practice formed

Specializing in the planning and design of highly technical building types, HKS’s Science & Technology practice offers the broadest range of services available to the academic and biomedical research, biotechnology, pharmaceutical and medical device community, including laboratory programming, planning and design, strategic science planning and laboratory equipment planning.

| Oct 25, 2011

Universal teams up with Earthbound Corp. to provide streamlined commercial framing solutions

The primary market for the Intact Structural Frame is light commercial buildings that are typically designed with concrete masonry walls, steel joists and steel decks.

| Oct 25, 2011

Ritner Steel CEO elected to AISC Board

Freund will begin serving on the AISC board of directors, assisting with the organization's planning and leadership in the steel construction industry.