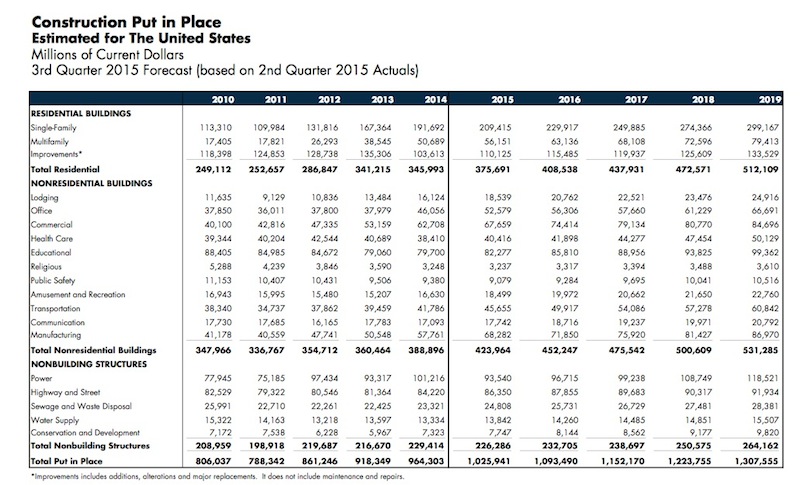

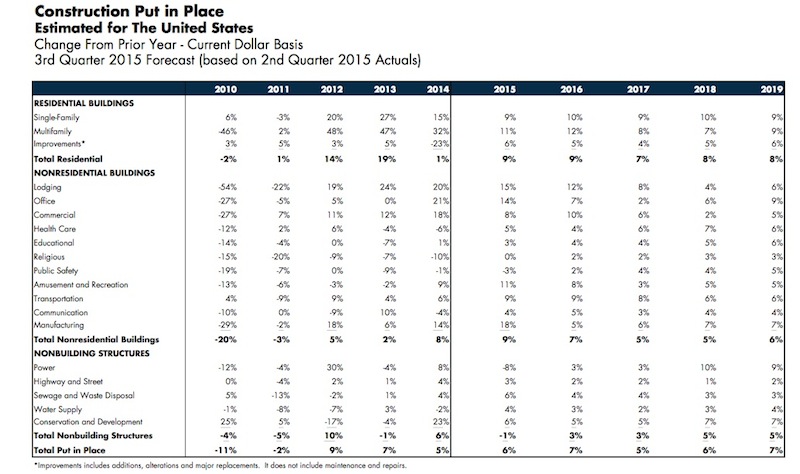

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

| Dec 17, 2010

5 Tips on Building with SIPs

Structural insulated panels are gaining the attention of Building Teams interested in achieving high-performance building envelopes in commercial, industrial, and institutional projects.

| Dec 17, 2010

How to Win More University Projects

University architects representing four prominent institutions of higher learning tell how your firm can get the inside track on major projects.

| Dec 13, 2010

Energy efficiency No. 1 priority for commercial office tenants

Green building initiatives are a key influencer when tenants decide to sign a commercial real estate lease, according to a survey by GE Capital Real Estate. The survey, which was conducted over the past year and included more than 2,220 office tenants in the U.S., Canada, France, Germany, Sweden, the UK, Spain, and Japan, shows that energy efficiency remains the No. 1 priority in most countries. Also ranking near the top: waste reduction programs and indoor air.

| Dec 7, 2010

Are green building RFPs more important than contracts?

The Request for Proposal (RFP) process is key to managing a successful LEED project, according to Green Building Law Update. While most people think a contract is the key element to a successful construction project, successfully managing a LEED project requires a clear RFP that addresses many of the problems that can lead to litigation.

| Dec 7, 2010

Blue is the future of green design

Blue design creates places that are not just neutral, but actually add back to the world and is the future of sustainable design and architecture, according to an interview with Paul Eagle, managing director of Perkins+Will, New York; and Janice Barnes, principal at the firm and global discipline leader for planning and strategies.

| Dec 7, 2010

Green building thrives in shaky economy

Green building’s momentum hasn’t been stopped by the economic recession and will keep speeding through the recovery, while at the same time building owners are looking to go green more for economic reasons than environmental ones. Green building has grown 50% in the past two years; total construction starts have shrunk 26% over the same time period, according to “Green Outlook 2011” report. The green-building sector is expected to nearly triple by 2015, representing as much as $145 billion in new construction activity.

| Dec 7, 2010

USGBC: Wood-certification benchmarks fail to pass

The proposed Forest Certification Benchmark to determine when wood-certification groups would have their certification qualify for points in the LEED rating systemdid not pass the USGBC member ballot. As a result, the Certified Wood credit in LEED will remain as it is currently written. To date, only wood certified by the Forest Stewardship Council qualifies for a point in the LEED, while other organizations, such as the Sustainable Forestry Initiative, the Canadian Standards Association, and the American Tree Farm System, are excluded.

| Dec 7, 2010

AGC of A Survey: 2011 Construction Industry Hiring and Business Outlook

The Associated General Contractors of America wants to know about your construction company’s business outlook for 2011. Help out the Association by answering a few quick questions in their 2011 Construction Industry Hiring and Business Outlook survey.

| Dec 7, 2010

Prospects for multifamily sector improve greatly

The multifamily sector is showing signs of a real recovery, with nearly 22,000 new apartment units delivered to the market. Net absorption in the third quarter surged by 94,000 units, dropping the national vacancy rate from 7.8% to 7.1%, one of the largest quarterly drops on record, and rents increased for the second quarter in a row.