The overall economy, as well as the economy in which they do business, might be down, but contractor panelists who provided these insights still see nonresidential construction on the upswing, according to FMI’s Second Quarter Nonresidential Construction Index (NRCI) Report.

Raleigh, N.C.-based FMI provides management consulting, investment banking, and people development services. Its quarterly index is based on voluntary responses from panelists to a 10-minute survey. The respondents represent a fairly wide cross-section of trades, company sizes, and markets. About 15% of the respondents are national contractors, 56% are Commercial General Building Contractors, and 39% operate businesses that generate between $51 million and $200 million in annual revenue. FMI declined to provide the number of panelists surveyed.

Chart: FMI

Chart: FMI

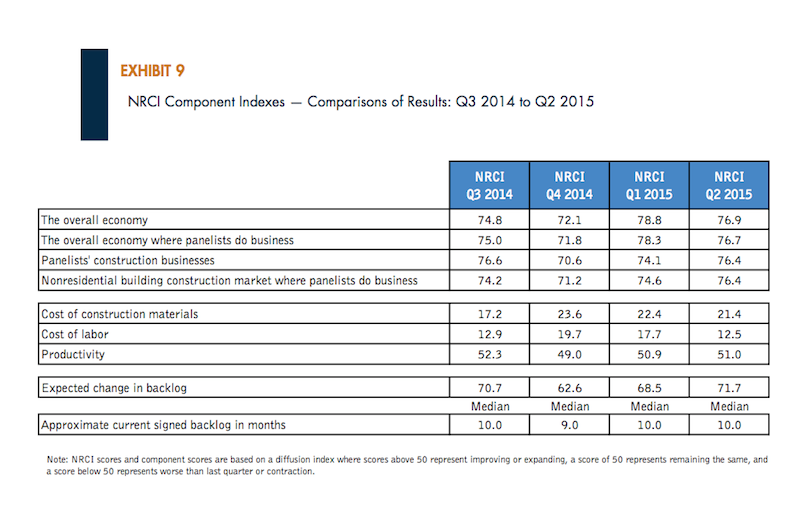

The NRCI for the second quarter was 64.9, virtually unchanged from the first quarter but improved from the 62.8 Index in the second quarter of 2014. FMI states that scores above 50 indicate expansion.

The panelists’ business outlook for specific nonresidential sectors is more ambivalent, however. Indices for healthcare and office construction are up, compared to a year ago, but down (albeit still on the growth side) for education, lodging, and manufacturing.

These scores might reflect the panelists’ perceptions of a still-volatile overall economy, whose second-quarter Index of 76.9 is down from the 78.8 Index in the first quarter. The panelists report that their own markets’ economies are off, too.

On the other hand, the panelists report improving productivity and steady backlogs. Half of the panelists said that their second-quarter backlogs grew faster than the previous quarter.

The indices for costs of materials and labor are down from the previous quarterly and yearly measurements, meaning those costs are rising. The NRCI Index for Construction Materials stood at 21.4, and 58.1% of the panelists said their materials costs increased from the first quarter. The Labor Cost Index was at 12.5, with 75% of the panelists reporting that their labor costs were higher in the second quarter than the first.

Chart: FMI

Chart: FMI

The survey also found that:

• Green construction made up only 28.6 percent of the panelists’ second-quarter backlogs, on average. FMI concludes from this finding that contractors no longer see green as anything special because it has become engrained into the mainstream of their businesses.

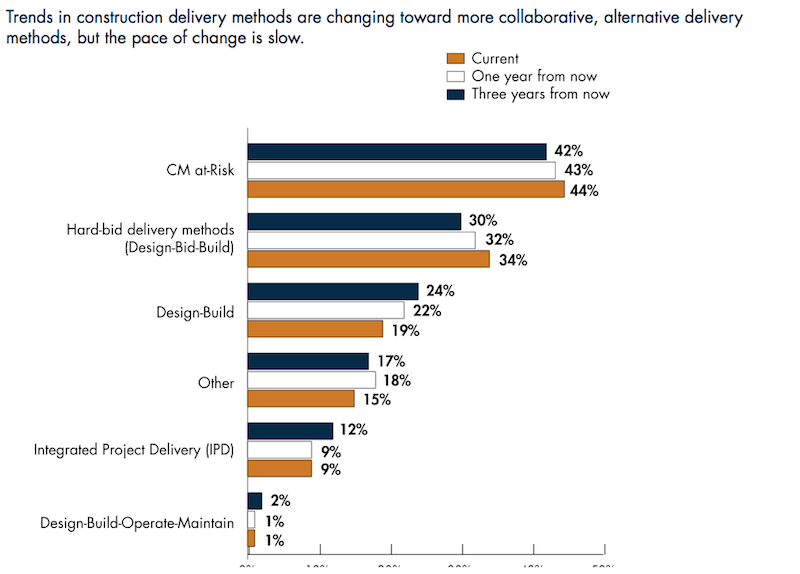

• The expediency of certain delivery methods during the recession is slowly yielding to more collaborative approaches among Building Teams and owners. “CM at-Risk is now allowed by most states, but those building CM at-Risk projects won’t quickly move to IPD [integrated project delivery].” FMI writes. “Design-build and IPD are expected to be growth areas for delivery methods; but IPD in particular, even though it offers many benefits to all parties, is not for everyone at this time. IPD, and even what has been called IPDish, requires more sophisticated owners, designers and contractors in order to realize the full benefits of this delivery approach.”

• Based on the panelists’ responses, FMI notes that other trends in construction—such as prefabrication, modularization, use of robotics, and 3D printing—are also likely to take a longer time to become mainstream like green construction has. “But the ongoing shortages of skilled labor will certainly hasten their coming.”

Related Stories

Giants 400 | Sep 28, 2017

Top 85 government construction firms

Turner Construction Co., PCL Construction Enterprises, and Clark Group top BD+C’s ranking of the nation’s largest government sector contractors and construction management firms, as reported in the 2017 Giants 300 Report.

Multifamily Housing | Sep 27, 2017

Pickleball, anyone?

Two-and-a-half million Americans are playing the game with the funny name.

Giants 400 | Sep 22, 2017

Top 80 hotel construction firms

Turner Construction Co., Swinerton, and The Whiting-Turner Contracting Co. top BD+C’s ranking of the nation’s largest hotel sector contractor and construction management firms, as reported in the 2017 Giants 300 Report.

40 Under 40 | Sep 22, 2017

Meet the 40 Under 40 Class of 2017

These AEC stars are making their mark in business, philanthropy, and in their communities.

40 Under 40 | Sep 21, 2017

Meet the 40 Under 40 Class of 2017

These AEC stars are making their mark in business, philanthropy, and in their communities.

Multifamily Housing | Sep 19, 2017

Top 90 multifamily construction firms

Lendlease, Suffolk Construction, and Clark Group top BD+C’s ranking of the nation’s largest multifamily sector contractor and construction management firms, as reported in the 2017 Giants 300 Report.

Contractors | Sep 19, 2017

Commercial Construction Index finds high optimism in U.S. commercial construction industry

Hurricane recovery efforts expected to heighten concerns about labor scarcities in the south, where two-thirds of contractors already face worker shortages.

Giants 400 | Sep 13, 2017

Top 75 retail construction firms

The Whiting-Turner Contracting Co., PCL Construction Enterprises, and Shawmut Design and Construction top BD+C’s ranking of the nation’s largest retail sector contractor and construction management firms, as reported in the 2017 Giants 300 Report.

Contractors | Sep 6, 2017

Following the money: G702 progress payment certifications

There is no single method of calculating progress payments, but the most common formula is the percentage of completion applied to the total contract price, less a retainage which is held by the owner until final acceptance of the project.

Multifamily Housing | Sep 5, 2017

Free WiFi, meeting rooms most popular business services amenities in multifamily developments

Complimentary, building-wide WiFi is more or less a given for marketing purposes in the multifamily arena.