The overall economy, as well as the economy in which they do business, might be down, but contractor panelists who provided these insights still see nonresidential construction on the upswing, according to FMI’s Second Quarter Nonresidential Construction Index (NRCI) Report.

Raleigh, N.C.-based FMI provides management consulting, investment banking, and people development services. Its quarterly index is based on voluntary responses from panelists to a 10-minute survey. The respondents represent a fairly wide cross-section of trades, company sizes, and markets. About 15% of the respondents are national contractors, 56% are Commercial General Building Contractors, and 39% operate businesses that generate between $51 million and $200 million in annual revenue. FMI declined to provide the number of panelists surveyed.

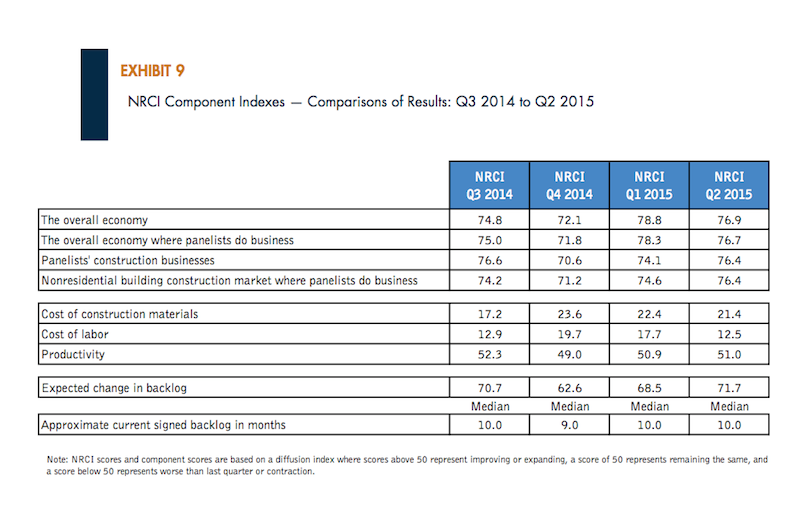

Chart: FMI

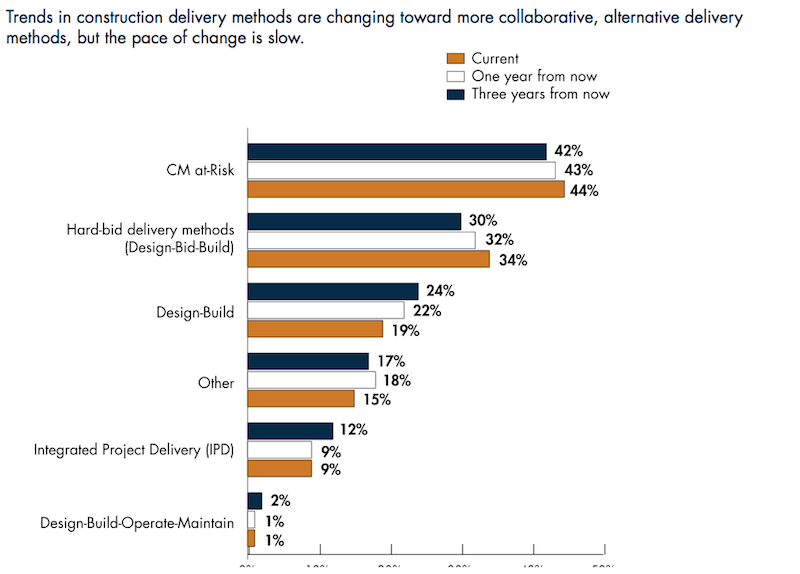

Chart: FMI

The NRCI for the second quarter was 64.9, virtually unchanged from the first quarter but improved from the 62.8 Index in the second quarter of 2014. FMI states that scores above 50 indicate expansion.

The panelists’ business outlook for specific nonresidential sectors is more ambivalent, however. Indices for healthcare and office construction are up, compared to a year ago, but down (albeit still on the growth side) for education, lodging, and manufacturing.

These scores might reflect the panelists’ perceptions of a still-volatile overall economy, whose second-quarter Index of 76.9 is down from the 78.8 Index in the first quarter. The panelists report that their own markets’ economies are off, too.

On the other hand, the panelists report improving productivity and steady backlogs. Half of the panelists said that their second-quarter backlogs grew faster than the previous quarter.

The indices for costs of materials and labor are down from the previous quarterly and yearly measurements, meaning those costs are rising. The NRCI Index for Construction Materials stood at 21.4, and 58.1% of the panelists said their materials costs increased from the first quarter. The Labor Cost Index was at 12.5, with 75% of the panelists reporting that their labor costs were higher in the second quarter than the first.

Chart: FMI

Chart: FMI

The survey also found that:

• Green construction made up only 28.6 percent of the panelists’ second-quarter backlogs, on average. FMI concludes from this finding that contractors no longer see green as anything special because it has become engrained into the mainstream of their businesses.

• The expediency of certain delivery methods during the recession is slowly yielding to more collaborative approaches among Building Teams and owners. “CM at-Risk is now allowed by most states, but those building CM at-Risk projects won’t quickly move to IPD [integrated project delivery].” FMI writes. “Design-build and IPD are expected to be growth areas for delivery methods; but IPD in particular, even though it offers many benefits to all parties, is not for everyone at this time. IPD, and even what has been called IPDish, requires more sophisticated owners, designers and contractors in order to realize the full benefits of this delivery approach.”

• Based on the panelists’ responses, FMI notes that other trends in construction—such as prefabrication, modularization, use of robotics, and 3D printing—are also likely to take a longer time to become mainstream like green construction has. “But the ongoing shortages of skilled labor will certainly hasten their coming.”

Related Stories

| Feb 16, 2012

TLC Engineering for Architecture opens Chattanooga office

TLC Engineering for Architecture provides mechanical, electrical, structural, plumbing, fire protection, communication, technology, LEED, commissioning and energy auditing services.

| Feb 16, 2012

Summit Design + Build begins build-out for Emmi Solutions in Chicago

The new headquarters will total 20,455 sq. ft. and feature a loft-style space with exposed masonry and mechanical systems, 15 foot clear ceilings, two large rooftop skylights and private offices with full glass partition walls.

| Feb 16, 2012

Highland named president of McCarthy Building Companies’ California region

Highland moved into this new role in January 2012 following a six-month transition period with Carter Chappell, the company’s former president, California region.

| Feb 16, 2012

Big-box retailers not just for DIYers

Nearly half of all contractor purchases made from stores like Home Depot and Lowe's.

| Feb 16, 2012

4.8-megawatt solar power system completed at Jersey Gardens Mall

Solar array among the largest rooftop systems in North America.

| Feb 15, 2012

Fourth-generation Ryan to lead Ryan Companies AE team

Ryan leads a team of eight architects, four civil engineers, two landscape architects and two virtual building specialists in their efforts to realize their customer’s vision and needs through Ryan’s integrated project delivery system.

| Feb 15, 2012

NAHB sees gradual improvement in multifamily sales for boomers

However, since the conditions of the current overall housing market are limiting their ability to sell their existing homes, this market is not recovering as quickly as might have been expected.

| Feb 15, 2012

Skanska secures $87M contract for subway project

The construction value of the project is $261.9 M. Skanska will include its full share, $87 M, in the bookings for Skanska USA Civil for the first quarter 2012.

| Feb 15, 2012

Code allowance offers retailers and commercial building owners increased energy savings and reduced construction costs

Specifying air curtains as energy-saving, cost-cutting alternatives to vestibules in 3,000-square-foot buildings and larger has been a recent trend among consulting engineers and architects.

| Feb 15, 2012

Englewood Construction announces new projects with Destination Maternity, American Girl

Englewood’s newest project for Wisconsin-based doll retailer American Girl, the company will combine four vacant storefronts into one large 15,000 square-foot retail space for American Girl.