The overall economy, as well as the economy in which they do business, might be down, but contractor panelists who provided these insights still see nonresidential construction on the upswing, according to FMI’s Second Quarter Nonresidential Construction Index (NRCI) Report.

Raleigh, N.C.-based FMI provides management consulting, investment banking, and people development services. Its quarterly index is based on voluntary responses from panelists to a 10-minute survey. The respondents represent a fairly wide cross-section of trades, company sizes, and markets. About 15% of the respondents are national contractors, 56% are Commercial General Building Contractors, and 39% operate businesses that generate between $51 million and $200 million in annual revenue. FMI declined to provide the number of panelists surveyed.

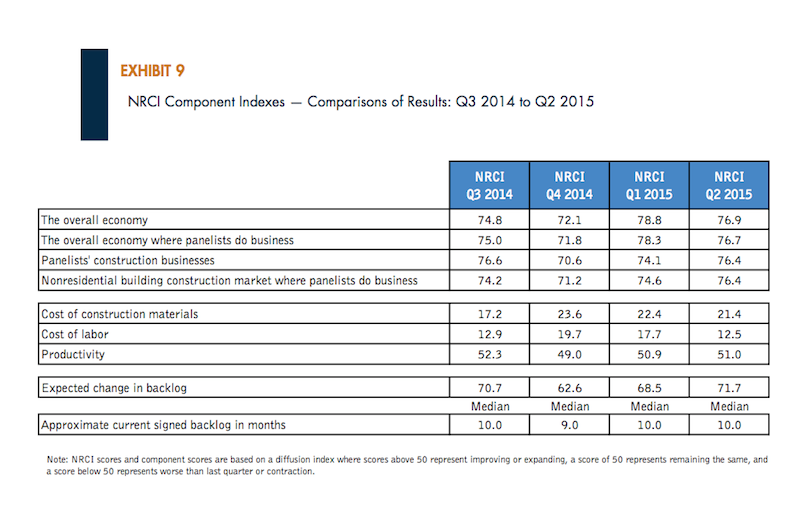

Chart: FMI

Chart: FMI

The NRCI for the second quarter was 64.9, virtually unchanged from the first quarter but improved from the 62.8 Index in the second quarter of 2014. FMI states that scores above 50 indicate expansion.

The panelists’ business outlook for specific nonresidential sectors is more ambivalent, however. Indices for healthcare and office construction are up, compared to a year ago, but down (albeit still on the growth side) for education, lodging, and manufacturing.

These scores might reflect the panelists’ perceptions of a still-volatile overall economy, whose second-quarter Index of 76.9 is down from the 78.8 Index in the first quarter. The panelists report that their own markets’ economies are off, too.

On the other hand, the panelists report improving productivity and steady backlogs. Half of the panelists said that their second-quarter backlogs grew faster than the previous quarter.

The indices for costs of materials and labor are down from the previous quarterly and yearly measurements, meaning those costs are rising. The NRCI Index for Construction Materials stood at 21.4, and 58.1% of the panelists said their materials costs increased from the first quarter. The Labor Cost Index was at 12.5, with 75% of the panelists reporting that their labor costs were higher in the second quarter than the first.

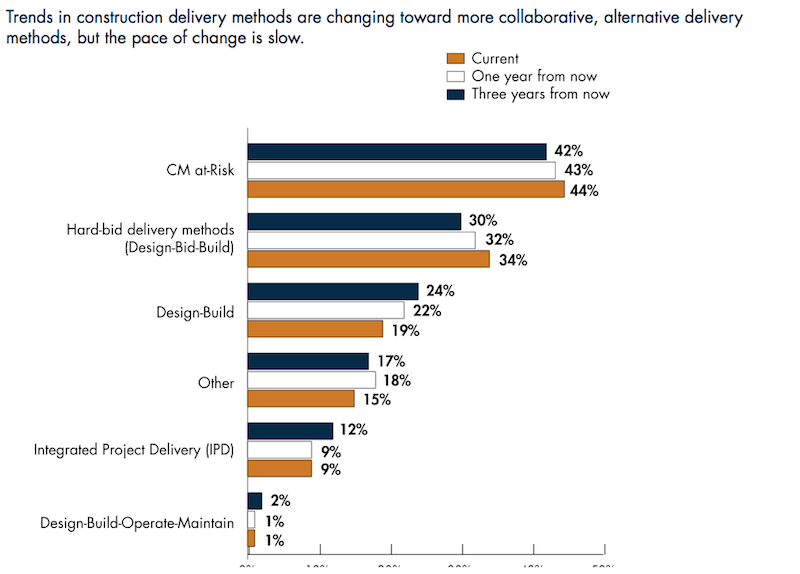

Chart: FMI

Chart: FMI

The survey also found that:

• Green construction made up only 28.6 percent of the panelists’ second-quarter backlogs, on average. FMI concludes from this finding that contractors no longer see green as anything special because it has become engrained into the mainstream of their businesses.

• The expediency of certain delivery methods during the recession is slowly yielding to more collaborative approaches among Building Teams and owners. “CM at-Risk is now allowed by most states, but those building CM at-Risk projects won’t quickly move to IPD [integrated project delivery].” FMI writes. “Design-build and IPD are expected to be growth areas for delivery methods; but IPD in particular, even though it offers many benefits to all parties, is not for everyone at this time. IPD, and even what has been called IPDish, requires more sophisticated owners, designers and contractors in order to realize the full benefits of this delivery approach.”

• Based on the panelists’ responses, FMI notes that other trends in construction—such as prefabrication, modularization, use of robotics, and 3D printing—are also likely to take a longer time to become mainstream like green construction has. “But the ongoing shortages of skilled labor will certainly hasten their coming.”

Related Stories

| Aug 17, 2022

Focusing on building envelope design and commissioning

Building envelope design is constantly evolving as new products and assemblies are developed.

| Aug 17, 2022

New York to deploy 30,000 window-sized electric heat pumps in city-owned apartments

New York officials recently announced the state and the city will invest $70 million to roll out 30,000 window-sized electric heat pumps in city-owned apartments.

| Aug 17, 2022

IBM’s former office buildings in Boca Raton turn into a modern tech campus

Built in 1968, the Boca Raton Innovation Campus (BRiC), at 1.7 million square feet, is the largest office campus in Florida.

| Aug 16, 2022

DOE funds 18 projects developing tech to enable buildings to store carbon

The Department of Energy announced $39 million in awards for 18 projects that are developing technologies to transform buildings into net carbon storage structures.

| Aug 16, 2022

Multifamily holds strong – for now

All leading indicators show that the multifamily sector is shrugging off rising interest rates, inflationary pressures and other economic challenges, and will continue to be a torrid market for design and construction firms for at least the rest of 2022.

| Aug 16, 2022

Cedars-Sinai Urgent Care Clinic’s high design for urgent care

The new Cedars-Sinai Los Feliz Urgent Care Clinic in Los Angeles plays against type, offering a stylized design to what are typically mundane, utilitarian buildings.

| Aug 15, 2022

IF you build it, will they come? The problem of staff respite in healthcare facilities

Architects and designers have long argued for the value of respite spaces in healthcare facilities.

| Aug 15, 2022

Boston high-rise will be largest Passive House office building in the world

Winthrop Center, a new 691-foot tall, mixed-use tower in Boston was recently honored with the Passive House Trailblazer award.

| Aug 12, 2022

Monthly Construction Input Prices Decreased 2% in July, Up 17% From a Year Ago, Says ABC

Construction input prices decreased 1.8% in July compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Hotel Facilities | Aug 12, 2022

Denver builds the nation’s first carbon-positive hotel

Touted as the nation’s first carbon-positive hotel, Populus recently broke ground in downtown Denver.