By mid-year 2014 approximately $2.3 billion of venture funding for digital health had been placed, surpassing the total investment made in all of 2013. This is yet another statistic that demonstrates an evolving healthcare ecosystem where reform is creating disruptive forces that alter the impact and importance of the players involved.

With changing business practices and a greater emphasis on consumerism, healthcare organizations are looking across their enterprises for answers. Facilities are not escaping the drag net and we continue to see evolving trends that will define the market for real estate and facilities services in 2015 and beyond. The three areas of change we will explore are new products, delivery models, and relationships.

NEW PRODUCTS

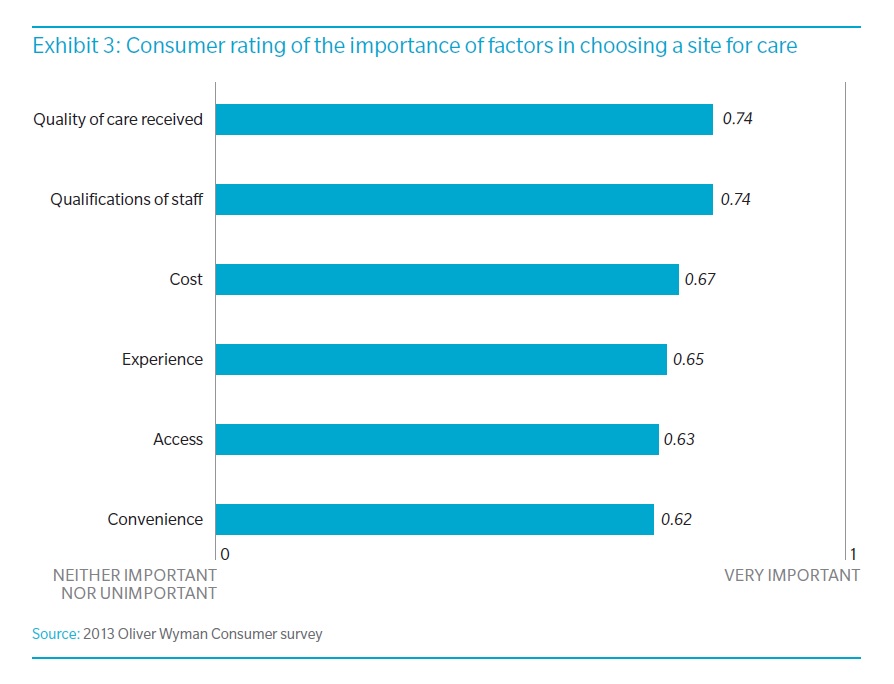

With consumers funding more and more of their healthcare services out of pocket, they are becoming more selective in who they seek healthcare services from. In a 2013 survey of healthcare consumers conducted by Oliver Wyman, consumers responded that their top reason for choosing a particular healthcare services location was the quality of care received. Consumers will be focused on every interaction they have with a healthcare provider to rate quality of care from setting up their appointments to the results they experience during and after their visit. The concept of “service” will become a focus of providers that will be successful in 2015 and beyond.

As healthcare organizations plan new facilities and evaluate their overall real estate portfolio, they will continue to look towards facilities that support a first class experience. Not only will they be concerned with the consumer experience, but employee satisfaction will also play a major role. The continued growth of retail care in a healthcare organizations real estate portfolio will continue to be a focus in 2015 and beyond. We will likely see more unique mixed-use projects that carry the live, work and play theme as healthcare focuses on prevention rather than episodic care.

DELIVERY MODELS

As healthcare organizations change their business practices across the enterprise, they are also looking to change the way facilities are delivered and managed. Integrated project delivery models are being requested on a more frequent basis. Many companies that used to market to healthcare organizations as design-build firms have altered their messaging to include the term “integrated.” Healthcare organizations continue to adopt performance improvement models such as Lean to improve their business and integrated project delivery is a natural fit for that culture.

The shift towards an integrated model of delivery is not just project by project based but portfolio based as well.

Healthcare organizations are beginning to see the value of reviewing their entire portfolio and determining the highest and best use for each asset with an understanding of the role it can play in a highly distributed service model. This has increased the demand for strategic real estate planning services that are more holistic than we have seen in the past.

There is a growing desire to develop key performance indicators (KPIs) that take into account clinical outcomes, service line financial performance, building performance and space utilization among other points. Analytical models will be developed in the future that provide an accepted rating system and allow healthcare organizations to measure the true performance of their real estate assets across the ecosystem.

RELATIONSHIPS

New products and an emphasis on new delivery models create new relationships. As healthcare organizations seek more opportunities to save in the delivery and care of facilities, they continue to demand more from group purchasing organizations (GPOs). In the past, GPOs have been focused on medical equipment and other essential supplies necessary to deliver care.

As healthcare organizations expand their net for savings opportunities, they are requesting volume pricing on construction materials, building systems and service contracts. With a limited amount of GPO coverage within this sector, healthcare organizations are exploring direct relationships with key suppliers in an effort to drive prices and increase schedule efficiencies by having more direct control over supply chains.

With an emphasis on ambulatory and retail building products, speed to market becomes more important and, therefore, better predictability with respect to schedule and budget. This has created a demand for roll-out strategies that can deliver portfolios rather than single projects. Healthcare organizations are seeking qualified integrated teams to deliver a solution including the ability to finance, design, build and maintain.

The relationship model continues to shift to a group of preferred providers that are in tune with the organization’s overall strategy and understand their culture and decision making style. In an industry with plenty of chaos, seeking solutions that provide a more predictable outcome will be a focus for healthcare organizations in 2015 and beyond.

CONCLUSION

Healthcare continues to shift toward Madison Avenue and Silicon Valley as it revamps business practices to focus on consumerism and efficiency. Not only does this impact the actual delivery of services, but it continues to have a large effect on the location and type of facility in which those services are delivered. In the next year, expect to see the following:

• Product. A continued emphasis on Ambulatory and Retail facilities and increased development of population health management tools such as wellness centers, adult daycare centers, and virtual medicine hubs.

• Delivery. Continued alignment in the delivery and care of facilities with a culture of improvement. An increase in integrated project delivery and risk sharing models based on short and long term outcomes. Development of holistic analytical models for evaluating portfolio performance.

• Relationships. A change in the relationship between Suppliers, GPOs and healthcare organizations that provides more direct access to innovations without delays and surcharges.

For service providers in the real estate, design and construction industry it will be important to understand how exactly how the healthcare industry is evolving. With shifting payment models and an emphasis on value creation, healthcare organizations will be open to partners that are able to contribute to achieving their strategic goals and not just deliver on a transaction.

The more a firm can demonstrate a predictable outcome that delivers results, the quicker they will become a trusted and preferred partner well into the future.

Related Stories

Mass Timber | Jan 27, 2023

How to set up your next mass timber construction project for success

XL Construction co-founder Dave Beck shares important preconstruction steps for designing and building mass timber buildings.

Sports and Recreational Facilities | Jan 26, 2023

Miami’s motorsport ‘country club’ to build sleek events center

Designed by renowned Italian design firm Pininfarina and with Revuelta as architect, The Event Campus at The Concours Club will be the first and only motorsport-based event campus located within minutes of a major metro area.

Student Housing | Jan 26, 2023

6 ways 'choice architecture' enhances student well-being in residence halls

The environments we build and inhabit shape our lives and the choices we make. NAC Architecture's Lauren Scranton shares six strategies for enhancing well-being in residence halls.

K-12 Schools | Jan 25, 2023

As gun incidents grow, schools have beefed up security significantly in recent years

Recently released federal data shows that U.S. schools have significantly raised security measures in recent years. About two-thirds of public schools now control access to school grounds—not just the building—up from about half in the 2017-18 school year.

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Sports and Recreational Facilities | Jan 24, 2023

Nashville boasts the largest soccer-specific stadium in the U.S. and Canada

At 30,105 seats and 530,000 sf, GEODIS Park, which opened in 2022, is the largest soccer-specific stadium in the U.S. and Canada. Created by design firms Populous and HASTINGS in collaboration with the Metro Nashville Sports Authority, GEODIS Park serves as the home of the Nashville Soccer Club as well as a venue for performances and events.

Concrete | Jan 24, 2023

Researchers investigate ancient Roman concrete to make durable, lower carbon mortar

Researchers have turned to an ancient Roman concrete recipe to develop more durable concrete that lasts for centuries and can potentially reduce the carbon impact of the built environment.

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Multifamily Housing | Jan 23, 2023

Long Beach, Calif., office tower converted to market rate multifamily housing

A project to convert an underperforming mid-century office tower in Long Beach, Calif., created badly needed market rate housing with a significantly lowered carbon footprint. The adaptive reuse project, composed of 203,177 sf including parking, created 106 apartment units out of a Class B office building that had been vacant for about 10 years.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.