If there’s a silver lining from the coronavirus pandemic, it’s the adrenalin rush it injected into life sciences research that has accelerated commercial and academic demand for lab space in new construction and, ironically, the adaptive reuse of offices that have been vacated during the ongoing health event.

“It’s the shiny object at the moment, and the demand is pretty immediate,” says Brent Zeigler, AIA, IIDA, CID, Principal and President with the architecture firm Dyer Brown in Boston, one of the country’s hottest spots for life sciences.

Over the last 20 months, New York-based engineering firm Jaros, Baum & Bolles (JB&B) has opened offices in Boston and Philadelphia, “each with a strong emphasis on life sciences,” says Robert Ayello, LEED AP and Senior Associate with that firm’s HVAC practice.

While there has always been institutional and academic investment in life sciences, what’s been occurring in recent years, explains Ayello, is increased interest on the commercial side. In New York, one can date this trend back to 2006 with the opening of the Alexandria Center for Life Sciences, which over the years has expanded to more than one million sf of commercial lab space. (JB&B worked on Alexandria’s east and west wings.)

In its 2021 North American Report titled “Life Sciences on the Rise,” Cushman & Wakefield projects that as much as $90 billion in public and private capital will have poured into the life sciences sector in North America in 2021, a 29 percent increase over the $70 billion invested in 2020, which itself was 93 percent higher than the previous year.

“This acceleration of the life sciences industry comes at a critical time, demonstrating the sector’s value and agility when the stakes have been so high,” that report states.

In its 2021 Life Sciences Real Estate Outlook, JLL states that market demand is being driven by adoption of new technologies (like large-molecule biologics and AI), and rapid advancements in innovation. Supply pipelines are growing with development and conversion activity, and new capital players are stimulating competition. Citing EvaluatePharma research, JLL estimates that Life Sciences R&D is expected to expand to $221 billion by 2024, versus $188 billion in 2020, and that estimate doesn’t include vaccines.

As of the second quarter of 2021 there were 147 million sf of lab space in the U.S., a sliver of office inventory, which was 4.3 billion sf; or of industrial inventory, at 13.6 billion sf. “Compared to other property sectors, labs are still very much niche in scale,” JLL states. As of that same quarter there were 21.6 million sf of lab space under construction in the U.S., three-quarters of which concentrated within three metro clusters: Boston (with 11 million sf under construction and 8 million sf on track to be delivered in 2022), San Francisco, and San Diego, which are expecting surges in development of 8.5 percent and 10.9 percent, respectively, this year.

GOING WHERE TALENT WANTS TO WORK

The first quarter of 2021 “was the largest quarter on record for life sciences real estate investment,” with a total transactional volume of $6.2 billion, estimates JLL. This investor appetite is driving record pricing for properties across several markets, notably Boston and Raleigh-Durham, N.C. However, life sciences has the most concentrated investment landscape, with 82 percent spent for properties in the top 10 markets where employee talent is most available. (Comparably, only 51 percent of industrial sector real estate investment is made in the top 10 markets.)

Some sources report that investors and developers are scouring secondary and tertiary markets for opportunities. One of these markets appears to be Houston, which in recent years has notched one the stronger records in the U.S. for growth in life science establishments, according to JLL.

“It is an unprecedented time for life sciences and innovation in the U.S., and Houston has all the factors that are required for explosive growth in this space,” Steve Purpura, President of Life Science at Beacon Capital Partners, says. Beacon is a development partner in Phase 1 of the 6-million-sf Gensler-designed Master Plan for Texas Medical Center’s new 37-acre life sciences campus. The campus’s hub, which started construction last January, is the 250,000-sf TMC3 Collaborative Building, whose building team includes Elkus Manfredi Architects, Vaughn Construction, and the landscape architect Mikyoung Kim Design.

Texas Medical Center (TMC) and its three academic healthcare partners—the University of Texas MD Anderson Cancer Center, Texas A&M University Health Center, and the University of Texas Health Science Center at Houston—are creating 43,000 sf of joint lab/coworking office space at TMC3. Another 85,000 sf of lab and office space will be developed for industry partners, and 14,200 sf will be earmarked for TMC’s investment platforms. TMC3 Collaborative is scheduled to open in the fall of 2023.

According to TMC, a key objective of the master plan—which will include a 521-room hotel, a 65,000-sf conference center, a 350-unit residential tower, and a 700,000-sf industry research building—was to ensure an environment where innovators from healthcare, science, academia, government, and industry could collaborate on new medicines, medical devices, diagnostic, and digital health platforms, and treatment solutions. The result is intended to attract high-quality talent by offering multiple opportunities for mentorship and career growth. “TMC has done the work necessary to seed innovation, build relationships with the world’s leading life sciences companies, and create the infrastructure needed for long-term success,” says Purpura.

Under development near TMC3 is Levit Green, a 52-acre, $1 billion mixed-use master plan (also designed by Gensler and Walter P Moore), whose first phase will include a five-story, 270,000-sf life sciences building, designed by HOK and built by Harvey Builders. According to Hines, the global real estate services firm that’s developing Levit Green with 2ML Real Estate Interests, the floor plates inside the life sciences building will average 55,000 sf for fitout flexibility. The building will include 25,000 sf for lab incubator space, and a 7,000-sf conference room. “We are seeing record-breaking R&D spending, creating the need for highly-sophisticated lab space and cutting-edge pharmaceutical facilities,” said Hines in a prepared statement.

Roger Soto, AIA, LEED AP, Design Principal for HOK, tells BD+C that the design team “reimagined” the life sciences building at Levit Green “from the point of view of the user.” For example, the building structure is entirely designed around the unique needs of lab planning and vibration criteria, which in turn drives the module and column spacing.

Levit Green is scheduled to start accepting occupants in the fourth quarter of next year.

HARVARD OPENS ONE OF THE HEALTHIEST LIFE SCIENCE BUILDINGS

There’s no dispute that life sciences’ demand is attracting new players. After watching the sector blossom on both coasts, Chicago-based developer Sterling Bay thought the Windy City should join the party. A few years ago, Sterling Bay “experimented” with the renovation of a 125,000-sf building for life sciences tenants that is now fully occupied. Last January, Sterling Bay launched a Life Sciences division whose first project is a 320,000-sf, Gensler-designed building called ALLY, whose construction broke ground on October 19 within the 53-acre Lincoln Yards scientific innovation district that’s under development in Chicago.

The eight-story ALLY will offer 280,000 sf of leasable lab and office space. The building will feature open-air terraces on each floor, and large shared conference and collaboration spaces on its main level that open onto an outdoor patio and to public spaces along the Chicago River. (Walsh Construction and Power Construction are part of the building team on ALLY, which is scheduled for completion in April 2023.)

Suzet McKinney, PhD, a public health professional who is a Principal and Director of Sterling Bay Life Sciences, says that buildings catering to this sector need to be “highly amenitized” and “thoughtful” about occupant health and wellness. She adds that Sterling Bay’s strategic approach is to develop life science “communities” whose designs are flexible enough to accommodate tenants’ growth. Sterling Bay recently held design competitions for two more life science buildings at Lincoln Yards.

“A lot of developers and municipalities have seen how life science clusters have been super successful,” observes John Swift, PE, CEM, LEED AP BD+C, Principal and firm leader for the national life sciences team at Buro Happold Engineering in Boston.

One of Buro Happold’s recent projects, for which it provided structural and geotechnical services, was the Behnisch Architekten-designed Science and Engineering Complex on Harvard University’s campus in Allston, Mass., that was completed in early 2021 and opened officially in the fall with a diverse mix of labs, classrooms, and offices.

This eight-level, 544,000-sf building—whose massing is organized into three four-story volumes connected by two multistory atria—was constructed on top of existing foundations and basement levels from a previous project that was suspended in 2008. To minimize structural interventions, the building’s atrium penetrates deep into the basement to let in more light. Buro Happold incorporated flexibility into the structural design to future-proof the lab spaces and allow for changes in the university programming.

Swift says his firm is comfortable working on life science projects with multiple stakeholders that might include prospective commercial tenants because “we can design for more robustness and flexibility when we know what all of the stakeholders want. That’s part of the fun and the challenge.”

Behnisch’s design included the world’s first hydroformed tensile façade system that saves energy by shading the façade and enhancing indirect light in the building. The design team also installed a water-based HVAC system that uses one-third the energy of a comparable air-driven system.

This is the largest building and the first wet labs to receive the International Future Institute Living Building Challenge’s Petal Certification. As part of that process, Harvard evaluated or tested 6,033 building materials and ultimately selected around 1,700 that complied with the Challenge’s Red List and met the requirements of Harvard’s Healthier Building Academy.

Harvard’s engineering school resides in this building. Matt Noblett, a Partner with Behnisch Architeken, says his firm is seeing more projects that combine engineering and life sciences. The answers that life science research is looking for “are lying somewhere in that blend,” he says.

ADAPTIVE REUSE IS SALVAGING VACATED OFFICES

Swift notes that Buro Happold has had a couple of large office projects that it tweaked to be “lab ready.” For the developer-owner Boston Properties, Dyer Brown redesigned space in a former office building in Lexington, Mass., to labs and offices for the biotech company Fractyl Health. The Broadway Company, a property management firm, recently proposed to Boston’s Planning & Development Agency replacing office buildings at West 1st Street in South Boston with a new development that would offer spaces for offices, life sciences, and other research.

As demand for life science research expands beyond the pandemic, “we need to find the next round of [lab] space,” says Bob Skolozdra, AIA, LEED AP, Partner with the New Haven, Conn.-based architecture firm Svigals + Partners. That’s why, he says, more developers are asking about converting their vacated office space for labs.

Because of Yale University, New Haven is a vibrant market for life sciences research. Skolozdra points to two new projects that reflect the market’s growth in this sector: 101 College, a new $100 million, 10-story, 500,000-sf building for bioscience labs and offices, in which Yale will be the anchor tenant when it’s ready for occupancy in Summer 2023; and 55 Church, an eight-story 105,000-sf office building that New Haven’s Board of Zoning Appeals OK’d for conversation to lab space in 2020.

Svigals + Partners was the design architect on the five-month-long adaptive reuse of the former Winchester Arms factory in New Haven for startup Halda Therapeutics’ new 7,500-sf headquarters, which was completed last April. (Fusco Corporation was this project’s CM.) The building’s lab has 40 wet benches that take up about half of the headquarters’ space (the rest is for offices and meeting areas). This $25 million conversion’s infrastructure upgrades included the installation of a three-foot-wide shaft that directs venting to a new air-handling system on the roof.

Among Jaros, Baum & Bolles’ recent projects is the conversion and expansion of an existing 160,000-sf Class B office building in Long Island City, N.Y., to a 266,800-sf Class A Life Sciences building called Innolabs that broke ground in December 2020. This project, for developer-owners King Street Properties and GFP Real Estate, entails a complete gut and renovation of the existing building, a four-story addition, and two six-story ground-up components. In September, Innolabs signed its first tenant, Opentrons, a biotech company, which starts leasing 47,790 sf early next year.

USING EVERY BTU

Offices aren’t automatically conducive to lab conversions. For one thing, office ceilings usually don’t go much higher than 12 feet, where labs favor ceilings that range from 12 to 18 feet. Older existing office buildings with higher interiors are in demand for adaptive reuse. HOK’s Soto notes that the vibration criteria sought after in life sciences buildings range between 2,000-8,000 mips to minimize the need for damping equipment. Most office buildings, however, are designed for human comfort, in the range of 10,000-12,000 mips. “Upgrading existing structure to [life science] levels can be quite costly,” cautions Soto.

Office-to-lab conversions also typically call for new, sometimes larger, HVAC systems to accommodate the labs’ more intense air-exchange and exhaust needs. Case in point: 125 West End Avenue in New York, which once was a Chrysler auto facility and, from 1985 through last January, provided office and studio spaces for ABC/Disney. The adaptive reuse team—Taconic Investment Partners, Nuveen Real Estate, Perkins and Will, and JB&B—is repositioning this eight-story, 400,000-sf building into a life sciences mecca with a robust mechanical plant, purpose-built lab infrastructure, high-performance façade, and roof terrace.

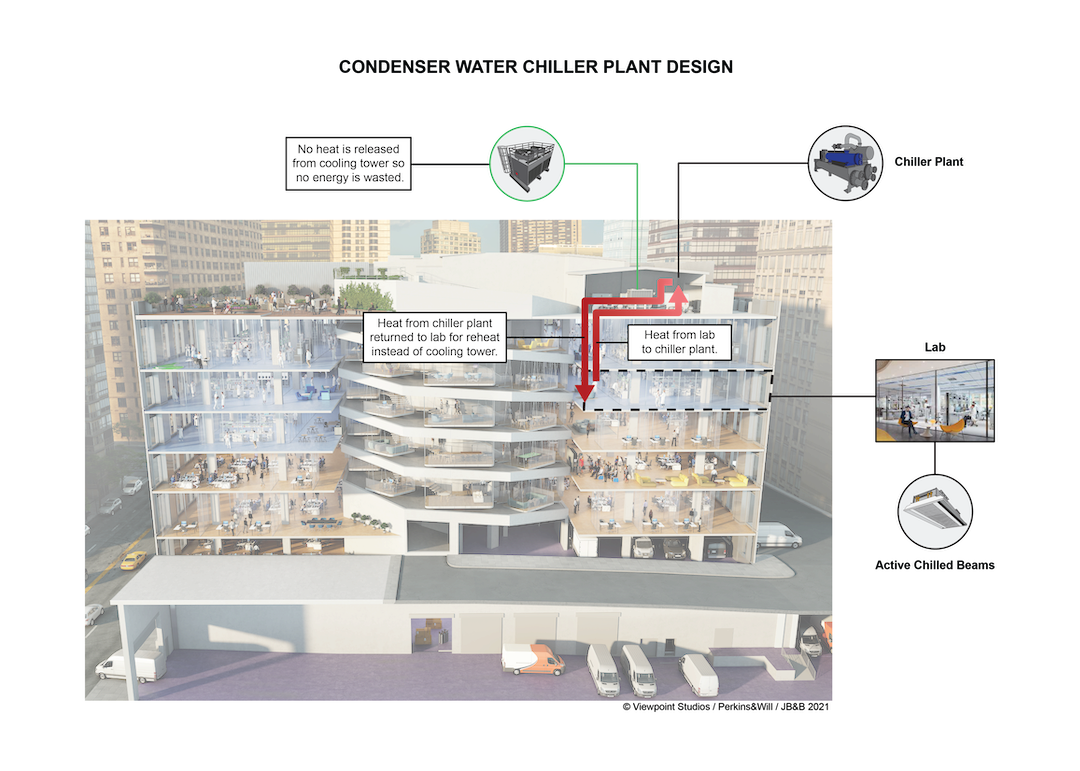

The project team had to devise ways to lower the converted building’s energy consumption (labs use two-to-three times more energy than offices) and carbon emissions to comply with Local Law 97, a centerpiece of New York City’s Climate Mobilization Act that requires buildings larger than 25,000 sf to meet ambitious carbon reduction targets. The “secret,” explains Ayello, who managed this conversion project for JB&B, “is to use every BTU that the building produces.”

To reuse heat generated from the mechanical compression refrigeration cycle at the central chiller plant for heating the building or injecting it into a hot-water lab reheat system, the project team captured the heat at the condenser water system where it otherwise would have escaped through the building’s cooling towers. The waste heat captured was 100 F, where traditional perimeter and reheat systems use water heated to between 150 and 180 F. The solution, says Ayello, deployed various configurations, including redesigned coils and equipment capacity, to not only use lower-temperature water but also to dramatically reduce the heat input the building required.

This was the first lab building in New York City to use this strategy to reduce energy consumption and carbon emissions.

Ayello says Taconic has embraced the building’s historical elements that include a spiral helix running through its center. Taconic, he says, wants this project to become a hub for social interaction among science and technology clients and workers. 125 West End Avenue is scheduled for completion in the Spring of 2023.

Related Stories

University Buildings | Jan 18, 2024

Houston’s Rice University opens the largest research facility on its core campus

Designed by Skidmore, Owings & Merrill (SOM), the 251,400-sf building provides students and researchers with state-of-the-art laboratories, classrooms, offices, and a cafe, in addition to multiple gathering spaces.

Healthcare Facilities | Jan 7, 2024

Two new projects could be economic catalysts for a central New Jersey city

A Cancer Center and Innovation district are under construction and expected to start opening in 2025 in New Brunswick.

Laboratories | Jan 5, 2024

Office conversions are helping to meet the growing demand for life-science space

Ware Malcomb and Rock Creek Property Group led the team that recently completed the adaptive reuse of two office buildings in Maryland.

Mass Timber | Jan 2, 2024

5 ways mass timber will reshape the design of life sciences facilities

Here are five reasons why it has become increasingly evident that mass timber is ready to shape the future of laboratory spaces.

Giants 400 | Nov 28, 2023

Top 55 Laboratory Construction Firms for 2023

Whiting-Turner, DPR Construction, STO Building Group, Skanska, and Hensel Phelps top BD+C's ranking of the nation's largest laboratory general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 28, 2023

Top 60 Laboratory Engineering Firms for 2023

Jacobs, Affiliated Engineers, Burns & McDonnell, Tetra Tech, and WSP head BD+C's ranking of the nation's largest laboratory engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 28, 2023

Top 100 Laboratory Design Firms for 2023

HDR, Flad Architects, DGA, Elkus Manfredi Architects, and Gensler top BD+C's ranking of the nation's largest laboratory architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 16, 2023

Top 80 Science + Technology Facility Construction Firms for 2023

DPR Construction, Austin Industries, Whiting-Turner, and Gilbane top BD+C's ranking of the nation's largest science and technology (S+T) facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Nov 16, 2023

Top 70 Science + Technology Facility Engineering Firms for 2023

Jacobs, Fluor, SSOE, Tetra Tech, and Affiliated Engineers head BD+C's ranking of the nation's largest science and technology (S+T) facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Nov 16, 2023

Top 100 Science + Technology Facility Architecture Firms for 2023

Gensler, HDR, Page Southerland Page, Flad Architects, and DGA top BD+C's ranking of the nation's largest science and technology (S+T) facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.