Hard to believe, but we’re only six months away from the day—January 1, 2014, to be precise—when the Affordable Care Act will usher in a radical transformation of the American healthcare system. Healthcare operators are scrambling to decipher what the new law will mean to their bottom lines and capital facility budgets.

For advice on how AEC firms can succeed under Obamacare, we turned to Patrick E. Duke, Senior Vice President at KLMK Group (www.klmkgroup.com), which advises healthcare operators on the planning and construction of capital facilities.

Duke, a BD+C “40 Under 40” honoree (Class of 2010), says firms must home in on three trends: 1) the shift by healthcare providers toward “population-based management”; 2) the push toward a fast-paced “retail environment” in healthcare; and 3) heightened interest in energy and operational cost savings among healthcare operators.

1. POPULATION-BASED MODEL HELPS SPREAD THE RISK

Today’s version of “fee-for-service,” whereby healthcare operators are reimbursed more on volume than on patient outcome, is on the way out, says Duke. It is being replaced by a system in which healthcare operators will be given a set amount of money to manage the care of a defined population of patients.

TOP HEALTHCARE ARCHITECTURE FIRMS

2012 Healthcare Revenue ($)1 HDR Architecture $185,763,0002 HKS $134,000,0003 Cannon Design $109,000,0004 Perkins+Will $100,962,2555 Stantec $98,471,4576 NBBJ $96,169,0007 HOK $84,300,0008 SmithGroupJJR $66,700,0009 Perkins Eastman $63,800,00010 RTKL Associates $60,746,000

TOP HEALTHCARE ENGINEERING FIRMS

2012 Healthcare Revenue ($)1 AECOM Technology Corp. $180,210,0002 Jacobs Engineering Group $77,100,0003 URS Corp. $43,327,3324 Smith Seckman Reid $40,105,6005 KPFF Consulting Engineers $30,000,0006 Affiliated Engineers $28,217,0007 TTG $24,719,9058 Parsons Brinckerhoff $22,700,0009 Dewberry $21,226,70210 Allen & Shariff $20,300,000

TOP HEALTHCARE CONSTRUCTION FIRMS

2012 Healthcare Revenue ($)1 Turner Corporation, The $1,856,850,0002 McCarthy Holdings $1,750,000,0003 Clark Group $1,055,387,8704 Skanska USA $833,093,7005 Brasfield & Gorrie $780,723,2476 JE Dunn Construction $759,053,6317 DPR Construction $749,013,6118 PCL Construction Enterprises $729,454,5149 Whiting-Turner Contracting Co., The $551,510,96710 Robins & Morton $545,100,000

Giants 300 coverage of Healthcare brought to you by DuPont www.fluidapplied.tyvek.com.

To be profitable under such a regimen, says Duke, healthcare operators will have to control costs by, ironically, keeping people out of the hospital. They will do so through various means: limiting the use of expensive emergency room visits, treating patients in lower-cost outpatient facilities, keeping people healthy through wellness programs, and cutting down on readmissions.

“The common response among providers thus far has been to cast as wide a net as possible to spread the risk over a broader population, just like life insurance,” says Duke. Some healthcare systems are growing their patient bases by buying up or merging with other providers. A more common practice is to build specialty facilities to provide more profitable services outside the hospital setting.

For example, the University of Maryland Medical System will open a 68,000-sf cancer center at its Upper Chesapeake Health affiliate in Bel Air, Md., in September. The new center will save local residents the 30-mile trip to UMMS’s Baltimore campus, while solidifying its position in the suburban market northeast of the city.

“Healthcare providers are looking at the services they can offer that are more specialized, with better outcomes in a lower-cost setting,” says Duke. AEC firms must be prepared to respond to this shift in direction.

2. ‘RETAIL HEALTHCARE’ PUTS EMPHASIS ON SPEED TO MARKET

As healthcare moves into more of a retail mode, getting specialty outpatient and primary-care outreach units to market as quickly as possible will be top-of-mind for hospital execs. Duke believes that will make them more open to modular construction. “If modular can get the facilities up faster to capture a growing market and get the cash registers ringing sooner, they’ll go with it,” he says.

Repurposing existing spaces is another route that healthcare systems are using to widen their patient bases quickly. In the Atlanta area, for example, Kaiser Permanente continues to explore repurposing vacant Blockbuster stores into neighborhood clinics, which then feeds patients into the Kaiser system. Vanderbilt University Medical Center has done the same at 100 Oaks Mall in Nashville, with great success.

“Healthcare operators want designers and contractors who can evaluate a building and come back quickly with solutions,” says Duke. Firms that can offer systems solutions for new facilities—designing standard units, bundling them, and rolling them out fast—will also be in demand, he says.

3. SAVING EVERY NICKEL ON ENERGY AND OPERATIONS

Healthcare providers are finally getting serious about saving on energy and operational costs. “Before Obamacare, they focused on supply chain and wouldn’t get serious about energy or facility operations because they didn’t need to,” says Duke. “As systems consolidate, they have the scale explore options like energy monitoring and retrocommissing, to identify sustainable cost-saving solutions.”

Another route to controlling costs is to develop new facilities under Performance Guaranteed Facilities arrangements. Under a PGF, the hospital contracts with a service provider to finance, plan, design, build, and maintain facilities over a 20- to 30-year period, at a fixed total cost.

“The hospital owns the building and the land, but the service provider takes the risk of developing the facility and maintaining it, including replacing equipment on an ongoing basis,” says Duke. This sheds a lot of risk for the hospital. If, for example, the OR goes down due to a maintenance error, the PGF provider takes the hit.

Duke says that, in Canada, value-for-money studies showed that life cycle cost savings averaged 15-20% on a net present value basis through the use of PGFs to build and operate new healthcare facilities versus traditional project delivery options.

The witching hour for Obamacare is fast approaching. Will your firm be ready to compete in the new American healthcare landscape?

Read BD+C's full Giants 300 Report

Related Stories

Adaptive Reuse | Aug 31, 2023

New York City creates team to accelerate office-to-residential conversions

New York City has a new Office Conversion Accelerator Team that provides a single point of contact within city government to help speed adaptive reuse projects. Projects that create 50 or more housing units from office buildings are eligible for this new program.

Codes and Standards | Aug 31, 2023

Community-led effort aims to prevent flooding in Chicago metro region

RainReady Calumet Corridor project favors solutions that use natural and low-impact projects such as rain gardens, bioswales, natural detention basins, green alleys, and permeable pavers, to reduce the risk of damaging floods.

Giants 400 | Aug 30, 2023

Top 75 Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, Langan, and IMEG head the rankings of the nation's largest engineering firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Building Team | Aug 28, 2023

Navigating challenges in construction administration

Vessel Architecture's Rebekah Schranck, AIA, shares how the demanding task of construction administration can be challenging, but crucial.

Multifamily Housing | Aug 23, 2023

Constructing multifamily housing buildings to Passive House standards can be done at cost parity

All-electric multi-family Passive House projects can be built at the same cost or close to the same cost as conventionally designed buildings, according to a report by the Passive House Network. The report included a survey of 45 multi-family Passive House buildings in New York and Massachusetts in recent years.

Regulations | Aug 23, 2023

Gas industry drops legal challenge to heat pump requirement in Washington building code

Gas and construction industry groups recently moved to dismiss a lawsuit they had filed to block new Washington state building codes that require heat pumps in new residential and commercial construction. The lawsuit contended that the codes harm the industry groups’ business, interfere with consumer energy choice, and don’t comply with federal law.

Government Buildings | Aug 23, 2023

White House wants to ‘aggressively’ get federal workers back to the office

The Biden administration wants to “aggressively” get federal workers back in the office by September or October. “We are returning to in-person work because it is critical to the well-being of our teams and will enable us to deliver better results for the American people,” according to an email by White House Chief of Staff Jeff Zients. The administration will not eliminate remote work entirely, though.

Building Owners | Aug 23, 2023

Charles Pankow Foundation releases free project delivery selection tool for building owners, developers, and project teams

Building owners and project teams can use the new Building Owner Assessment Tool (BOAT) to better understand how an owner's decision-making profile impacts outcomes for different project delivery methods.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

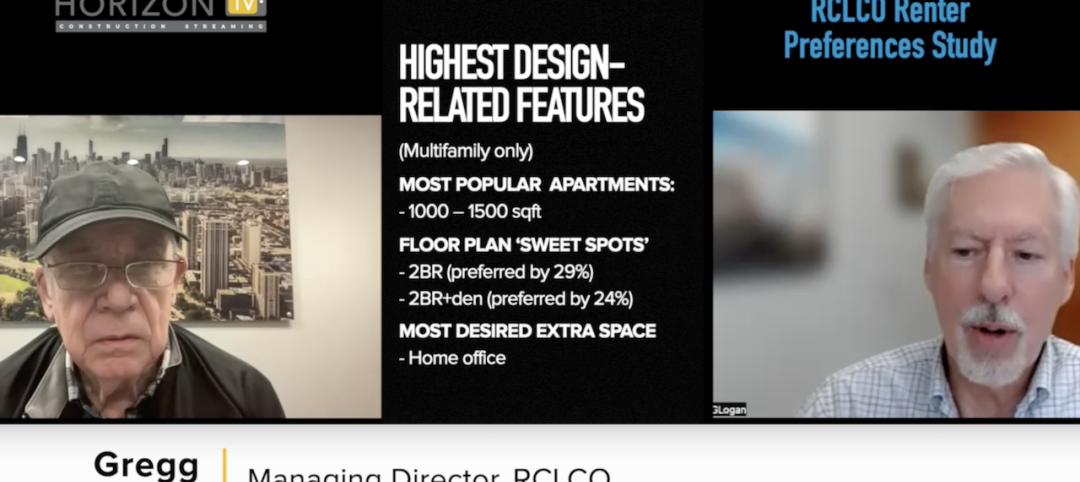

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.