The hotel sector is booming. But for how long?

Last April, the Real Deal, which tracks real estate news and trends, reported that new hotel construction in New York, which peaked in 2014, “is finally crashing” because so many new properties were coming online and developers were shying away from planning new projects.

In the first three months of this year, hoteliers had submitted permit applications for only six new hospitality properties, a total of 512 units, citywide. The Real Deal estimates that barely 10,000 new hotel rooms would be added to New York’s inventory this year, compared to more than 9,000 in 2014.

On Tuesday, Lodging Econometrics, the Portsmouth, N.H.-based market research firm, reported that New York City has the country’s largest hotel construction pipeline by project count: 196 projects and 32,121. New York has had the largest project count since the fourth quarter of 2011.

New York is followed by Houston (170 projects, 20,083 rooms), which has been the second-largest hotel market for the past 10 quarters, according to Lodging Econometrics. The rest of the top five hotel construction metros are Dallas (128 projects/15,662 rooms), Nashville (109/13,789), and Los Angeles (104/17,912).

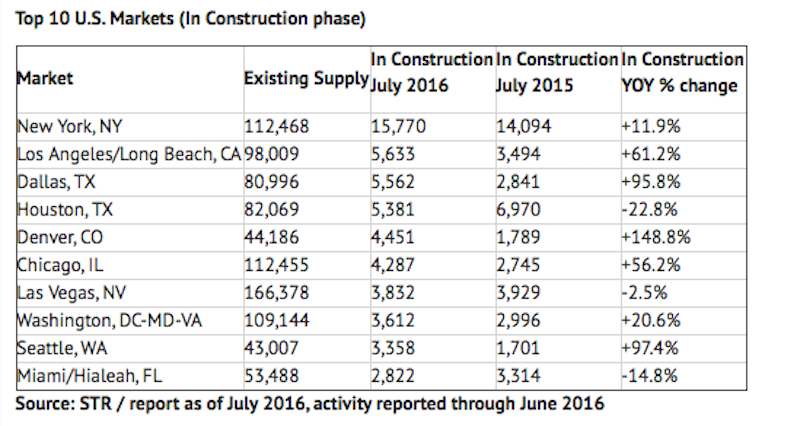

A day before Lodging Econometrics released this data, STR, a global data benchmarking and analytics firm, released its July 2016 Pipeline Report, which showed 171,276 rooms in 1,305 projects under construction, a 32.6% increase over the same month a year ago.

STR estimates that New York, with an existing supply of 112,468 rooms, had 15,770 rooms under construction, 11.9% more than in July 2015. Three other markets—L.A./Long Beach, Dallas, and Houston—had more than 5,000 rooms under construction.

Conversely, Bobby Bowers, STR’s Senior Vice President of Operations, notes that the San Francisco/San Mateo, Calif., market may be reaching a saturation point, with room construction among the five-lowest in the country.

New York City continues to lead the nation in new hotel construction and rooms under contract. The nation's 26 largest cities are, for the most part, seeing strong growth in their hospitality sectors, even as some developers worry that too much inventory may be coming online. Chart: STR

Related Stories

Modular Building | Feb 1, 2016

Hotel developers turn to modular construction to meet demand

A $90 million rebuilding project in Yellowstone National Park exemplifies this trend.

Casinos | Jan 30, 2016

Boston ends its opposition to a casino, Wynn to build $1.7B resort

A judge’s ruling last year paved the way for Wynn Resorts to begin construction on a 33-acre gambling palace in Everett, Mass.

Resort Design | Jan 26, 2016

Atlantis planning to build the world’s most expensive resort in Hawaii

The project was first announced in 2005 but has progressed little since.

Hotel Facilities | Jan 19, 2016

8 trends sparking the hospitality sector

Hotels and restaurants are branching out to attract more customers—and hold onto them longer.

| Jan 14, 2016

How to succeed with EIFS: exterior insulation and finish systems

This AIA CES Discovery course discusses the six elements of an EIFS wall assembly; common EIFS failures and how to prevent them; and EIFS and sustainability.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Urban Planning | Jan 4, 2016

The next boomtown? Construction and redevelopment sizzle in San Diego

The city's emission-reduction plan could drive influx into downtown

Hotel Facilities | Dec 14, 2015

Greater Fort Lauderdale is enjoying a building boom

This business-friendly South Florida market has several large hotel and multifamily projects in construction.

Greenbuild Report | Dec 14, 2015

Sensible sustainability: The new standard for hotels

In October 2008, The Proximity, a 147-room hotel in Greensboro, N.C., became the first LEED Platinum–certified hotel in the U.S. Since then, only two other hotels have earned LEED Platinum.

Multifamily Housing | Dec 7, 2015

Are long-term apartment rentals Airbnb’s next target?

Some developers are thinking about that possibility, says one West Coast real estate consultant.