The hotel sector is booming. But for how long?

Last April, the Real Deal, which tracks real estate news and trends, reported that new hotel construction in New York, which peaked in 2014, “is finally crashing” because so many new properties were coming online and developers were shying away from planning new projects.

In the first three months of this year, hoteliers had submitted permit applications for only six new hospitality properties, a total of 512 units, citywide. The Real Deal estimates that barely 10,000 new hotel rooms would be added to New York’s inventory this year, compared to more than 9,000 in 2014.

On Tuesday, Lodging Econometrics, the Portsmouth, N.H.-based market research firm, reported that New York City has the country’s largest hotel construction pipeline by project count: 196 projects and 32,121. New York has had the largest project count since the fourth quarter of 2011.

New York is followed by Houston (170 projects, 20,083 rooms), which has been the second-largest hotel market for the past 10 quarters, according to Lodging Econometrics. The rest of the top five hotel construction metros are Dallas (128 projects/15,662 rooms), Nashville (109/13,789), and Los Angeles (104/17,912).

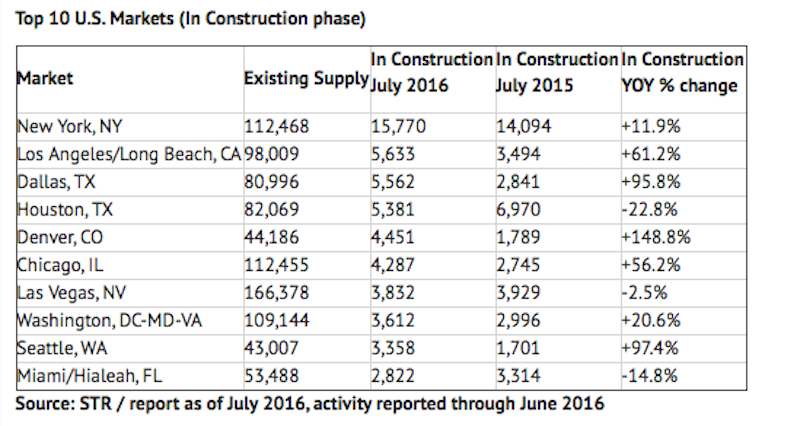

A day before Lodging Econometrics released this data, STR, a global data benchmarking and analytics firm, released its July 2016 Pipeline Report, which showed 171,276 rooms in 1,305 projects under construction, a 32.6% increase over the same month a year ago.

STR estimates that New York, with an existing supply of 112,468 rooms, had 15,770 rooms under construction, 11.9% more than in July 2015. Three other markets—L.A./Long Beach, Dallas, and Houston—had more than 5,000 rooms under construction.

Conversely, Bobby Bowers, STR’s Senior Vice President of Operations, notes that the San Francisco/San Mateo, Calif., market may be reaching a saturation point, with room construction among the five-lowest in the country.

New York City continues to lead the nation in new hotel construction and rooms under contract. The nation's 26 largest cities are, for the most part, seeing strong growth in their hospitality sectors, even as some developers worry that too much inventory may be coming online. Chart: STR

Related Stories

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

BAS and Security | Oct 19, 2022

The biggest cybersecurity threats in commercial real estate, and how to mitigate them

Coleman Wolf, Senior Security Systems Consultant with global engineering firm ESD, outlines the top-three cybersecurity threats to commercial and institutional building owners and property managers, and offers advice on how to deter and defend against hackers.

Hotel Facilities | Oct 12, 2022

Global hotel chain citizenM opens its first Chicago property and its fifth of the year

citizenM, a global chain of affordable luxury hotels, has opened its first Chicago property—its fifth opening of 2022.

Giants 400 | Sep 9, 2022

Top 90 Hospitality Sector Contractors + CM Firms for 2022

AECOM, Suffolk Construction, STO Building Group, and The Yates Companies top the ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 9, 2022

Top 70 Hospitality Sector Engineering + EA Firms for 2022

Jacobs, Jensen Hughes, EXP, and Kimley-Horn head the ranking of the nation's largest hospitality facilities sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 9, 2022

Top 120 Hospitality Sector Architecture + AE Firms for 2022

Gensler, WATG, HKS, and JCJ Architecture top the ranking of the nation's largest hospitality facilities sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 9, 2022

Top 80 Hotel Sector Contractors + CM Firms for 2022

AECOM, Suffolk Construction, STO Building Group, and Swinerton top the ranking of the nation's largest hotel and resort sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Sep 9, 2022

Top 70 Hotel Sector Engineering + EA Firms for 2022

Jensen Hughes, Jacobs, WSP, and Kimley-Horn top the ranking of the nation's largest hotel and resort sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Sep 8, 2022

Top 115 Hotel Sector Architecture + AE Firms for 2022

Gensler, WATG, HKS, and Stantec top the ranking of the nation's largest hotel and resort sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Aug 22, 2022

Top 90 Construction Management Firms for 2022

CBRE, Alfa Tech, Jacobs, and Hill International head the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2022 Giants 400 Report.