A PDF of the Annual Roofing Survey can be downloaded at the bottom of this page.

Key findings of the roofing survey

- Respondents named metal (56%) and EPDM (50%) as the roofing systems they (or their firms) employed most in projects. However, the results show that they used a wide variety of roofing types, including built-up, shakes and shingles, modified bitumen, TPO, PVC, and tiles.

- Insulation choice was also spread among several product categories, with polyisocyanurate leading the way (62%) and EPS, XPS, and sprayed polyurethane foam also showing support.

- More than half of respondents (53%) said their roofing projects were essentially all low-slope jobs (2/12 rise or less), but nearly a third (31%) said steep-slope roofs (>2/12 rise) comprised all or almost all of their roofing-related projects.

- New construction and retrofits were fairly evenly split among respondents’ roofing-related projects over the last couple of years.

- Initial cost is not the most important factor in choosing a roofing system. That honor went to durability and reliability, at least from the experience of respondents and their perception of their clients’ priorities.

- In a related finding, it is not surprising that “leaks or failures” (42%) was the single biggest concern or worry expressed by respondents, along with such related factors as “quality/performance” (17%) and “incorrect installation” (11%). Again, cost was not the key concern, with only 13% of respondents checking it as their number one worry.

- In terms of “green” factors, energy efficiency (52%) is far and away the crucial component of a roofing system, followed distantly by life cycle cost (25%).

- Building information modeling is still largely in its infancy in respondents’ roofing-related projects, with less than one-third (32%) saying that they used BIM. However, the use of BIM is expected to grow to about 59% over the next two years or so.

- Only a small percentage of respondents (4%) said they (or their firms) have made extensive use of photovoltaics on roofs in the last two years, but three in 10 (30%) had used PVs in a few projects. The upside is that 57% plan to do so in the next 18-24 months.

- Similarly, the extensive use of green vegetative roofs is limited (2%), but 23% of respondents (or their firms) have tried them in at least a few projects in the last two years, and 38% said they intend to do so in the next 18-24 months.

Survey Methodology

The survey was emailed to a representative sample of BD+C’s subscriber list. No incentive was offered; 263 qualified returns were obtained. The majority of responses (52%) came from architects and designers, a group that represents half of BD+C’s subscriber base; however, respondents were spread across the professions and included nearly one-fifth (18%) from among owners and facilities directors. In terms of location, respondents’ roofing-related projects covered the entire U.S. (and a bit in Canada), although the Mid-Atlantic region may have been underrepresented (8%). A margin of error of 6-7% at the 95% confidence level can be applied in most cases.

Note: Some of the tables refer to “Top % rank,” the percentage of respondents who rated the factor as their single most important factor. “Weighted score” was calculated by tripling the number of respondents who rated the factor #1, doubling those who rated the factor #2 by 2, multiplying by one those who rated the factor #3 by 1, and dividing the sum by three to obtain the average.

Download a PDF of the Annual Roofing Survey below

Related Stories

Sponsored | Architects | Jul 19, 2017

Introducing StrXur by Bluebeam

Our goal is to present unique perspectives you may not be able to find anywhere else.

Sponsored | Accelerate Live! | Jul 13, 2017

Defining the future by mastering the art of change

From my perspective, what separates organizations thriving in the digital revolution from those who are not boils down to one thing: leadership.

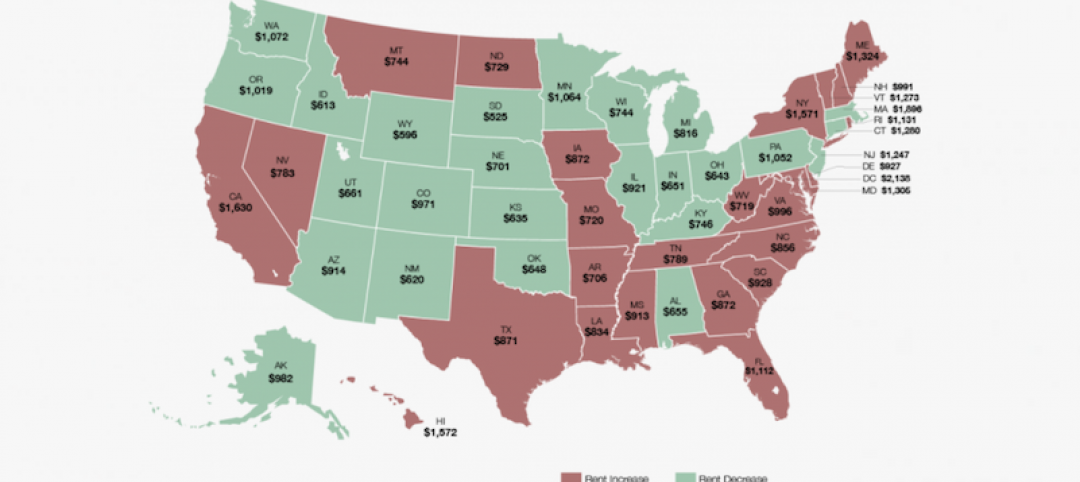

Multifamily Housing | Jul 12, 2017

Midyear Rent Report: 26 states saw rental price increases in first half of 2017

The most notable rental increases are in growing markets in the South and Southwest: New Orleans, Glendale, Ariz., Houston, Reno, N.V., and Atlanta.

Giants 400 | Jul 12, 2017

Innovation abounds, but will it lead to growth for AEC Giants?

Engineering firms such as Arup, Glumac, and Thornton Tomasetti are leveraging their in-house expertise to develop products and tools for their design teams, clients, and even the competition.

Multifamily Housing | Jul 12, 2017

7 noteworthy multifamily projects: posh amenities, healthy living, plugged-in lifestyle

Zen meditation gardens, bocce courts, saltwater pools, and free drinks highlight the niceties at these new multifamily developments.

Accelerate Live! | Jul 6, 2017

Watch all 20 Accelerate Live! talks on demand

BD+C’s inaugural AEC innovation conference, Accelerate Live! (May 11, Chicago), featured talks on machine learning, AI, gaming in construction, maker culture, and health-generating buildings.

Healthcare Facilities | Jun 29, 2017

Uniting healthcare and community

Out of the many insights that night, everyone agreed that the healthcare industry is ripe for disruption and that communities contribute immensely to our health and wellness.

Architects | Jun 25, 2017

Stantec adds RNL Design to its stable, fortifying several of its business units

The engineering giant also names successor to CEO who will retire at the end of this year.

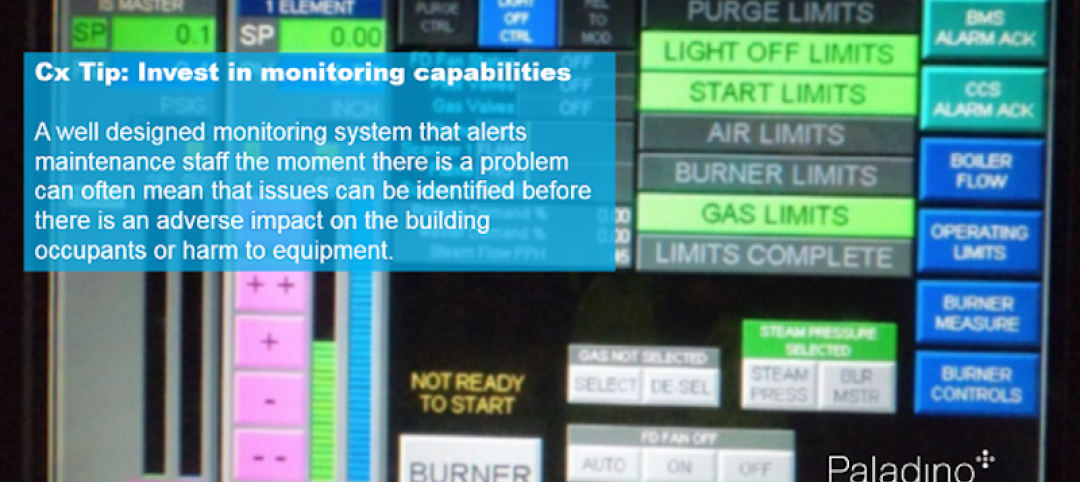

Building Team | Jun 22, 2017

Seven lessons learned on commissioning projects

Commissioning is where the rubber meets the road in terms of building design.

Sponsored | Building Team | Jun 20, 2017

Plan ahead when building in the west

Getting a project through plan review can be an unusually long process, anywhere from six months to two years.