A PDF of the Annual Roofing Survey can be downloaded at the bottom of this page.

Key findings of the roofing survey

- Respondents named metal (56%) and EPDM (50%) as the roofing systems they (or their firms) employed most in projects. However, the results show that they used a wide variety of roofing types, including built-up, shakes and shingles, modified bitumen, TPO, PVC, and tiles.

- Insulation choice was also spread among several product categories, with polyisocyanurate leading the way (62%) and EPS, XPS, and sprayed polyurethane foam also showing support.

- More than half of respondents (53%) said their roofing projects were essentially all low-slope jobs (2/12 rise or less), but nearly a third (31%) said steep-slope roofs (>2/12 rise) comprised all or almost all of their roofing-related projects.

- New construction and retrofits were fairly evenly split among respondents’ roofing-related projects over the last couple of years.

- Initial cost is not the most important factor in choosing a roofing system. That honor went to durability and reliability, at least from the experience of respondents and their perception of their clients’ priorities.

- In a related finding, it is not surprising that “leaks or failures” (42%) was the single biggest concern or worry expressed by respondents, along with such related factors as “quality/performance” (17%) and “incorrect installation” (11%). Again, cost was not the key concern, with only 13% of respondents checking it as their number one worry.

- In terms of “green” factors, energy efficiency (52%) is far and away the crucial component of a roofing system, followed distantly by life cycle cost (25%).

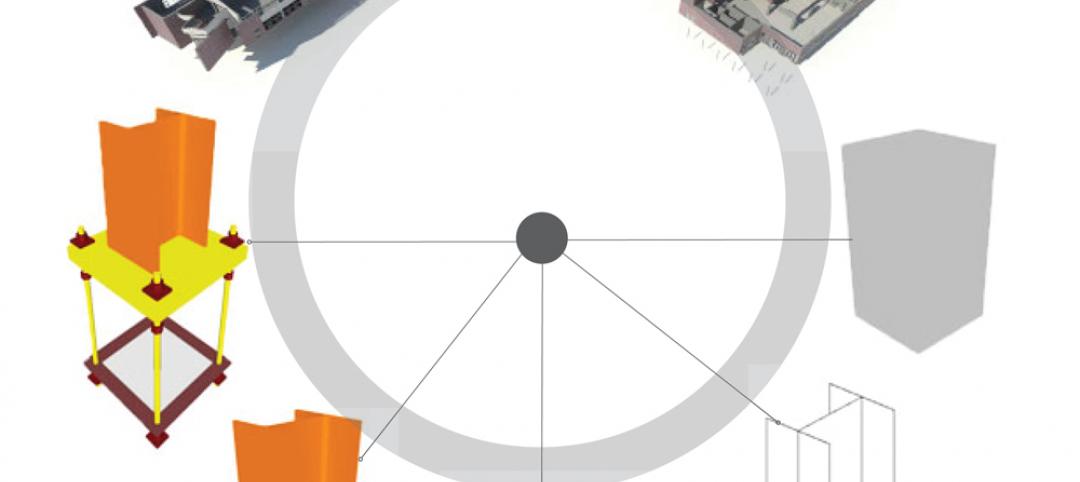

- Building information modeling is still largely in its infancy in respondents’ roofing-related projects, with less than one-third (32%) saying that they used BIM. However, the use of BIM is expected to grow to about 59% over the next two years or so.

- Only a small percentage of respondents (4%) said they (or their firms) have made extensive use of photovoltaics on roofs in the last two years, but three in 10 (30%) had used PVs in a few projects. The upside is that 57% plan to do so in the next 18-24 months.

- Similarly, the extensive use of green vegetative roofs is limited (2%), but 23% of respondents (or their firms) have tried them in at least a few projects in the last two years, and 38% said they intend to do so in the next 18-24 months.

Survey Methodology

The survey was emailed to a representative sample of BD+C’s subscriber list. No incentive was offered; 263 qualified returns were obtained. The majority of responses (52%) came from architects and designers, a group that represents half of BD+C’s subscriber base; however, respondents were spread across the professions and included nearly one-fifth (18%) from among owners and facilities directors. In terms of location, respondents’ roofing-related projects covered the entire U.S. (and a bit in Canada), although the Mid-Atlantic region may have been underrepresented (8%). A margin of error of 6-7% at the 95% confidence level can be applied in most cases.

Note: Some of the tables refer to “Top % rank,” the percentage of respondents who rated the factor as their single most important factor. “Weighted score” was calculated by tripling the number of respondents who rated the factor #1, doubling those who rated the factor #2 by 2, multiplying by one those who rated the factor #3 by 1, and dividing the sum by three to obtain the average.

Download a PDF of the Annual Roofing Survey below

Related Stories

| Aug 8, 2013

Top Science and Technology Sector Engineering Firms [2013 Giants 300 Report]

Affiliated Engineers, Middough, URS top Building Design+Construction's 2013 ranking of the largest science and technology sector engineering and engineering/architecture firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Architecture Firms [2013 Giants 300 Report]

HDR, Perkins+Will, HOK top Building Design+Construction's 2013 ranking of the largest science and technology sector architecture and architecture/engineering firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Construction Firms [2013 Giants 300 Report]

Skanska, DPR, Suffolk top Building Design+Construction's 2013 ranking of the largest science and technology sector contractors and construction management firms in the U.S.

| Aug 8, 2013

Level of Development: Will a new standard bring clarity to BIM model detail?

The newly released LOD Specification document allows Building Teams to understand exactly what’s in the BIM model they’re being handed.

| Aug 8, 2013

Vertegy spins off to form independent green consultancy

St. Louis-based Vertegy has announced the formation of Vertegy, LLC, transitioning into an independent company separate from the Alberici Enterprise. The new company was officially unveiled Aug. 1, 2013

| Aug 5, 2013

Top Retail Architecture Firms [2013 Giants 300 Report]

Callison, Stantec, Gensler top Building Design+Construction's 2013 ranking of the largest retail architecture and architecture/engineering firms in the United States.

| Aug 5, 2013

Top Retail Engineering Firms [2013 Giants 300 Report]

Jacobs, AECOM, Henderson Engineers top Building Design+Construction's 2013 ranking of the largest retail engineering and engineering/architecture firms in the United States.

| Aug 5, 2013

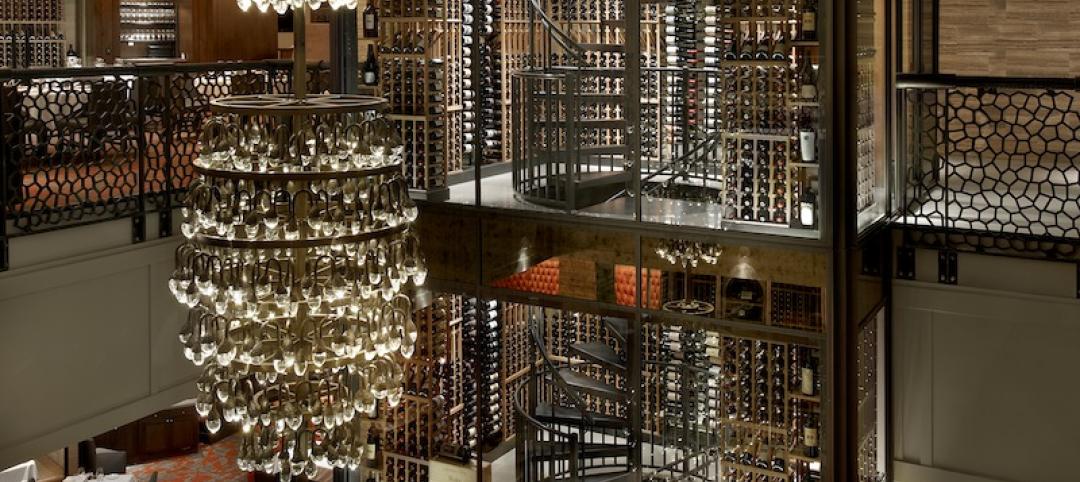

Retail market shows signs of life [2013 Giants 300 Report]

Retail rentals and occupancy are finally on the rise after a long stretch in the doldrums.

| Aug 5, 2013

Top Retail Construction Firms [2013 Giants 300 Report]

Shawmut, Whiting-Turner, PCL top Building Design+Construction's 2013 ranking of the largest retail contractor and construction management firms in the United States.

| Aug 2, 2013

Michael Baker Corp. agrees to be acquired by Integrated Mission Solutions

Michael Baker Corporation (“Baker”) (NYSE MKT:BKR) announced today that it has entered into a definitive merger agreement to be acquired by Integrated Mission Solutions, LLC (“IMS”), an affiliate of DC Capital Partners, LLC (“DC Capital”).