Industrial development continues to be a growth sector for many metros, especially in the western U.S. But aggressive building may be finally catching up with that sector’s demand, at least temporarily.

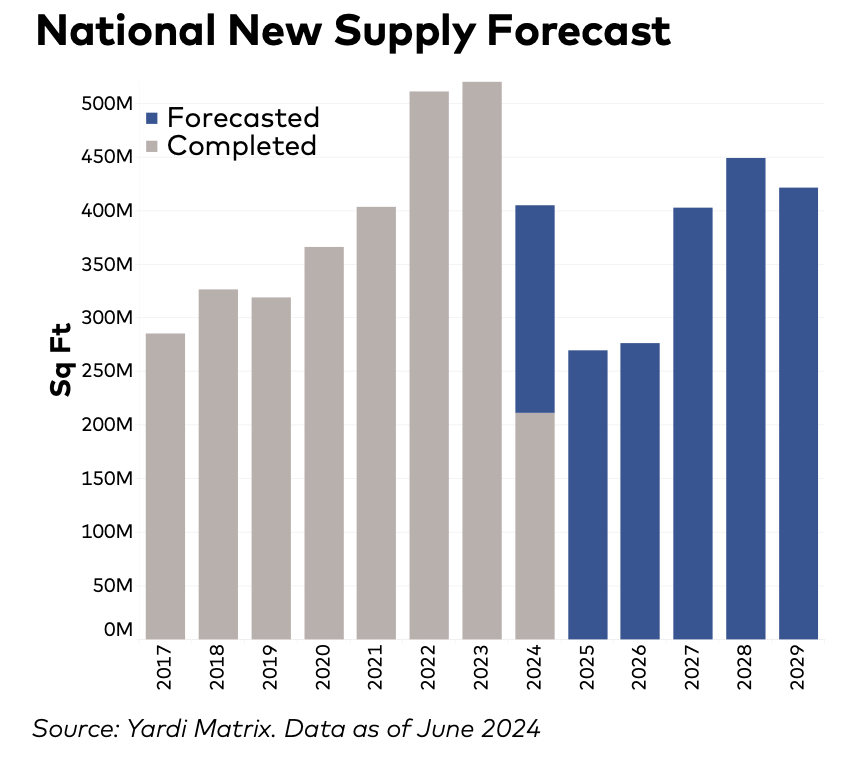

After two years of record-smashing deliveries, the industrial pipeline has slowed in a number of markets. In its latest National Industrial Report, CommercialEdge estimates that 97.8 million sf of industrial space were started in the first half of 2024, a 33% decline from the same period a year earlier. By comparison, 1.1 billion sf were started between 2021 and 2022, with 313 million sf started in the first half of 2022 alone. The latest slowdown in starts has been occurring for the past six quarters, says CommercialEdge, which attributes the erosion to “normalized” tenant demand, oversupply, rising construction costs, and “economic uncertainty.”

Nationwide, 375.7 million sf of industrial space were in various stages of construction through the first half of 2024, representing 1.9% of total stock. In the latest six-month period, 209 million sf of new space were delivered, compared to 160 million sf in the first half of 2022. “This growth underscores the market’s capacity to bring projects to completion despite the decline in construction starts,” CommercialEdge states.

This sector has gotten a big bump from manufacturing, which accounted for 16.1% of annualized industrial construction starts through June, compared to an estimated 7.5% in 2018 through 2021, and more than 13% in 2022 and 2023. As more manufacturing returns to the U.S., demand for industrial space is expected to benefit.

Indeed, CommercialEdge forecasts that the new development pipeline will grow in the next few years, but at a slower clip. It points out that developers have disclosed plans for 561.2 million sf of new space. “Once the market absorbs the recently completed stock, and the cost of capital begins to decrease, we expect many of these projects to see shovels in the ground,” predicts CommercialEdge.

Vacancy rates and rents for industrial space rising

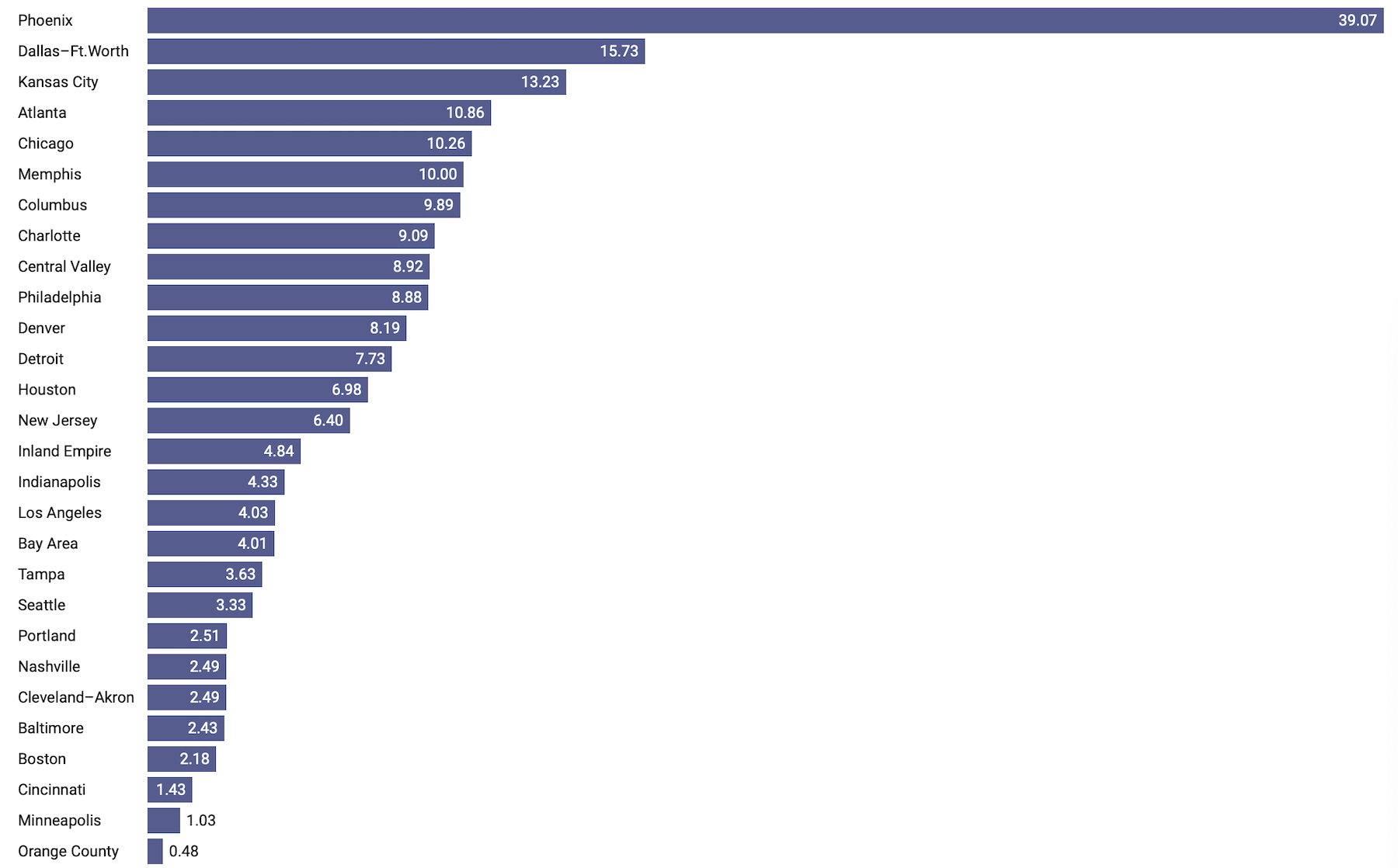

Phoenix leads the country by far in new industrial space, with 39.07 million sf under construction. The next-closest metro was Dallas-Fort Worth, at 15.23 million sf. DFW’s vacancy rate sat at a relatively manageable 6.5%, but it appears this market is “hitting the brakes” on new development after delivering 126.4 million sf of industrial space since the start of 2022.

Nationally, the vacancy rate for industrial space stood at 6.1%, up slightly. The national average rent in June was $8.04 per sf, although the average for contracts signed over the previous 12 months was $10.56. The San Francisco Bay Area recorded the highest average rent, at $13.34, and $16.24 per sf for newer contracts. Miami experienced the largest premium for new leases that, at $17.35, cost tenants $5.85 more than the national average.

California’s Inland Empire led the nation in rent growth, with in-place rents rising 12.5% year-over-year. Conversely, the Midwest saw the slowest rent growth: In Kansas City, for example, in-place rents increased only 2.5%; in St. Louis, 3.4%.

Bay Area leads industrial sales

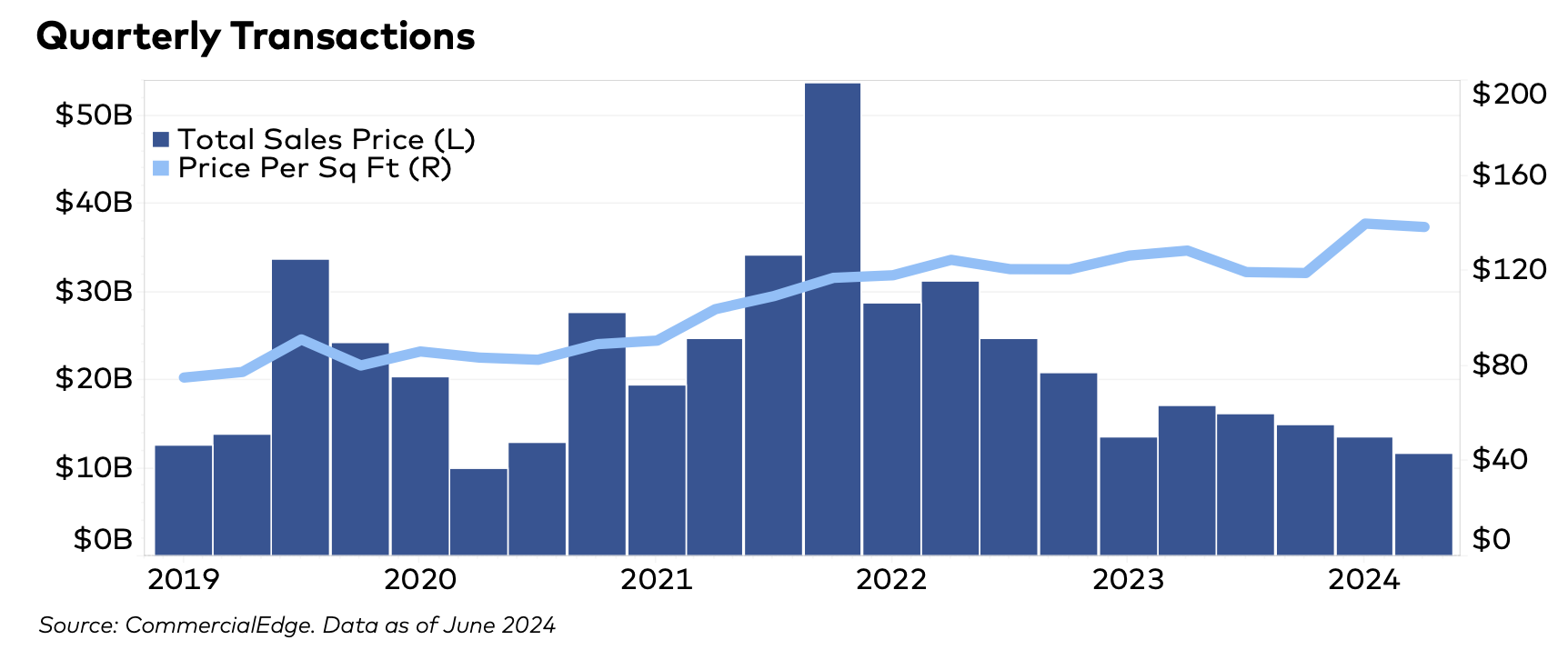

The sale of industrial buildings totaled $25.1 billion through the first half of 2024, and demand remains strong, with the average sale price of $139 per sf rising 12.9% over the same period in 2023, according to CommercialEdge estimates.

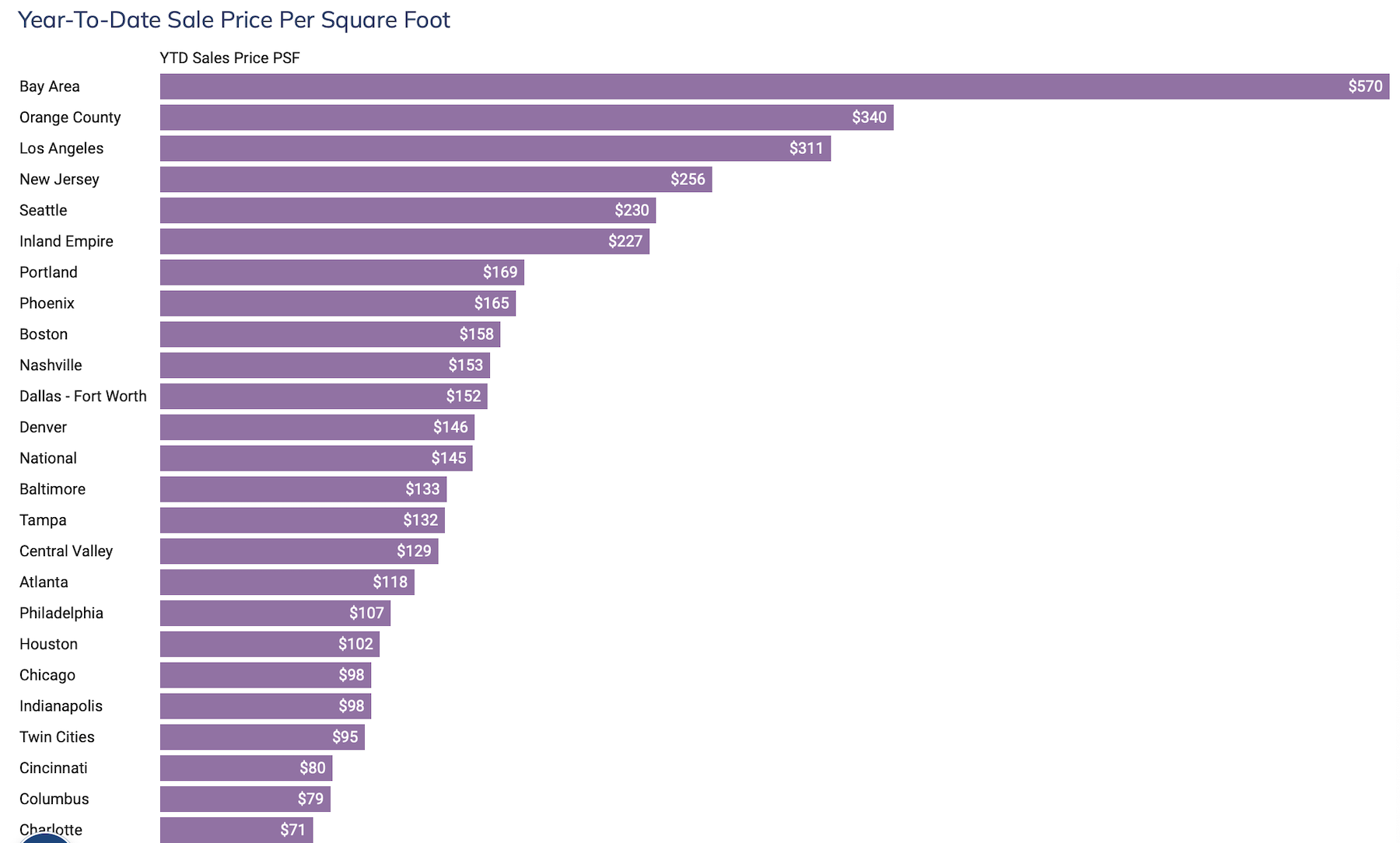

Again, the Bay Area led all markets in year-to-date industrial sales, at $2.285 billion. San Francisco was followed by Dallas-Fort Worth ($2.006 billion), Los Angeles ($1.581 billion, and Chicago ($1.314 billion).

Southern California remains the most sought-after location for distribution center and warehouse sales and development. CommercialEdge notes that earlier this year Rexford Industrial Realty paid $1 billion for 3 million sf across 48 properties in L.A. and Orange counties.

The Bay Area led the nation in average sales price per sf, at $570. This market has seen a spike in demand for advanced manufacturing space. Over 4 million sf of industrial space are under construction in the Bay Area.

In the South, the surge in Texas’s population—it’s the fastest-growing state in the U.S.—drove demand for industrial space, with DFW serving as a hub from products arriving from Mexico, which recently surpassed Canada as America’s largest trading partner, according to the Census Bureau. That positioning is why CommercialEdge expects Dallas-Fort Worth’s industrial development and construction to eventually pick up steam again.

Other markets worth keeping an eye on include Charlotte and Nashville, with their low vacancy rates and tight supply.

On the other hand, Boston—one of the country’s most expensive markets—reported the highest industrial vacancy rate, at 8.8%. New Jersey, another pricy rent market, nevertheless remained a regional leader in industrial sales, with over $1 billion in transactions closing through June.

Related Stories

| Nov 8, 2013

S+T buildings embrace 'no excuses' approach to green labs

Some science-design experts once believed high levels of sustainability would be possible only for low-intensity labs in temperate zones. But recent projects prove otherwise.

| Nov 6, 2013

Energy-efficiency measures paying off for commercial building owners, says BOMA study

The commercial real estate industry’s ongoing focus on energy efficiency has resulted in a downward trend in total operating expenses (3.9 percent drop, on average), according to BOMA's Experience Exchange Report.

| Oct 30, 2013

11 hot BIM/VDC topics for 2013

If you like to geek out on building information modeling and virtual design and construction, you should enjoy this overview of the top BIM/VDC topics.

| Oct 28, 2013

Urban growth doesn’t have to destroy nature—it can work with it

Our collective desire to live in cities has never been stronger. According to the World Health Organization, 60% of the world’s population will live in a city by 2030. As urban populations swell, what people demand from their cities is evolving.

| Oct 18, 2013

Meet the winners of BD+C's $5,000 Vision U40 Competition

Fifteen teams competed last week in the first annual Vision U40 Competition at BD+C's Under 40 Leadership Summit in San Francisco. Here are the five winning teams, including the $3,000 grand prize honorees.

| Oct 18, 2013

Researchers discover tension-fusing properties of metal

When a group of MIT researchers recently discovered that stress can cause metal alloy to fuse rather than break apart, they assumed it must be a mistake. It wasn't. The surprising finding could lead to self-healing materials that repair early damage before it has a chance to spread.

| Oct 7, 2013

10 award-winning metal building projects

The FDNY Fireboat Firehouse in New York and the Cirrus Logic Building in Austin, Texas, are among nine projects named winners of the 2013 Chairman’s Award by the Metal Construction Association for outstanding design and construction.

| Sep 24, 2013

8 grand green roofs (and walls)

A dramatic interior green wall at Drexel University and a massive, 4.4-acre vegetated roof at the Kauffman Performing Arts Center in Kansas City are among the projects honored in the 2013 Green Roof and Wall Awards of Excellence.

| Sep 19, 2013

What we can learn from the world’s greenest buildings

Renowned green building author, Jerry Yudelson, offers five valuable lessons for designers, contractors, and building owners, based on a study of 55 high-performance projects from around the world.

| Sep 19, 2013

6 emerging energy-management glazing technologies

Phase-change materials, electrochromic glass, and building-integrated PVs are among the breakthrough glazing technologies that are taking energy performance to a new level.