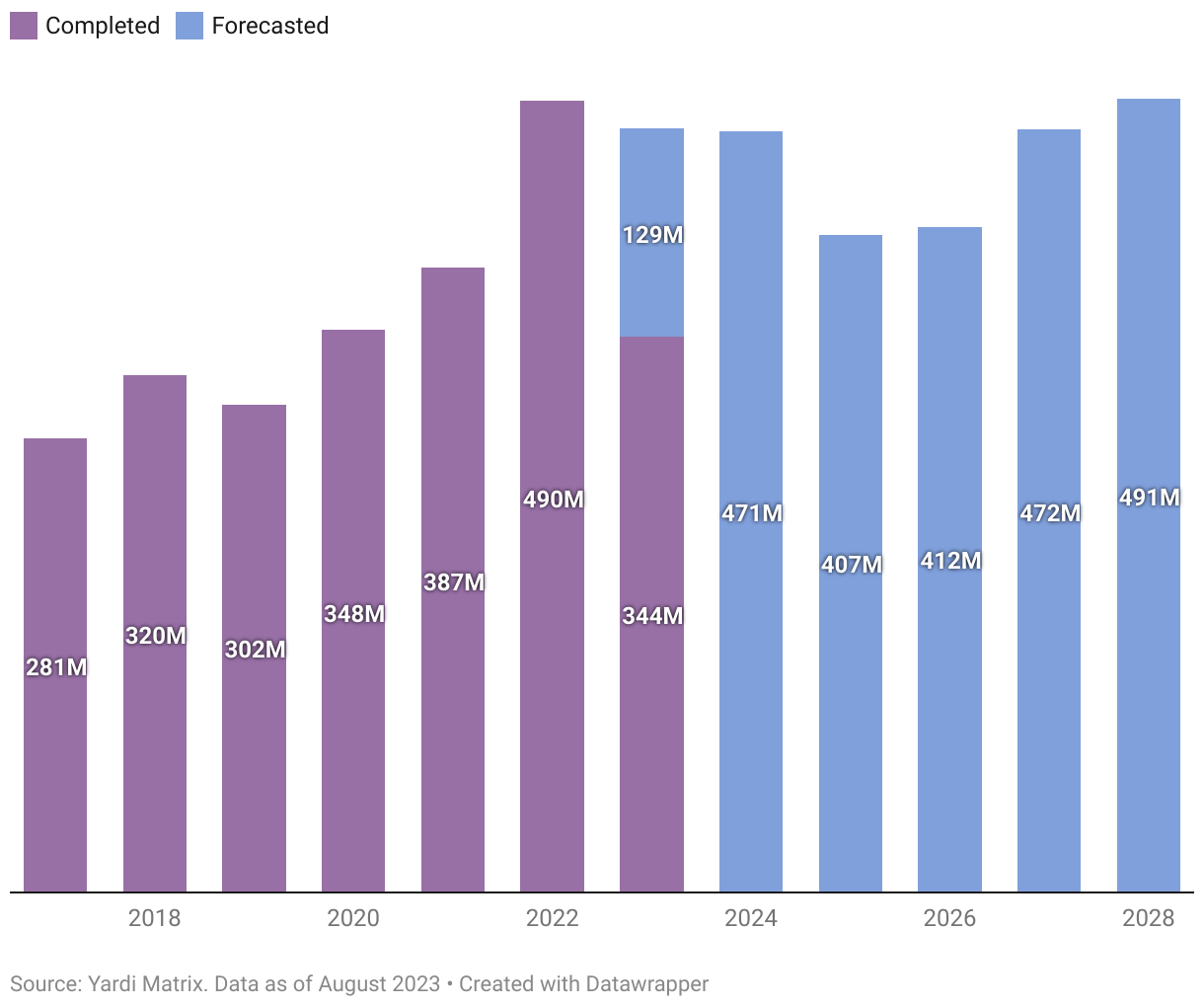

For the past several years, Industrial has been one of the hottest sectors in commercial construction. Through August 31 of this year, there were 566.71 million square feet of industrial space for manufacturing and distribution under construction, according to CommercialEdge’s National Industrial Report for September 2023.

However, construction starts in this sector through August dropped to 204.3 million sf, from 614.2 million in 2022 and 586 million sf in 2021. Concerns about inflation, supply chain snags, and labor have made speculative development in this sector riskier. And as e-commerce has flattened, demand for logistics centers has “normalized,” according to CommercialEdge.

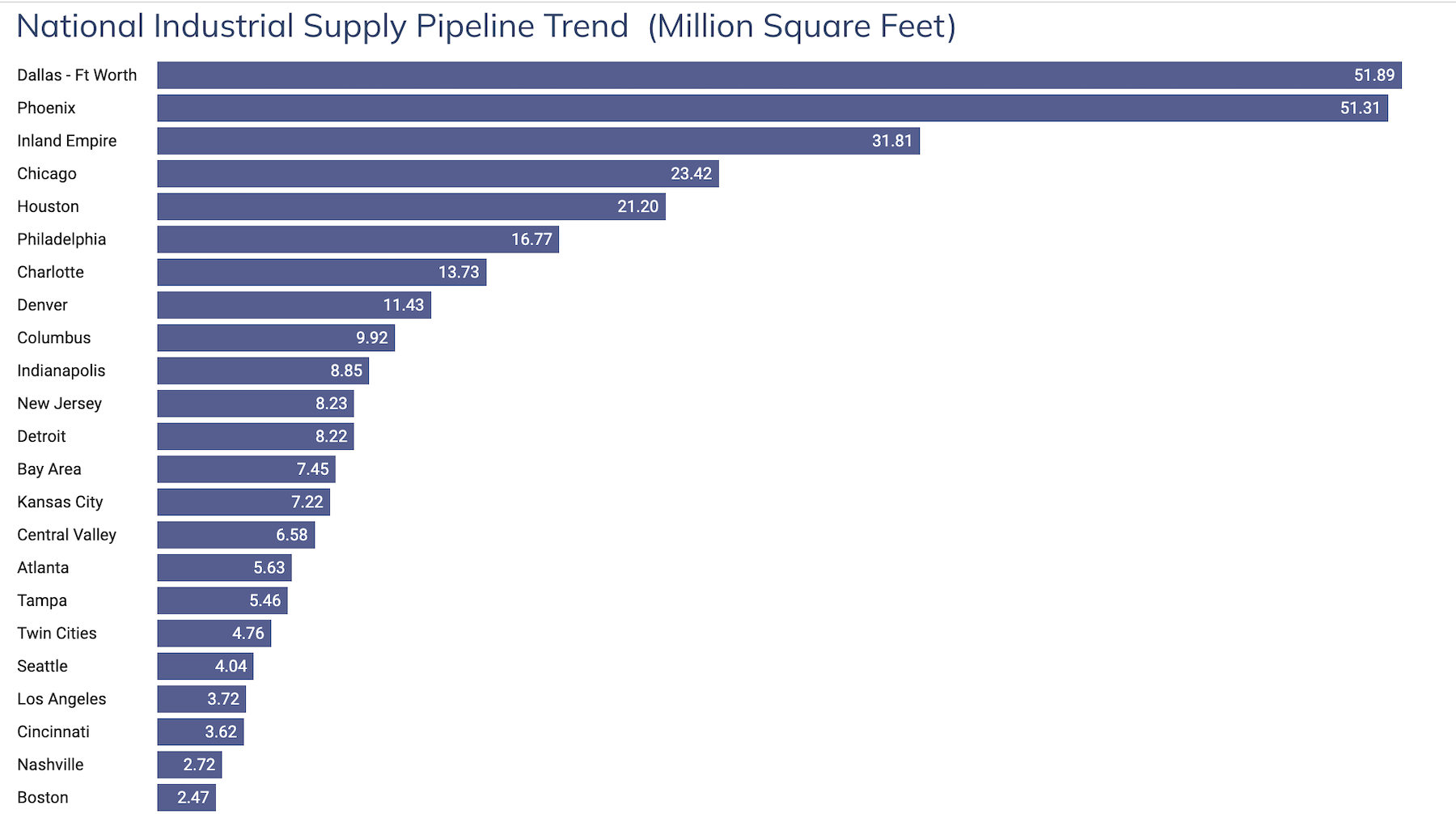

The Dallas-Fort Worth Metroplex led all metros with 51.89 million sf of industrial space under construction as of August 31, the equivalent of 5.8 percent of its total rentable stock. Phoenix had 51.31 million sf under construction, 14.1 percent of its total stock, including Airpark Logistics Center, a three-building 1.4 million-sf facility developed by Creation and designed by LGE Design|Build, which just opened in the suburb of Goodyear, Ariz. And in southern California, which has the largest logistics cluster in the nation, the Inland Empire had 31.81 million sf of industrial space under construction.

Most of the 21.2 million sf under construction in Houston were for logistics parks, estimates CommercialEdge.

While construction activity is expected to dip slightly next year and then more steeply in 2025 and 2026, CommercialEdge is predicting rebounds in 2027 and 2028. And the current trend toward a “just in case” inventory strategy has meant that logistics centers are getting bigger to carry the extra goods.

More markets building multistory warehouses

Chicago, at 23.42 million sf, is among the top five markets for new industrial construction. One of the projects there is 1237 W. Division Street, the region’s first multistory logistics facility. The 1.2 million-sf building, which is scheduled for completion in the third quarter of 2024, is located downtown in Chicago’s Goose Island neighborhood. With a 36-ft clear height and 1,600 vehicle parking spaces, 1237 W. Division will serve more than $2 billion in ecommerce customers within a five-mile radius.

The Chicago facility is one of five case studies examined in JLL’s Fall 2023 report on Multistory Warehouses.

JLL’s report includes a history of urban logistics, which in New York City dates back to 1900. The report also notes how the U.S. has been a relative newcomer to multistory warehouse development, compared to land-constrained markets in Europe and Asia (the latter of which has some warehouses that are 22 floors).

Because vertical warehouses often provide development solutions under tight land conditions, automobile parking is a crucial component, says JLL. Typically, these facilities double as last-mile distribution and fulfillment centers. In New York, for example, projects either under construction or in the planning/proposal stage total 9.4 million sf of additional last-mile logistics space.

One of JLL’s case studies is the 385,000-sf Red Hook Logistics Center in Brooklyn, N.Y., which opens next year and, according to JLL, “combines multiple levels of ultramodern Class A functionality with immediate access to one of the country’s largest concentrations of consumers.” The building will have 19 dock-high doors, eight drive-in doors, and a 31-ft 4-inch clear height.

The 1.3 million-sf Bronx Logistics Center, which opened in the second quarter of this year, is the largest such facility in New York City, and the first on the East Coast built to earn LEED Platinum certification. The building has two warehouse floors, each 250,000 sf, accessed nearly 800 ft from one another through separate entrances. It has 48 loading docks, and the single-largest availability of parking in the market. Bronx Logistics is also distinguished by its rooftop greenery and solar array.

JLL states that while coastal cities, because of their population densities and costly land, have, until recently, been the primary markets for urban logistics development, they are now being joined by metros like Atlanta, Miami, Dallas, Houston, and Seattle (where, ironically, the first multistory warehouse in the U.S. was built. Called Georgetown Crossing, this three-story 590,000-sf facility opened in 2018).

Opportunities call for agile design

JLL’s report cites opportunities and challenges in the future of last-mile buildings. Developers must grapple with outdated zoning, NIMBYism, land availability and growing competition for that land from developers of assets like hotels and housing.

Developers and their AEC partners must be agile in their architectural and design considerations. Where should the loading docks be? Should the building include offices? How should the building’s roof be utilized?

Developers need to account for where warehouse employees and delivery trucks will park. And to what extent should new technologies, like electric bikes and scooters and EV chargers be incorporated into the building’s operational and delivery strategies?

JLL’s report advocates for human-centric design, and anticipates that acquisitions are likely to shape the industrial sector’s future.

Related Stories

| Aug 22, 2013

Warehouse remake: Conversion project turns derelict freight terminal into modern office space [slideshow]

The goal of the Freight development is to attract businesses to an abandoned industrial zone north of downtown Denver.

| Aug 20, 2013

As costs rise, Building Teams turn to novel energy-saving schemes for data centers [2013 Giants 300 Report]

Shrinking IT budgets and rising operational costs have led data center operators and corporate clients to scrutinize project budgets. As a result, AEC firms are being tasked with finding solutions for lowering the overall cost of computing and operating and maintaining the facilities.

| Aug 20, 2013

Top Data Center Construction Firms [2013 Giants 300 Report]

DPR, Balfour Beatty, Holder head Building Design+Construction's 2013 ranking of the largest data center contractors and construction management firms in the U.S.

| Aug 20, 2013

Top Data Center Engineering Firms [2013 Giants 300 Report]

Fluor, Syska, Jacobs top Building Design+Construction's 2013 ranking of the largest data center engineering and engineering/architecture firms in the U.S.

| Aug 20, 2013

Top Data Center Architecture Firms [2013 Giants 300 Report]

Corgan, Gensler, HDR head Building Design+Construction's 2013 ranking of the largest data center architecture and architecture/engineering firms in the U.S.

| Aug 14, 2013

Green Building Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest green design and construction firms.

| Jul 29, 2013

2013 Giants 300 Report

The editors of Building Design+Construction magazine present the findings of the annual Giants 300 Report, which ranks the leading firms in the AEC industry.

| Jul 19, 2013

Renovation, adaptive reuse stay strong, providing fertile ground for growth [2013 Giants 300 Report]

Increasingly, owners recognize that existing buildings represent a considerable resource in embodied energy, which can often be leveraged for lower front-end costs and a faster turnaround than new construction.

| Jul 18, 2013

Top Local Government Sector Construction Firms [2013 Giants 300 Report]

Turner, Clark Group, PCL top Building Design+Construction's 2013 ranking of the largest local government sector contractor and construction management firms in the U.S.

| Jul 18, 2013

Top Local Government Sector Engineering Firms [2013 Giants 300 Report]

STV, URS, AECOM top Building Design+Construction's 2013 ranking of the largest local government sector engineering and engineering/architecture firms in the U.S.