Even as ecommerce has moderated somewhat, the industrial market in the U.S. continues to attract unrelenting investor interest, as new construction and adaptive reuse play catch-up with demand, according to CommercialEdge’s National Industrial Report, which it released earlier this month and covers the first half of 2022.

The national industrial vacancy rate in June was 4.6 percent, falling 10 basis points from the previous month. The lowest vacancy rates were in California’s Inland Empire (0.6 percent), Columbus (1.4 percent), Los Angeles (1.9 percent) and Nashville (2.1 percent).

“Supply of new industrial space cannot maintain pace with demand, a problem more pronounced in areas where geography limits the amount of land available for development. Port markets, and Southern California in particular, are most attuned to this issue,” the report states.

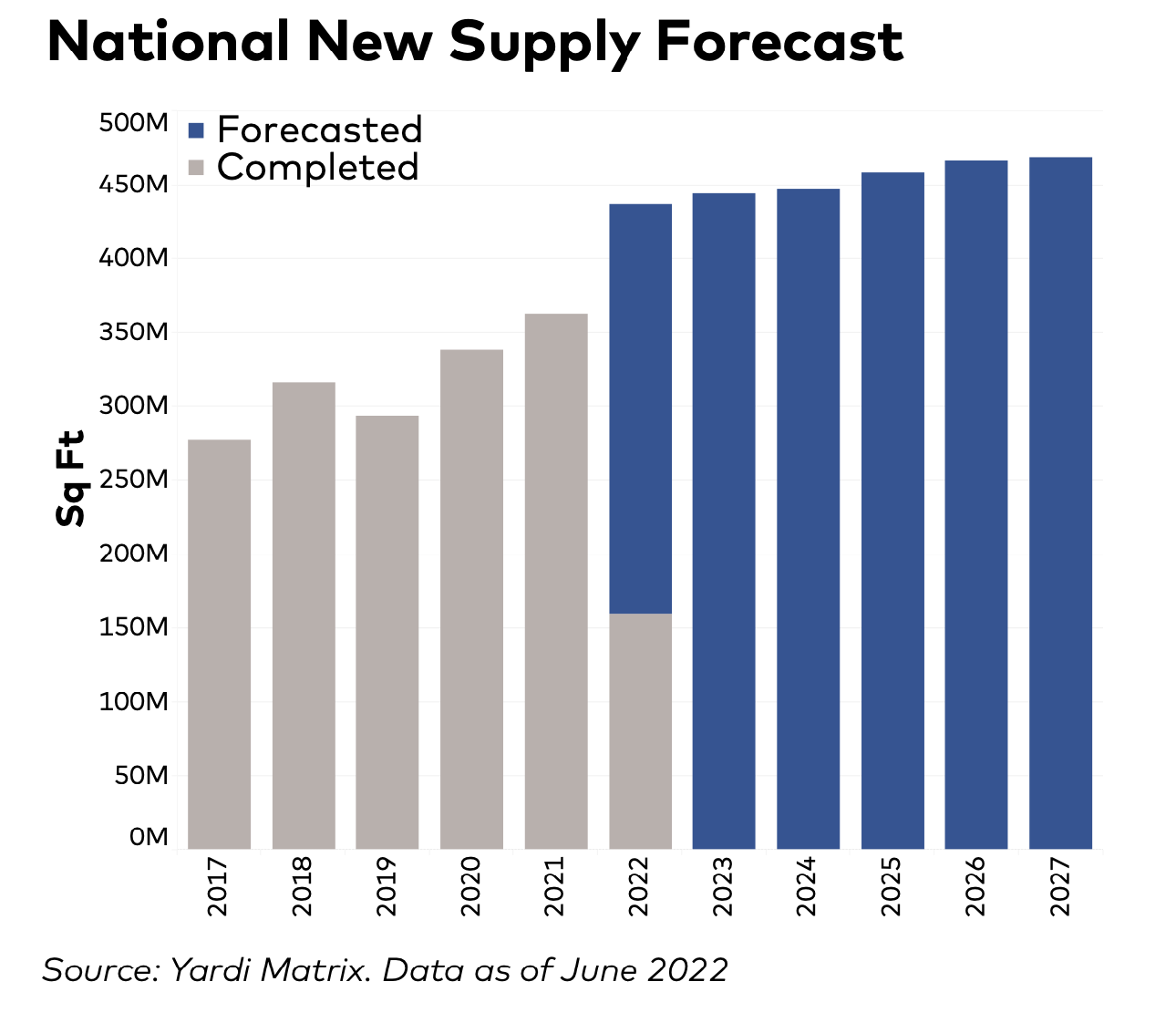

This despite the fact that 667.5 million sf of new industrial stock were under construction nationally, and an additional 684.6 million sf are in the planning stages. The first half of the year saw 159.6 million sf of deliveries logged by CommercialEdge. So far, Dallas has by far delivered the most new stock in 2022, with 15.9 million sf completed, more than the second (Indianapolis, with 7.9 million sf) and third (Phoenix, 7.7 million sf) most-active markets combined.

Indianapolis—a logistics hub due to its central location, with access to interstate highways and the second-largest FedEx hub in the world—has become a hotbed for new development. Indianapolis has the fifth-largest pipeline in the nation by square footage and the second largest by percentage of existing stock. The largest project underway is a 2.2 million- sf Walmart Distribution Center that began construction in 2020 and is set to deliver later this year. The vast majority of projects in Indy are logistics parks, both new and expansions of existing complexes.

GOING UP

Land scarcity is leading to new modes of operation from both occupiers and developers. Multistory buildings have garnered more interest, although their main constraint is cost, with estimates pegging a multistory building at 40 percent more expensive than a single-story property with an equivalent amount of space. But multistory projects have been popping up in the New York metro area. CommercialEdge points to a joint venture between Turnbridge Equities and Dune Real Estate Partners that will develop Bronx Logistics Center, a 500,000-sf multistory building with 800,000 sf of parking between a garage and the roof.

Outdoor storage is also being used to fill gaps in the supply chain when there is a lack of sufficient land for industrial properties, with outdoor lots increasingly used by e-commerce and logistics companies.

The lack of land is leading some developers to consider conversions of old office and retail space into industrial. Conversions remain rare at the moment, but may increase in the future as land in coastal markets becomes scarcer.

STRONG RENT GAINS

As demand exceeds supply, the average in-place rents for industrial buildings in June grew 4.9 percent year-over-year to $6.57 per foot. The average cost of a new lease signed in the last 12 months was 88 cents higher per foot than the overall average.

CommercialEdge reports that supply conditions have improved of late, with backlogs at ports easing in the last few months and both energy and commodity prices falling in recent weeks. But inflation remains well above target. CommercialEdge correctly predicted that the Federal Reserve would counter inflation with higher interest rates, which the research firm speculates could also lead to new supply and transaction markets cooling as the cost of capital increases.

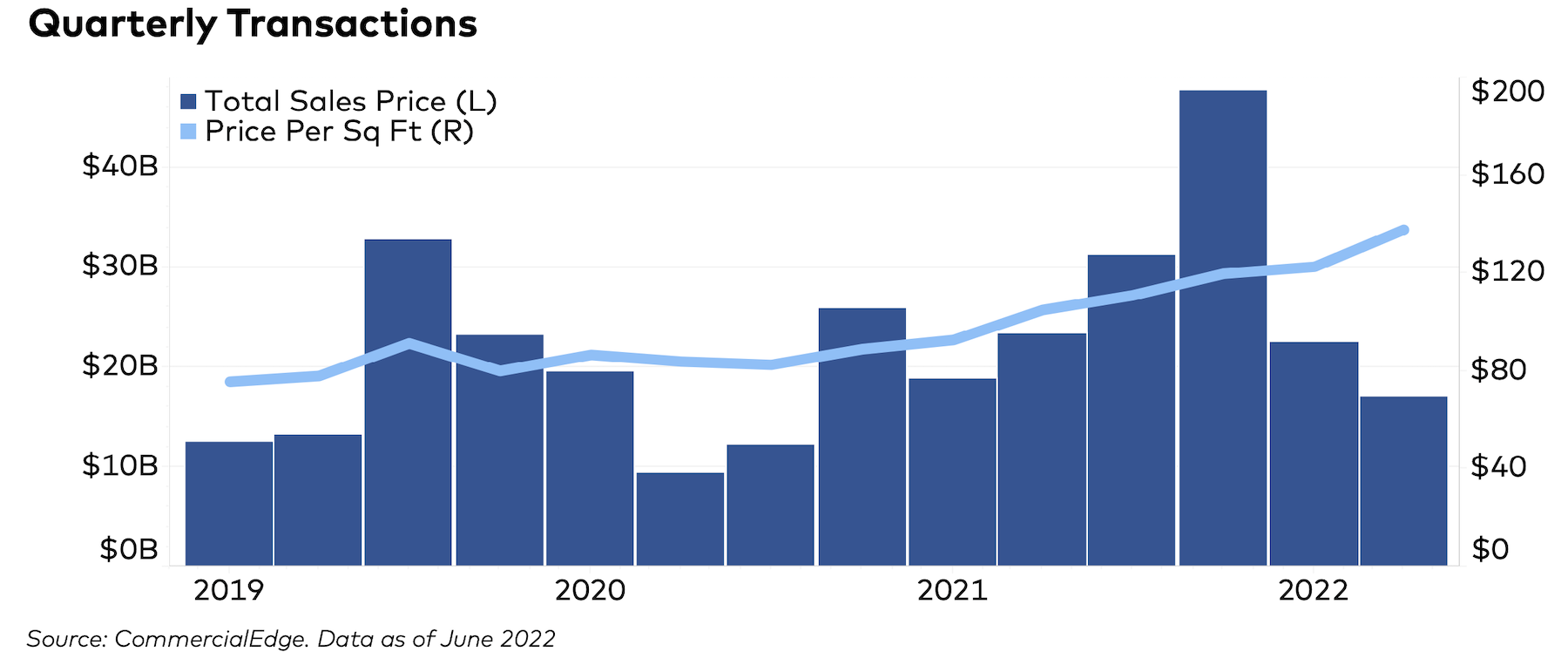

Nationally, there were $39.6 billion in industrial-sector transactions during the first half of the year, according to CommercialEdge. The average price per square foot of an industrial building in the second quarter was $138, up 12.4 percent over the first quarter and 31.3 percent year-over-year. The second quarter was the seventh straight quarter with in- creasing average sale prices. The average sale price of an industrial property increased 67 percent during that time.

With the lowest vacancy rates in the country and the highest rent growth, investors are hungry for assets in the Inland Empire. In all, $1.7 billion of industrial sales have been completed in the market so far this year, and the average sale price of industrial properties has more than doubled in the last two years, from $138 per foot in 2020 to $299 per foot in 2022. The most popular submarket in 2022 is Fontana, Calif., where 11 industrial properties have sold for more than $500 million through the first half of this year.

Related Stories

| Sep 17, 2014

New developments in data center design

From the dozen or so facilities housing Google’s 900,000 servers to the sprawling server farms of Facebook to Amazon’s seven sites scattered around the world, today’s data centers must accommodate massive power demand, high heat loads, strict maintenance protocols, and super-tight security. This AIA Discovery course is worth 1.0 AIA CES HSW learning units.

| Sep 9, 2014

Using Facebook to transform workplace design

As part of our ongoing studies of how building design influences human behavior in today’s social media-driven world, HOK’s workplace strategists had an idea: Leverage the power of social media to collect data about how people feel about their workplaces and the type of spaces they need to succeed.

| Sep 7, 2014

Ranked: Top state government sector AEC firms [2014 Giants 300 Report]

PCL Construction, Stantec, and AECOM head BD+C's rankings of the nation's largest state government design and construction firms, as reported in the 2014 Giants 300 Report.

| Sep 3, 2014

New designation launched to streamline LEED review process

The LEED Proven Provider designation is designed to minimize the need for additional work during the project review process.

| Sep 2, 2014

Ranked: Top green building sector AEC firms [2014 Giants 300 Report]

AECOM, Gensler, and Turner top BD+C's rankings of the nation's largest green design and construction firms.

| Sep 2, 2014

Extreme conversion: 17-story industrial silo to be converted to high-rise housing

As part of Copenhagen's effort to turn an industrial seaport into a bustling neighborhood, Danish architecture firm COBE was invited to convert a grain silo into a residential tower.

| Aug 26, 2014

Ranked: Top industrial sector AEC firms [2014 Giants 300 Report]

Stantec, Jacobs, and Turner top BD+C's rankings of the nation's largest industrial sector design and construction firms, as reported in the 2014 Giants 300 Report.

| Aug 6, 2014

25 projects win awards for design-build excellence

The 2014 Design-Build Project/Team Awards showcase design-build best practices and celebrate the achievements of owners and design-build teams in nine categories across the spectrum of horizontal and vertical construction.

| Aug 4, 2014

Facebook’s prefab data center concept aims to slash construction time in half

Less than a year after opening its ultra-green, hydropowered data center facility in Luleå, Sweden, Facebook is back at it in Mother Svea with yet another novel approach to data center design.

| Jul 28, 2014

Reconstruction market benefits from improving economy, new technology [2014 Giants 300 Report]

Following years of fairly lackluster demand for commercial property remodeling, reconstruction revenue is improving, according to the 2014 Giants 300 report.