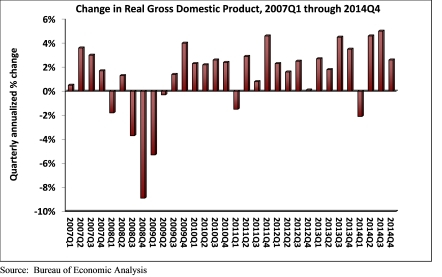

Real gross domestic product (GDP) expanded 2.6% (seasonally adjusted annual rate) during the fourth quarter of 2014, following a 5% increase in the third quarter, according to the Bureau of Economic Analysis Jan. 30 release. Nonresidential fixed investment grew by only 1.9% after expanding 8.9% in the third quarter. Investment in equipment declined 1.9%, while investment in nonresidential structures increased 2.6%.

"Today's headline GDP number will be broadly viewed as disappointing as many economists had expected to see a quarterly number in excess of 3%," said Associated Builders and Contractors Chief Economist Anirban Basu. "However, it is important to note that the federal spending category subtracted more than half a percentage point, which means the non-federal portion of the economy expanded faster than 3%.

"In addition to the impact of federal spending which shrank farther than expected, it is also worth noting that spending on nonresidential structures continues to climb," said Basu. "With the economic recovery persisting and with job growth accelerating, business confidence has generally been on the rise, translating into shrinking office and retail vacancy rates and rising hotel occupancy rates. All of this creates a context in which nonresidential construction spending, particularly private construction spending, is likely to expand, which is consistent with ABC's view that the nonresidential construction recovery will continue.

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

"Though today's release indicates that the economy enters 2015 with somewhat less momentum than had been thought, the fact of the matter is that the past nine months represents the strongest period of growth in the current recovery cycle," said Basu. "Undoubtedly, financial markets will continue to be roiled by ongoing fluctuations in input prices and uncertainties regarding the strengthening of the U.S. dollar. But with gas prices low and with job creation now brisk, consumers are likely to continue to push the U.S. economy forward in 2015."

The following segments expanded during the fourth quarter and/or contributed to GDP.

- Personal consumption expenditures added 2.9% to GDP after contributing 2.2% in the third quarter.

- Spending on goods grew 5.4% after increasing by 4.7% in the previous quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 1.8% for the quarter after a 5% increase in the third quarter.

- Nondefense spending expanded 1.7% after increasing by 0.4% in the previous quarter.

- State and local government spending expanded 1.3% during the fourth quarter after growing 1.1% in the third quarter.

- A number of key segments did not experience growth for the quarter.

- Federal government spending contracted by 7.5% in the fourth quarter following a -9.9% increase in the prior quarter.

- National defense spending declined by 12.5% after expanding by a full 16% in the third quarter.

To view the previous GDP report, click here.

Related Stories

BIM and Information Technology | May 27, 2015

4 projects honored with AIA TAP Innovation Awards for excellence in BIM and project delivery

Morphosis Architects' Emerson College building in Los Angeles and the University of Delaware’s ISE Lab are among the projects honored by AIA for their use of BIM/VDC tools.

Healthcare Facilities | May 27, 2015

Rochester, Minn., looks to escape Twin Cities’ shadow with $6.5 billion biotech development

The 20-year plan would also be a boon to Mayo Clinic, this city’s best-known address.

BIM and Information Technology | May 21, 2015

How AEC firms should approach BIM training

CASE Founding Partner Steve Sanderson talks about the current state of software training in the AEC industry and common pitfalls in AEC training.

Architects | May 20, 2015

Architecture billings remain stuck in winter slowdown

Regional business conditions continue to thrive in the South and West

University Buildings | May 19, 2015

Special Report: How your firm can help struggling colleges and universities meet their building project goals

Building Teams that want to succeed in the higher education market have to help their clients find new funding sources, control costs, and provide the maximum value for every dollar.

University Buildings | May 19, 2015

Renovate or build new: How to resolve the eternal question

With capital budgets strained, renovation may be an increasingly attractive money-saving option for many college and universities.

University Buildings | May 19, 2015

KU Jayhawks take a gander at a P3 development

The P3 concept is getting a tryout at the University of Kansas, where state funding for construction has fallen from 20% of project costs to about 11% over the last 10 years.

Retail Centers | May 18, 2015

ULI forecast sees clear skies for real estate over next three years

With asset availability declining in several sectors, rents and transactions should rise.

Contractors | May 18, 2015

Gilbane foresees double-digit growth in construction spending in 2015

In its Spring outlook, the construction company frets about hiring patterns that aren’t fully taking a project’s workload into account.

Architects | May 10, 2015

Harness the connection between managing risk and increasing profitability, Part 2

In Part 1, we covered taking control of the submittals schedule and managing RFIs. Let’s move on to properly allocating substitutions and limiting change orders.