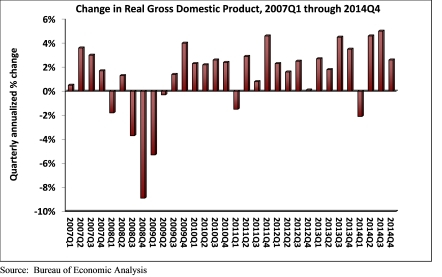

Real gross domestic product (GDP) expanded 2.6% (seasonally adjusted annual rate) during the fourth quarter of 2014, following a 5% increase in the third quarter, according to the Bureau of Economic Analysis Jan. 30 release. Nonresidential fixed investment grew by only 1.9% after expanding 8.9% in the third quarter. Investment in equipment declined 1.9%, while investment in nonresidential structures increased 2.6%.

"Today's headline GDP number will be broadly viewed as disappointing as many economists had expected to see a quarterly number in excess of 3%," said Associated Builders and Contractors Chief Economist Anirban Basu. "However, it is important to note that the federal spending category subtracted more than half a percentage point, which means the non-federal portion of the economy expanded faster than 3%.

"In addition to the impact of federal spending which shrank farther than expected, it is also worth noting that spending on nonresidential structures continues to climb," said Basu. "With the economic recovery persisting and with job growth accelerating, business confidence has generally been on the rise, translating into shrinking office and retail vacancy rates and rising hotel occupancy rates. All of this creates a context in which nonresidential construction spending, particularly private construction spending, is likely to expand, which is consistent with ABC's view that the nonresidential construction recovery will continue.

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis

"Though today's release indicates that the economy enters 2015 with somewhat less momentum than had been thought, the fact of the matter is that the past nine months represents the strongest period of growth in the current recovery cycle," said Basu. "Undoubtedly, financial markets will continue to be roiled by ongoing fluctuations in input prices and uncertainties regarding the strengthening of the U.S. dollar. But with gas prices low and with job creation now brisk, consumers are likely to continue to push the U.S. economy forward in 2015."

The following segments expanded during the fourth quarter and/or contributed to GDP.

- Personal consumption expenditures added 2.9% to GDP after contributing 2.2% in the third quarter.

- Spending on goods grew 5.4% after increasing by 4.7% in the previous quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 1.8% for the quarter after a 5% increase in the third quarter.

- Nondefense spending expanded 1.7% after increasing by 0.4% in the previous quarter.

- State and local government spending expanded 1.3% during the fourth quarter after growing 1.1% in the third quarter.

- A number of key segments did not experience growth for the quarter.

- Federal government spending contracted by 7.5% in the fourth quarter following a -9.9% increase in the prior quarter.

- National defense spending declined by 12.5% after expanding by a full 16% in the third quarter.

To view the previous GDP report, click here.

Related Stories

| Dec 3, 2013

Creating a healthcare capital project plan: The truth behind the numbers

When setting up a capital project plan, it's one thing to have the data, but quite another to have the knowledge of the process.

| Dec 3, 2013

Architects urge government to reform design-build contracting process

Current federal contracting laws are discouraging talented architects from competing for federal contracts, depriving government and, by inference, taxpayers of the best design expertise available, according to AIA testimony presented today on Capitol Hill.

| Dec 3, 2013

Construction spending hits four-year peak after rare spike in public outlays

An unusual surge in public construction in October pushed total construction spending to its highest level since May 2009 despite a dip in both private residential and nonresidential activity.

| Nov 27, 2013

BIG's 'oil and vinegar' design wins competition for the Museum of the Human Body [slideshow]

The winning submission by Bjarke Ingels Group (BIG) and A+ Architecture mixes urban pavement and parkland in a flowing, organic plan, like oil and vinegar, explains Bjarke Ingels.

| Nov 27, 2013

Retail renaissance: What's next?

The retail construction category, long in the doldrums, is roaring back to life. Send us your comments and projects as we prepare coverage for this exciting sector.

| Nov 27, 2013

Pediatric hospitals improve care with flexible, age-sensitive design

Pediatric hospitals face many of the same concerns as their adult counterparts. Inpatient bed demand is declining, outpatient visits are soaring, and there is a higher level of focus on prevention and reduced readmissions.

| Nov 27, 2013

Exclusive survey: Revenues increased at nearly half of AEC firms in 2013

Forty-six percent of the respondents to an exclusive BD+C survey of AEC professionals reported that revenues had increased this year compared to 2012, with another 24.2% saying cash flow had stayed the same.

| Nov 27, 2013

Wonder walls: 13 choices for the building envelope

BD+C editors present a roundup of the latest technologies and applications in exterior wall systems, from a tapered metal wall installation in Oklahoma to a textured precast concrete solution in North Carolina.

| Nov 27, 2013

University reconstruction projects: The 5 keys to success

This AIA CES Discovery course discusses the environmental, economic, and market pressures affecting facility planning for universities and colleges, and outlines current approaches to renovations for critical academic spaces.

| Nov 26, 2013

7 ways to make your firm more successful

Like all professional services businesses, AEC firms are challenged to effectively manage people. And even though people can be rather unpredictable, a firm’s success doesn’t have to be. Here are seven ways to make your firm more successful in the face of market variability and uncertainty.