The top 50 venture capital investments in Built Industry Technology totaled just under $1 billion in 2019, about one-tenth of the top 50 deals the previous year.

That’s according to Builtworlds’ latest ranking of seed and early-stage investments in ConTech and real estate enterprises. While there were no blockbuster deals like SoftBank’s $865 million investment in Katerra in 2018, investors haven’t stopped looking for that idea or product that will move the industry’s dial forward.

In 2019, the top 50 venture deals totaled $967.8 million, compared to just under $10 billion that were raised in the top 50 deals in 2018. The latest ranking includes several familiar ConTech names such as Blokable, Rhumbix, Dvele, eSUB Construction Software, ALICE Technologies, and IrisVR. (The full list of deals can be viewed at http://bit.ly/2SPiMwD.)

Ironically, in a year marked by WeWork’s failed initial public offering, investors still showed interest in workplace solutions. Two companies that specialize in offering customized flexible workspaces captured the top two deals on Builtworld’s list.

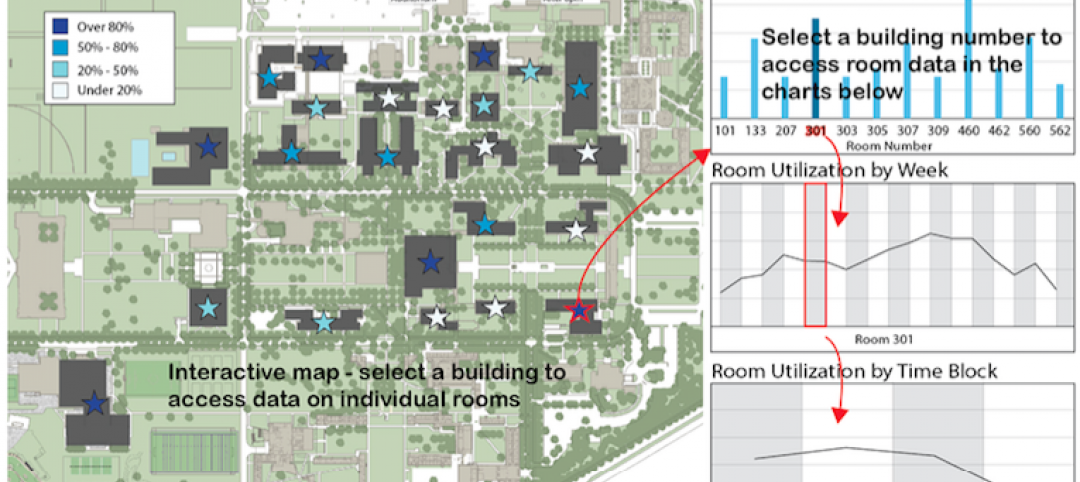

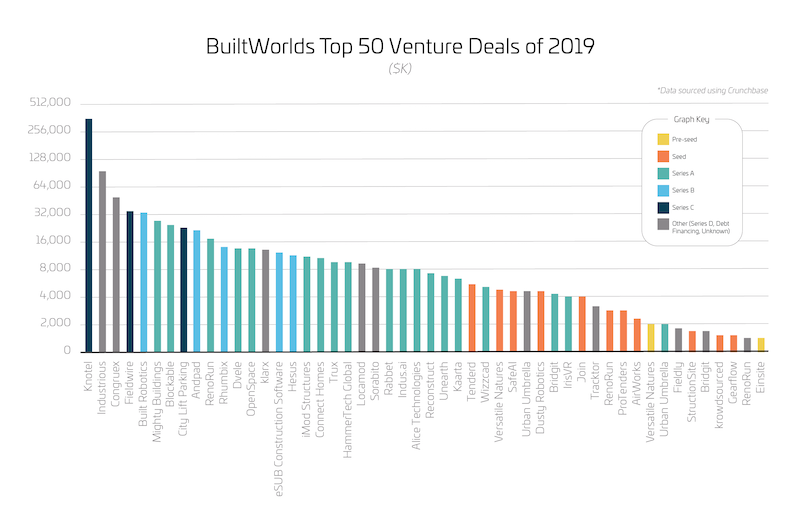

The top 50 Contech investment deals were with companies that, for the most part, are beyond the startup phase. Chart: Builtworlds

The top 50 Contech investment deals were with companies that, for the most part, are beyond the startup phase. Chart: Builtworlds

New York-based Knotel, which actively pitches itself as a steadier alternative to WeWork, last summer raised $400 million through a Series C funding round from an investment group that included Kuwait-based Wafra Inc., and Japan-based Mori Trust, Itochu Corp., and Mercuria Investments. The fundraising was in exchange for 15% to 30% of the closely held company, and increased Knotel’s valuation to at least $1.3 billion, according to Bloomberg (https://bloom.bg/39XmYjS).

Knotel recently topped 5 million sf in global workspace, according to Yahoo! Finance (https://yhoo.it/2VfkTf0). It differs from WeWork in that it doesn’t do coworking: its clients include corporations ranging from Starbucks to AT&T. It also does a mix of direct leases and revenue share deals.

Knotel was followed on Builtworlds’ ranking by Industrious, another workspace company with more than 95 locations across 45 U.S. cities offering turnkey spec suites, private offices, and community memberships that can be bought on a month-to-month basis. Last August, Industrious announced it had raised $80 million in Series D financing from investors that included Wells Fargo Strategic Capital, TF Cornerstone, Riverwood Capital, Granite Properties, Equinox Fitness, Canada Pension Plan, Fifth Wall, and Brookfield Properties Retail. In this latest round, Industrious raised over $220 million.

Industrious last year redirected its business model toward revenue-sharing deals with landlords. Its CEO Jamie Hodari told Reuters (https://reut.rs/2PekzJm) that the company expects to be profitable in 2020.

No. 3 on Builtworlds’ ranking was Congreux, founded in 2017, a national provider of design, engineering, construction management and maintenance services to broadband service providers. Last July, Congruex completed its sixth acquisition with the purchase of HHS Construction, which offers infrastructure services to telecommunications and cable providers, mostly in Southern California. Last August, Congruex disclosed that it had raised $48.9 million in private equity financing from an investor group led by Crestview Partners, which has had a strategic alliance with Congruex for the past three years.

Next on Builtworlds’ list is Fieldwire, which last September said it had raised $33.5 million in Series C financing from investors that included Menlo Park Ventures, Peak State Ventures, Formation 8, Hilti Group, and Brick & Mortar Ventures. Founded in 2013, Fieldwire claims to power over 750,000 jobsites worldwide with cloud-based jobsite management software accessible by construction teams through a app. It told Tech Crunch last September (https://tcrn.ch/2vaKb30) that it had 2,000 paying customers (including Clark Construction Group, which last year rolled out Fieldwire companywide to manage project documents), and was starting to make inroads into Europe.

Built Robotics is ready to introduce the first fully autonomous construction equipment. Image credit: Built Robotics

Built Robotics is ready to introduce the first fully autonomous construction equipment. Image credit: Built Robotics

Rounding out Builtworlds’ top 5 venture deals is Built Robotics, which on September 16 announced it had raised $33 million in Series B funding from investors led by Next47 and including Presidio Ventures, New Enterprise Associates, Lemnos VC, Founders Fund, and Building Ventures.

Built Robotics, founded in 2016, is dedicated to construction automation. BD+C reported last year that Built Robotics had formed a partnership with Mortenson to develop a suite of autonomous equipment. Next month, Built Robotics will exhibit at the CONEXPO-CON/AGG construction trade show in Las Vegas, where the company plans to unveil what it’s calling the first commercially deployed autonomous construction equipment. Show attendees will be able to operate a Built robot located in Houston to perform such tasks as digging trenches or grading building pads. Built Robotics asserts that its AI guidance system can be installed onto existing equipment from any manufacturer.

Related Stories

AEC Tech | Aug 24, 2017

Big Data helps space optimization, but barriers remain

Space optimization is a big issue on many university campuses, as schools face increasing financial constraints, writes Hanbury’s Jimmy Stevens.

Lighting | Aug 2, 2017

Dynamic white lighting mimics daylighting

By varying an LED luminaire’s color temperature, it is possible to mimic daylighting, to some extent, and the natural circadian rhythms that accompany it, writes DLR Group’s Sean Avery.

Office Buildings | Jul 20, 2017

SGA uses virtual design and construction technology to redevelop N.Y. building into modern offices

287 Park Avenue South is a nine-story Classical Revival building previously known as the United Charities Building.

Accelerate Live! | Jul 6, 2017

Watch all 20 Accelerate Live! talks on demand

BD+C’s inaugural AEC innovation conference, Accelerate Live! (May 11, Chicago), featured talks on machine learning, AI, gaming in construction, maker culture, and health-generating buildings.

| Jun 13, 2017

Accelerate Live! talk: Is the road to the future the path of least resistance? Sasha Reed, Bluebeam (sponsored)

Bluebeam’s Sasha Reed discusses why AEC leaders should give their teams permission to responsibly break things and create ecosystems of people, process, and technology.

| Jun 13, 2017

Accelerate Live! talk: 3D laser scanning for the project lifecycle, FARO Technologies (sponsored)

Brent Slawnikowski of FARO Technologies and Jennifer Suerth of Pepper Construction discuss how implementation of laser scanning has helped Pepper become more successful in the completion of their projects.

| Jun 13, 2017

Accelerate Live! talk: Incubating innovation through R&D and product development, Jonatan Schumacher, Thornton Tomasetti

Thornton Tomasetti’s Jonatan Schumacher presents the firm’s business model for developing, incubating, and delivering cutting-edge tools and solutions for the firm, and the greater AEC market.

| Jun 13, 2017

Accelerate Live! talk: The future of computational design, Ben Juckes, Yazdani Studio of CannonDesign

Yazdani’s Ben Juckes discusses the firm’s tech-centric culture, where scripting has become an every-project occurrence and each designer regularly works with computational tools as part of their basic toolset.

| Jun 13, 2017

Accelerate Live! talk: A case for Big Data in construction, Graham Cranston, Simpson Gumpertz & Heger

Graham Cranston shares SGH’s efforts to take hold of its project data using mathematical optimization techniques and information-rich interactive visual graphics.

| Jun 13, 2017

Accelerate Live! talk: Scaling change in a changing industry, Chris Mayer, Suffolk Construction

Suffolk’s CIO Chris Mayer talks about the firm’s framework for vetting and implementing new technologies and processes.