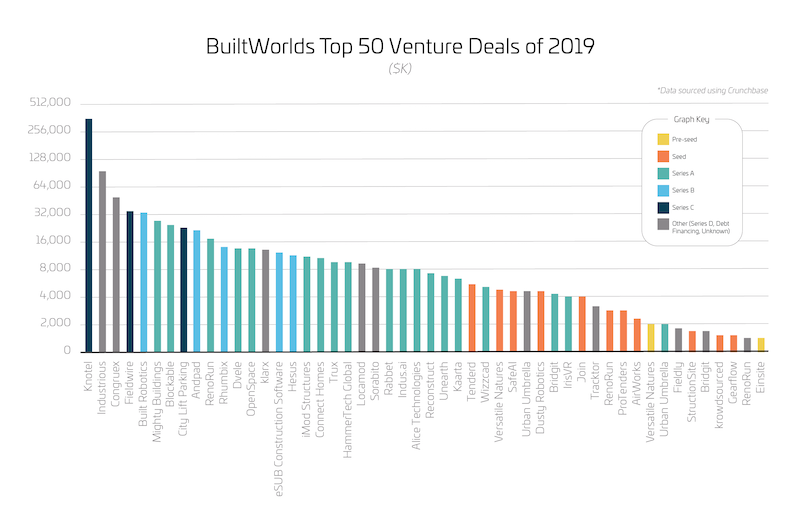

The top 50 venture capital investments in Built Industry Technology totaled just under $1 billion in 2019, about one-tenth of the top 50 deals the previous year.

That’s according to Builtworlds’ latest ranking of seed and early-stage investments in ConTech and real estate enterprises. While there were no blockbuster deals like SoftBank’s $865 million investment in Katerra in 2018, investors haven’t stopped looking for that idea or product that will move the industry’s dial forward.

In 2019, the top 50 venture deals totaled $967.8 million, compared to just under $10 billion that were raised in the top 50 deals in 2018. The latest ranking includes several familiar ConTech names such as Blokable, Rhumbix, Dvele, eSUB Construction Software, ALICE Technologies, and IrisVR. (The full list of deals can be viewed at http://bit.ly/2SPiMwD.)

Ironically, in a year marked by WeWork’s failed initial public offering, investors still showed interest in workplace solutions. Two companies that specialize in offering customized flexible workspaces captured the top two deals on Builtworld’s list.

The top 50 Contech investment deals were with companies that, for the most part, are beyond the startup phase. Chart: Builtworlds

The top 50 Contech investment deals were with companies that, for the most part, are beyond the startup phase. Chart: Builtworlds

New York-based Knotel, which actively pitches itself as a steadier alternative to WeWork, last summer raised $400 million through a Series C funding round from an investment group that included Kuwait-based Wafra Inc., and Japan-based Mori Trust, Itochu Corp., and Mercuria Investments. The fundraising was in exchange for 15% to 30% of the closely held company, and increased Knotel’s valuation to at least $1.3 billion, according to Bloomberg (https://bloom.bg/39XmYjS).

Knotel recently topped 5 million sf in global workspace, according to Yahoo! Finance (https://yhoo.it/2VfkTf0). It differs from WeWork in that it doesn’t do coworking: its clients include corporations ranging from Starbucks to AT&T. It also does a mix of direct leases and revenue share deals.

Knotel was followed on Builtworlds’ ranking by Industrious, another workspace company with more than 95 locations across 45 U.S. cities offering turnkey spec suites, private offices, and community memberships that can be bought on a month-to-month basis. Last August, Industrious announced it had raised $80 million in Series D financing from investors that included Wells Fargo Strategic Capital, TF Cornerstone, Riverwood Capital, Granite Properties, Equinox Fitness, Canada Pension Plan, Fifth Wall, and Brookfield Properties Retail. In this latest round, Industrious raised over $220 million.

Industrious last year redirected its business model toward revenue-sharing deals with landlords. Its CEO Jamie Hodari told Reuters (https://reut.rs/2PekzJm) that the company expects to be profitable in 2020.

No. 3 on Builtworlds’ ranking was Congreux, founded in 2017, a national provider of design, engineering, construction management and maintenance services to broadband service providers. Last July, Congruex completed its sixth acquisition with the purchase of HHS Construction, which offers infrastructure services to telecommunications and cable providers, mostly in Southern California. Last August, Congruex disclosed that it had raised $48.9 million in private equity financing from an investor group led by Crestview Partners, which has had a strategic alliance with Congruex for the past three years.

Next on Builtworlds’ list is Fieldwire, which last September said it had raised $33.5 million in Series C financing from investors that included Menlo Park Ventures, Peak State Ventures, Formation 8, Hilti Group, and Brick & Mortar Ventures. Founded in 2013, Fieldwire claims to power over 750,000 jobsites worldwide with cloud-based jobsite management software accessible by construction teams through a app. It told Tech Crunch last September (https://tcrn.ch/2vaKb30) that it had 2,000 paying customers (including Clark Construction Group, which last year rolled out Fieldwire companywide to manage project documents), and was starting to make inroads into Europe.

Built Robotics is ready to introduce the first fully autonomous construction equipment. Image credit: Built Robotics

Built Robotics is ready to introduce the first fully autonomous construction equipment. Image credit: Built Robotics

Rounding out Builtworlds’ top 5 venture deals is Built Robotics, which on September 16 announced it had raised $33 million in Series B funding from investors led by Next47 and including Presidio Ventures, New Enterprise Associates, Lemnos VC, Founders Fund, and Building Ventures.

Built Robotics, founded in 2016, is dedicated to construction automation. BD+C reported last year that Built Robotics had formed a partnership with Mortenson to develop a suite of autonomous equipment. Next month, Built Robotics will exhibit at the CONEXPO-CON/AGG construction trade show in Las Vegas, where the company plans to unveil what it’s calling the first commercially deployed autonomous construction equipment. Show attendees will be able to operate a Built robot located in Houston to perform such tasks as digging trenches or grading building pads. Built Robotics asserts that its AI guidance system can be installed onto existing equipment from any manufacturer.

Related Stories

Urban Planning | Dec 15, 2021

EV is the bridge to transit’s AV revolution—and now is the time to start building it

Thinking holistically about a technology-enabled customer experience will make transit a mode of choice for more people.

Designers / Specifiers / Landscape Architects | Nov 16, 2021

‘Desire paths’ and college campus design

If a campus is not as efficient as it could be, end users will use their feet to let designers know about it.

AEC Tech | Oct 25, 2021

Token Future: Will NFTs revolutionize the design industry?

How could non-fungible tokens (NFTs) change the way we value design? Woods Bagot architect Jet Geaghan weighs risk vs. reward in six compelling outcomes.

Sponsored | BD+C University Course | Oct 15, 2021

7 game-changing trends in structural engineering

Here are seven key areas where innovation in structural engineering is driving evolution.

AEC Tech Innovation | Oct 7, 2021

How tech informs design: A conversation with Mancini's Christian Giordano

Mancini's growth strategy includes developing tech tools that help clients appreciate its work.

AEC Tech | Oct 5, 2021

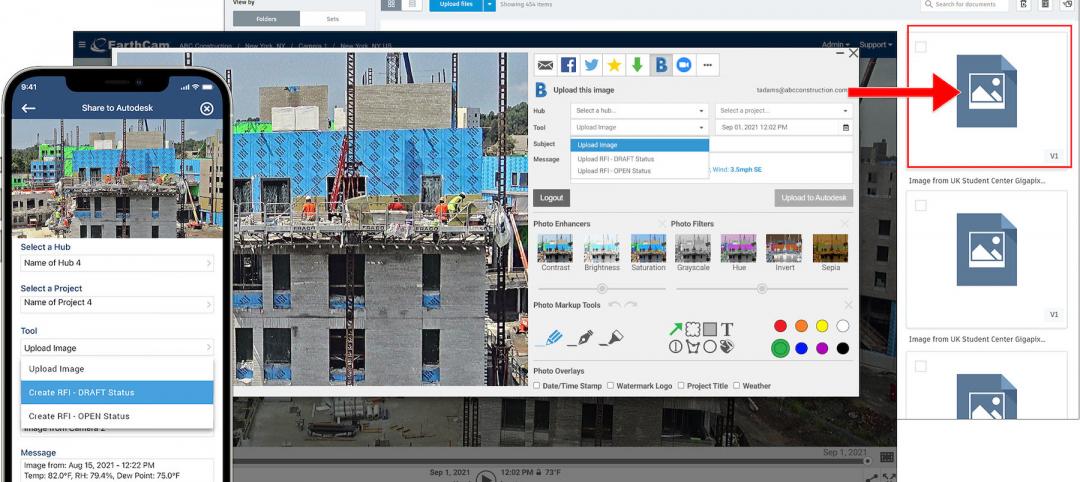

EarthCam Builds On its Connectivity with Autodesk Construction Cloud

Premiering new visual verification features for Autodesk Build and BIM 360

AEC Tech | Sep 21, 2021

A new webtool follows ConTech from incubation to application and beyond

MIT and JLL have created Tech Tracker to help real estate professionals see what’s hot now and what might be.

Architects | Aug 5, 2021

Lord Aeck Sargent's post-Katerra future, with LAS President Joe Greco

After three years under the ownership of Katerra, which closed its North American operations last May, the architecture firm Lord Aeck Sargent is re-establishing itself as an independent company, with an eye toward strengthening its eight practices and regional presence in the U.S.

Architects | Aug 5, 2021

Lord Aeck Sargent's post-Katerra future, with LAS President Joe Greco

After three years under the ownership of Katerra, which closed its North American operations last May, the architecture firm Lord Aeck Sargent is re-establishing itself as an independent company, with an eye toward strengthening its eight practices and regional presence in the U.S.

AEC Tech | Jul 14, 2021

Bjarke Ingels Group and UNStudio invest in SpaceForm, a virtual workspace for architects

Squint/Opera developed the platform in 2018.