A strong retail sector has helped drive 2016 U.S. construction activity with retail construction projects up 24.4% year-over-year. Overshadowing the good news is a cloud of economic uncertainty that has companies laser-focused on lean budgeting and smart spending decisions.

According to JLL’s latest report on non-residential construction activity, U.S. construction employment grew 4.7% in the first quarter of 2016 over the first quarter of 2015, with many workers engaged on retail projects. Concerns about China’s steep economic deceleration, combined with a drop in U.S. gross domestic product (GDP) from 1.4% in the fourth quarter of 2015 to 0.5% in the first quarter of 2016, have made companies reluctant to invest.

The market for commercial construction remains active for now. The JLL report shows a strong first quarter with steady growth projected for second quarter. The office, industrial and retail sectors are very active as companies continue projects that broke ground a year or two ago. A hint of the economic clouds causing concern comes from a small decline in office construction starts.

“Developers and occupiers are proceeding with caution, but they continue to build and renovate,” explains Todd Burns, President, Project and Development Services, JLL Americas. “However, project sponsors today are thinking more strategically about development versus renovation. The best-managed companies have learned to keep their capital spend within about two% of the plan by starting with a realistic budget, leveraging data and analytical platforms, and putting the right skills together in a centralized project team.”

Key sectors to watch

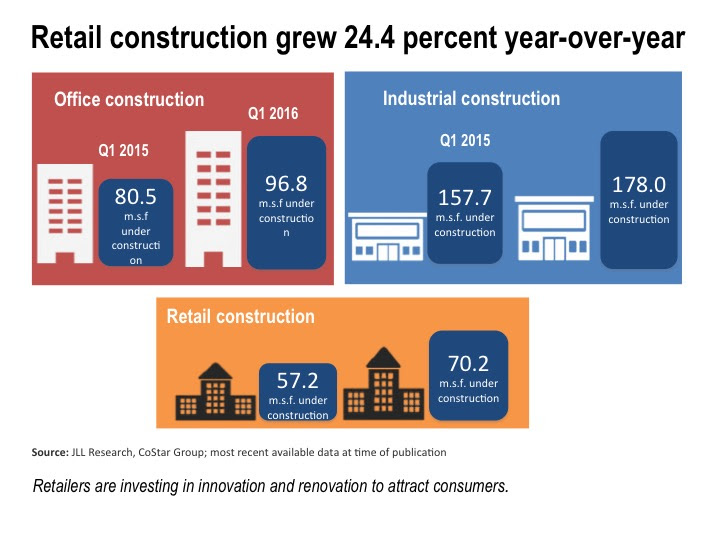

Retail: Retail vacancies continue to decline, and retail has surged ahead of other property types in construction activity. Construction grew 24.4% year over year, from 57.2 million sf in first.

Industrial: Industrial facility deliveries grew year-over-year in Q1 2016, reflecting the continuing strength in demand for modern industrial properties—much of it from retailers and e-commerce companies striving to meet changing consumer demand and service requirements. Construction grew 12.9%, from 157.7 million sf in Q1 2015 to 178 million sf in Q1 2016.

Office: Office building construction grew by 20.2 year-over-year, from 80.5 million sf to 96.8 million sf—but starts declined by 33%, from 20.3 million to 13.6 million, reflecting economic concerns and hesitancy to launch new projects.

Retail innovation and renovation

Much of the retail construction growth in Q1 2016 has come from renovation, rather than new deliveries, as retailers are evolving to meet consumers’ ever-growing expectations for unified online and brick-and-mortar experiences.

“Retailers must innovate quickly to capture the untapped needs and expectations of consumers, who expect the same brand experience whether shopping online or in the brick-and-mortar store,” said Aaron Spiess, co-founder of Big Red Rooster, JLL’s brand experience company. “If retailers wait too long to translate latent customer expectations into new stores or renovation programs, they may find that customers have become entrenched with competing brands and are not going to return.”

Another incentive to renovate, notes Spiess, is a new federal tax break providing “safe harbor” for some remodeling expenses. Eligible retailers and restaurants can reduce 75% of qualifying expenses with the remaining 25% capitalized and depreciated over time.

Key markets to watch

Nashville: The Southeast saw an uptick in office, industrial and retail construction in the last year. Nashville, in particular, has seen rapid construction growth and low vacancy rates as employers take advantage of the city’s low-cost, well-educated workforce.

San Francisco: The Bay area is catching up to New York in of construction costs, driven by high demand and high labor costs. San Francisco is on pace to exceed New York as the U.S.’ most expensive construction market in 2016.

Dallas: As retailers followed population flows to Texas, Dallas has become one of the few markets that experienced retail development growth. Dallas was the most active retail market in Q1, up nearly 80% year over year.

Related Stories

M/E/P Systems | Oct 30, 2024

After residential success, DOE will test heat pumps for cold climates in commercial sector

All eight manufacturers in the U.S. Department of Energy’s Residential Cold Climate Heat Pump Challenge completed rigorous product field testing to demonstrate energy efficiency and improved performance in cold weather.

MFPRO+ New Projects | Oct 30, 2024

Luxury waterfront tower in Brooklyn features East River and Manhattan skyline views

Leasing recently began for The Dupont, a 41-story luxury rental property along the Brooklyn, N.Y., waterfront. Located within the 22-acre Greenpoint Landing, where it overlooks the newly constructed Newtown Barge Park, the high-rise features East River and Manhattan skyline views along with 20,000 sf of indoor and outdoor communal space.

Resiliency | Oct 29, 2024

Climate change degrades buildings slowly but steadily

While natural disasters such as hurricanes and wildfires can destroy buildings in minutes, other factors exacerbated by climate change degrade buildings more slowly but still cause costly damage.

Hotel Facilities | Oct 29, 2024

Hotel construction pipeline surpasses 6,200 projects at Q3 2024

According to the U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics, the total hotel pipeline stands at 6,211 projects/722,821 rooms, a new all-time high for projects in the U.S.

Office Buildings | Oct 29, 2024

Editorial call for Office Building project case studies

BD+C editors are looking to feature a roundup of office building projects for 2024, including office-to-residential conversions. Deadline for submission: December 6, 2024.

Healthcare Facilities | Oct 28, 2024

New surgical tower is largest addition to UNC Health campus in Chapel Hill

Construction on UNC Health’s North Carolina Surgical Hospital, the largest addition to the Chapel Hill campus since it was built in 1952, was recently completed. The seven-story, 375,000-sf structure houses 26 operating rooms, four of which are hybrid size to accommodate additional equipment and technology for newly developed procedures.

Contractors | Oct 25, 2024

Construction industry CEOs kick off effort to prevent suicide among workers

A new construction industry CEO Advisory Council dedicated to addressing the issue of suicide in the construction industry recently took shape. The council will guide an industry-wide effort to develop solutions targeting the high rate of suicide among construction workers.

Sports and Recreational Facilities | Oct 24, 2024

Stadium renovation plans unveiled for Boston’s National Women’s Soccer League

A city-owned 75-year-old stadium in Boston’s historic Franklin Park will be renovated for a new National Women’s Soccer League team. The park, designed by Fredrick Law Olmsted in the 1880s, is the home of White Stadium, which was built in 1949 and has since fallen into disrepair.

Laboratories | Oct 23, 2024

From sterile to stimulating: The rise of community-centric life sciences campuses

To distinguish their life sciences campuses, developers are partnering with architectural and design firms to reimagine life sciences facilities as vibrant, welcoming destinations. By emphasizing four key elements—wellness, collaboration, biophilic design, and community integration—they are setting their properties apart.

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.