Lab design has failed to keep pace with scientific advances and the changing needs of researchers. If, as expected, the next generation ushers in significant revolutions in the ways science is conducted, then lab design and operations, and the ways that scientists interact with these environments, will be at the heart of this change.

That is the scenario CBRE Global Workplace Solutions lays out in a just-released report, “Lab of the Future,” authored by Gregory Weddle, CBRE’s Vice President of Innovation and Products; and Hannah Hahn, its Global Workplace Innovation Manager.

The report draws heavily from a benchmarking study of labs that CBRE completed in 2014, which collected data from 24 labs in three global regions across four leading pharmaceutical companies. The report also reflects more than 68 lab professionals who responded to a questionnaire and contributed qualitative data on occupancy, instrumentation, spatial use, and collaborative space.

There are several reasons why labs need fresh design approaches. The era of the blockbuster drug discovery is past, and long-term trends lean toward personalized care, data-driven discovery, and digitization of lab spaces. “Hyper-flexible spaces that can be reconfigured as needs change will become more important.”

In addition, R&D is moving to lower-cost countries and to be closer to new markets. By 2025, two thirds of the world’s population could be living in Asia. Per-capita health spending in these markets today is significantly below Western levels. “The ability to collaborate quickly and efficiently among global locations will be more vital than ever.”

Indeed, CBRE sees organizations placing far more emphasis on speed to market and maximizing the use cost for their research facilities. “There is intense scrutiny on the return on investment for all R&D projects.”

Future labs need to be adaptable to changing technologies, and be set up to deliver products quicker to market. Image: CBRE Global Workplace Solutions

CBRE says that, at the very least, organizations with lab space should be asking themselves:

• Does your organization have many large molecule products in its pipeline?

• Is your science focus changing?

• Is your organization well-funded?

• Is your organization able to attract the scientists it requires in timely fashion?

• How willing is my organization to adopt new processes?

“Business strategy, therefore, must drive laboratory strategy,” CBRE concludes.

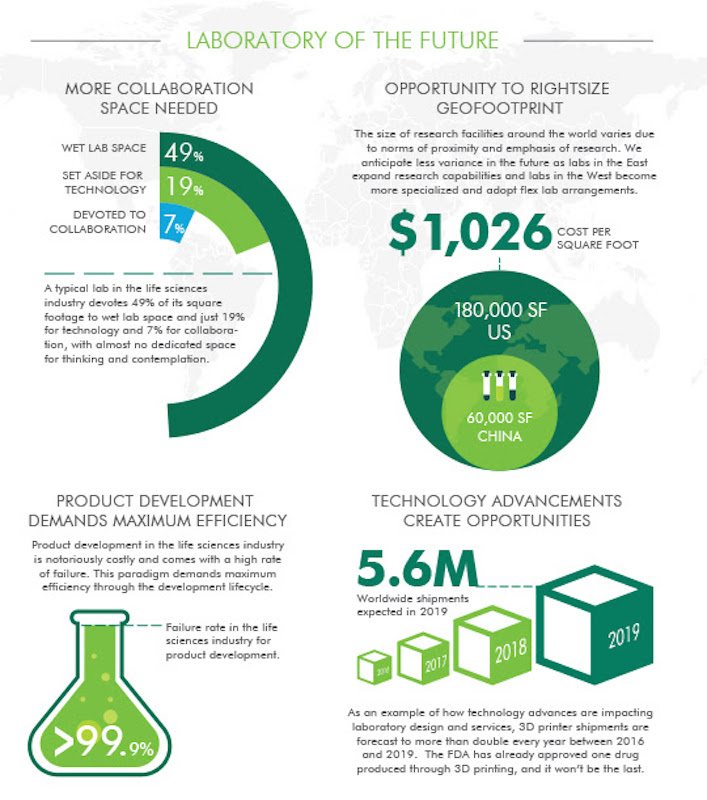

Among the trends that the CBRE’s report cites include digital lab space, which reflects the new generation of researchers known as digital natives, who are accustomed to digital technology having grown up with it. Social technology is changing communication patterns within labs, leading to flatter structures based on specialty interests. And given that only 7% of current lab space is set aside for collaboration, future labs must allocate more area for researcher collaboration, enabled by technology and design concepts.

Standardization could be a key to making labs more efficient and amenable, says CBRE. “Modular planning principles will be used to create a collaborative, flexible lab floorplan that can be used as a rotating lab,” the report states. “This means each lab space must be essentially the same size to allow for changes in lab furniture, bench space and overall layout. Today’s (and tomorrow’s) labs are aided by the ability to prefabricate building elements.”

Other factors influencing the shifting utilization of lab space include the miniaturization of equipment, which has been going on for a while, and helps to make researchers more productive in less floor space. Automation and robotics, so-called “shy” technology that’s barely noticeble (such as devices that communicate with each other), 3D printing, and artificial intelligence will all play roles in lab design and space utilization.

CBRE points out that, as life sciences become more technologically focused, labs must be set up to handle the greater volumes of data. Currently about 20% of lab space is set aside for technology, and that will need to increase significantly over the next 25 years.

And adept, skilled facilities managers will be in demand to keeping labs functional. “Put simply, as the physical location of the lab and all of its equipment become more fluid, a team that keeps track of utilization, operation, and maintenance of equipment will play an important role,” the report states.

Related Stories

University Buildings | Jan 18, 2024

Houston’s Rice University opens the largest research facility on its core campus

Designed by Skidmore, Owings & Merrill (SOM), the 251,400-sf building provides students and researchers with state-of-the-art laboratories, classrooms, offices, and a cafe, in addition to multiple gathering spaces.

Healthcare Facilities | Jan 7, 2024

Two new projects could be economic catalysts for a central New Jersey city

A Cancer Center and Innovation district are under construction and expected to start opening in 2025 in New Brunswick.

Laboratories | Jan 5, 2024

Office conversions are helping to meet the growing demand for life-science space

Ware Malcomb and Rock Creek Property Group led the team that recently completed the adaptive reuse of two office buildings in Maryland.

Mass Timber | Jan 2, 2024

5 ways mass timber will reshape the design of life sciences facilities

Here are five reasons why it has become increasingly evident that mass timber is ready to shape the future of laboratory spaces.

Giants 400 | Nov 28, 2023

Top 55 Laboratory Construction Firms for 2023

Whiting-Turner, DPR Construction, STO Building Group, Skanska, and Hensel Phelps top BD+C's ranking of the nation's largest laboratory general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 28, 2023

Top 60 Laboratory Engineering Firms for 2023

Jacobs, Affiliated Engineers, Burns & McDonnell, Tetra Tech, and WSP head BD+C's ranking of the nation's largest laboratory engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 28, 2023

Top 100 Laboratory Design Firms for 2023

HDR, Flad Architects, DGA, Elkus Manfredi Architects, and Gensler top BD+C's ranking of the nation's largest laboratory architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Nov 16, 2023

Top 80 Science + Technology Facility Construction Firms for 2023

DPR Construction, Austin Industries, Whiting-Turner, and Gilbane top BD+C's ranking of the nation's largest science and technology (S+T) facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Nov 16, 2023

Top 70 Science + Technology Facility Engineering Firms for 2023

Jacobs, Fluor, SSOE, Tetra Tech, and Affiliated Engineers head BD+C's ranking of the nation's largest science and technology (S+T) facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Giants 400 | Nov 16, 2023

Top 100 Science + Technology Facility Architecture Firms for 2023

Gensler, HDR, Page Southerland Page, Flad Architects, and DGA top BD+C's ranking of the nation's largest science and technology (S+T) facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.