Leopardo Companies, Inc. released its 2015 Construction Economics Report and Outlook, an essential guide to help business leaders, healthcare administrators, and government decision-makers understand the factors that impact construction costs.

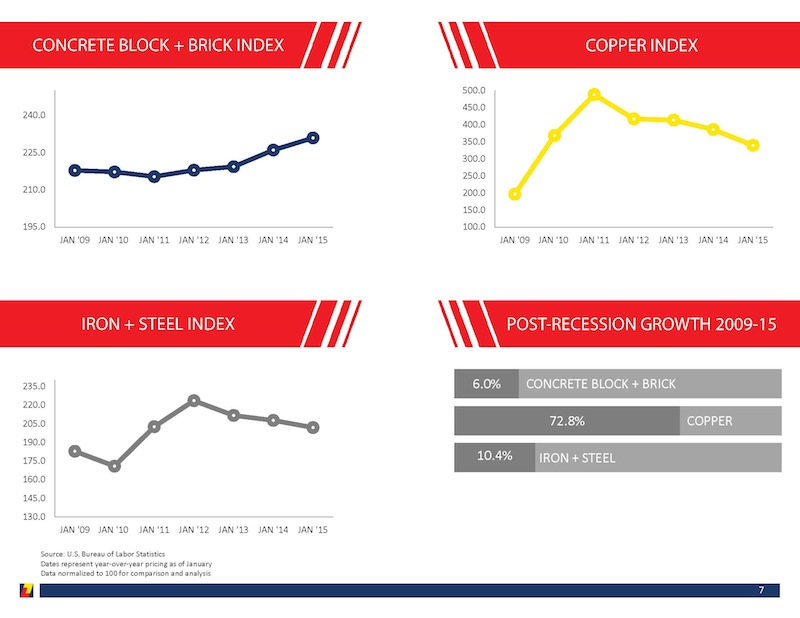

This year’s report shows that different factors have opposing effects on construction costs. Low oil prices greatly reduce the cost of construction, and some material costs have come down over the past year.

But these factors reducing cost are more than offset by the strong increase in labor costs, brought on by a shortage of skilled workers as more than 25% of Illinois construction workers left the industry over the past five years. The overall effect is that construction costs are rising as development volume increases in Chicago and across Illinois.

“Organizations that are considering new construction and renovation projects need to understand the factors in the economy and in the construction industry that may affect the timing and cost of their projects,” said Leopardo President Rick Mattioda. “Our annual Construction Economics Report and Outlook offers a wealth of useful information to help people make informed decisions when building.”

To create the report, Leopardo analyzed economic and construction industry data from universally respected sources, and utilized that data as well as the experience of the firm’s principals to forecast the direction of construction costs over the next year.

The report provides current and recent costs relating to:

• Construction materials, including steel, wood, concrete, asphalt, aluminum, copper and paint

• Oil, electricity and other energy sources

• Union and general wage increases for construction workers and specialty contractors

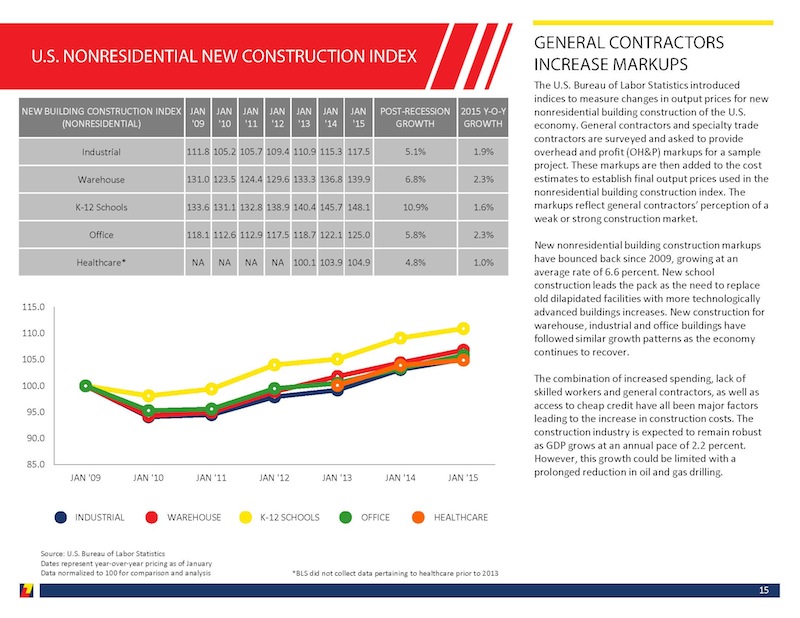

• Average markup of contractor and subcontractor bids

Also included in the report is economic data such as the Producer Price Index, the Consumer Price Index, employment projections for Illinois, and construction spending by industry.

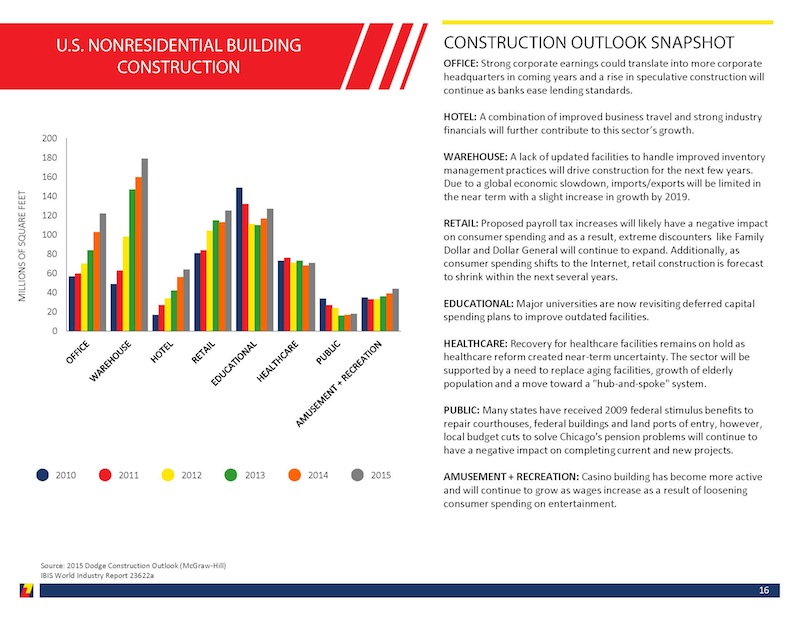

The report concludes with a snapshot of construction volume and trends by property type, including office, warehouse, hotel, multifamily residential, healthcare, educational, entertainment, and public-sector properties.

Related Stories

| Jul 20, 2012

K-12 Schools Report: ‘A lot of pent-up need,’ with optimism for ’13

The Giants 300 Top 25 AEC Firms in the K-12 Schools Sector.

| Jul 20, 2012

Higher education market holding steady

But Giants 300 University AEC Firms aren’t expecting a flood of new work.

| Jul 20, 2012

3 important trends in hospital design that Healthcare Giants are watching closely

BD+C’s Giants 300 reveals top AEC firms in the healthcare sector.

| Jul 20, 2012

Global boom for hotels; for retail, not so much

The Giants 300 Top 10 Firms in the Hospitality and Retail sectors.

| Jul 20, 2012

Gensler, Stantec, Turner lead ‘green’ firms

The Top 10 AEC Firms in Green Buildings and LEED Accredited Staff.

| Jul 19, 2012

Renovation resurgence cuts across sectors

Giants 300 reconstruction sector firms ‘pumping fresh blood in tired spaces.’

| Jul 19, 2012

AEC firms ready to dive into public projects

But the size of the pool keeps shrinking for the Top 25 AEC firms in the Government Sector.

| Jul 19, 2012

BIM finally starting to pay off for AEC firms

In surveying Giants 300 firms about BIM, we went right for the jugular: Is BIM paying off—through cost savings, higher quality, or client satisfaction? Here’s what they told us.

| Jul 19, 2012

Contractors finally ‘moving off the bottom’

C and CM Agent + PM Giants 300 Firms also taking steps to improve project efficiency.