Select-service hotels, which are designed with space efficiency and a lean labor model in mind, accounted for 70% of the total U.S. hotel construction pipeline at the end of last year. About that same percentage of investors surveyed by JLL recently were bullish on select-services hotels, believing they enhance portfolio returns.

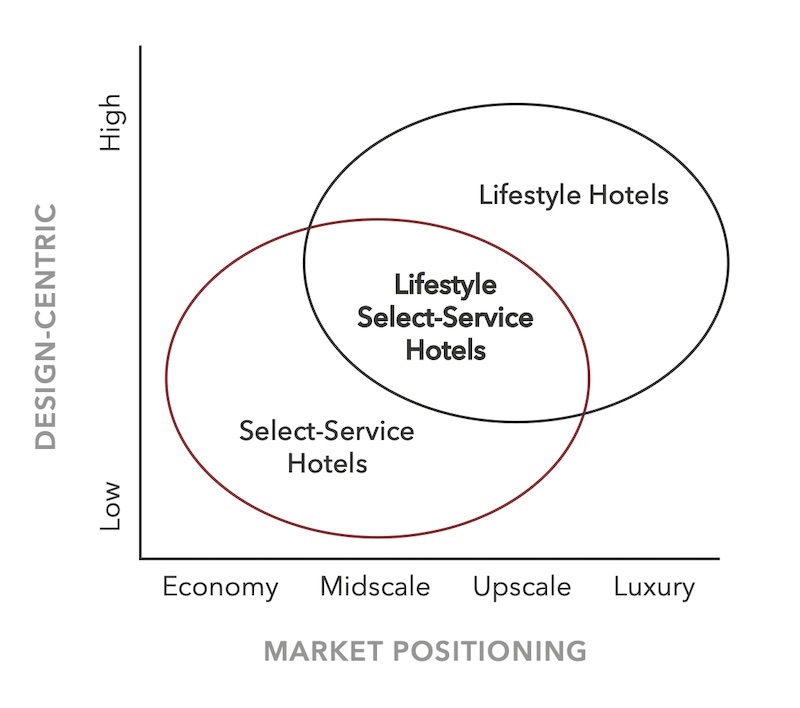

But lifestyle and cost-sensitive hotel concepts have been making inroads into the select-service space, causing traditional select-service brands to refresh and update, often with “lifestyle” qualities that place more emphasis on design and localization, and connecting modern travelers to local communities.

In a new 14-page white paper, WATG Strategy explores the intersection of select-service and lifestyle. “This breed of hotels, when differentiated by design and driven by efficiency, is at once style and lucrative,” the paper’s authors conclude.

Lifestyle and select-service hotel models are intersecting at the midscale-upscale price level. Image: WATG Strategy

FAVORABLE ECONOMICS

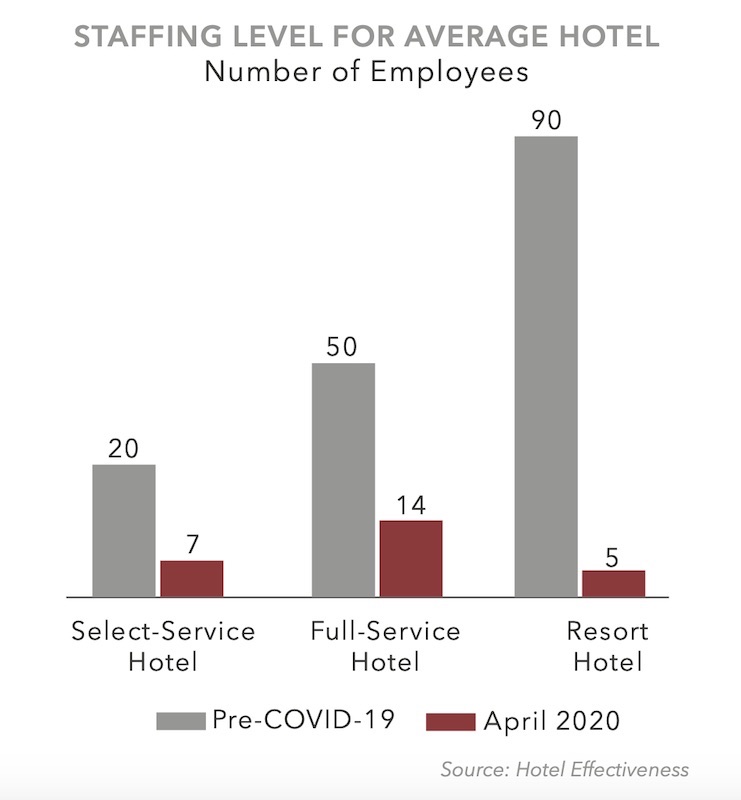

Select-service hotels focus on rooms, and their average room department profit margin—73% in the U.S.—far exceeds the average food and beverage profit margin of 29%. Given that staffing levels at select-service hotels are typically 40-50% of those in full-service hotels, their operational costs are significantly lower.

WATG Strategy, quoting the hospitality consultant HVS’s U.S. Hotel Development Cost Survey 2018-19, notes that building select-service hotels averages $290,000 per key, compared to $397,000 for full-service hotels. Select-service hotels are also more conducive to cost-saving modular construction.

Select-service hotels, with their flexible staffing model, typically have 40-50% of the employees of a full-service hotel. Image: WATG Strategy

During the pandemic, more select-service hotels, with a nimbler operations model, have been able to stay open than their full-service counterparts. For example, on its earnings call for the first quarter of 2020, Hyatt said it had temporarily closed 62% of its full-service hotels, but only 19% of its select-service hotels.

WATG Strategy also observes that lifestyle hotels of all service levels have shown financial resilience compared to traditional and standardized hotels. The benefits of lifestyle hotels include a flexible rate ceiling, additional revenue streams from locals who might frequent the hotels’ cafes, shops and lobbies; higher net revenue through direct bookings, and—when they’re design driven—photo-worthy spaces that travelers might post on social media.

Consequently, lifestyle select-service hotels have been popping up to the point where this market sector is now “fiercely competitive,” says WATG Strategy. Indeed, more of these hotels are shifting their branding to emphasize “lifestyle,” sometimes to the extent where the line between traditional and lifestyle gets blurred. (WATG Strategy explains that it’s easier and less expensive to alter a hotel’s image than it is to terminate a brand entirely.)

WATG Strategy also sees a trend toward proliferation, but without market dilution. Not every hotel brand wants to be in every market: Marriott, for example, had only 32 Moxy hotels in its North America pipeline as of year-end 2019.

DESIGN WILL INFLUENCE SUCCESS

Regardless of the number of hotels within a certain brand, “as the hotel industry braces itself for a period of reprioritization, whether a hotel brand and property can withstand the test of time will be influenced by a key factor: design,” states the white paper.

Key design trends that currently define today’s lifestyle select-service hotel include lobby and communal spaces, F&B service that features beverage and caters to the all-day grab-and-go patron, and what WATG Strategy calls “chameleon spaces,” such as Marriott’s AC Hotels that display museum-quality artifacts, or Hyatt’s Joie de Vivre brand that’s known to reflect its vibrant neighborhoods.

The Joie de Vivre brand includes the recently completed Hotel 50 Bowery in New York City, a boutique hotel with 229 rooms. There, past meets present in the reclaimed wood reception desk set resting on contemporary poured concrete, while a Corten steel screen to the rear evokes a Chinese landscape painting. The Crown, a rooftop bar and lounge occupies the 21st floor and provides views of Lower Manhattan and Brooklyn across the water.

The Crown roofdeck at Hotel 50 Bowery offers panoramic views of New York City. Image: Hyatt Joie de Vivre

SMALLER, MORE SUMPTUOUS ROOMS

However, the guestroom remains the focus of these hybrid hotels. “Lifestyle select-service hotels are all about the delicate balance of delivering a premium experience while maintaining cost efficiency,” says the white paper. “Therefore, they focus on what guests need in the guestrooms, and eliminate everything else.

Guestrooms are getting smaller in lifestyle select-service hotels, but compensate with sumptuous beds and customized touches like fresher air, controllable sound, and personalized lighting. These rooms are also more likely to have spacious showers and communal spaces such as kitchens or living rooms.

The next generation of lifestyle select-service hotels, predicts WATG Strategy, will balance efficiency and high perception of value. That balance, though, must transcend touchless technology that tends to make traditional select-service hotels somewhat antiseptic.

With the emergence, in more markets, of wellness, coworking, and co-living social clubs, WATG Strategy sees the next generation the lifestyle select-service hotel progressing alongside its users to become more than a place to sleep for a few nights. “It can become multi-faceted work-play-stay hub while continuing to deliver superior value for its owners and heartfelt hospitality for its guests.”

Related Stories

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Sustainability | Apr 20, 2023

13 trends, technologies, and strategies to expect in 2023

Biophilic design, microgrids, and decarbonization—these are three of the trends, technologies, and strategies IMEG’s market and service leaders believe are poised to have a growing impact on the built environment.

High-rise Construction | Dec 7, 2022

SOM reveals its design for Singapore’s tallest skyscraper

Skidmore, Owings & Merrill (SOM) has revealed its design for 8 Shenton Way—a mixed-use tower that will stand 63 stories and 305 meters (1,000 feet) high, becoming Singapore’s tallest skyscraper. The design team also plans to make the building one of Asia’s most sustainable skyscrapers. The tower incorporates post-pandemic design features.

Hotel Facilities | Nov 8, 2022

6 hotel design trends for 2022-2023

Personalization of the hotel guest experience shapes new construction and renovation, say architects and construction experts in this sector.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

Hotel Facilities | Oct 12, 2022

Global hotel chain citizenM opens its first Chicago property and its fifth of the year

citizenM, a global chain of affordable luxury hotels, has opened its first Chicago property—its fifth opening of 2022.

University Buildings | Oct 7, 2022

Auburn’s new culinary center provides real-world education

The six-story building integrates academic and revenue-generating elements.

Giants 400 | Sep 9, 2022

Top 90 Hospitality Sector Contractors + CM Firms for 2022

AECOM, Suffolk Construction, STO Building Group, and The Yates Companies top the ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 9, 2022

Top 70 Hospitality Sector Engineering + EA Firms for 2022

Jacobs, Jensen Hughes, EXP, and Kimley-Horn head the ranking of the nation's largest hospitality facilities sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 9, 2022

Top 120 Hospitality Sector Architecture + AE Firms for 2022

Gensler, WATG, HKS, and JCJ Architecture top the ranking of the nation's largest hospitality facilities sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.