According to the third quarter report by analysts at Lodging Econometrics (LE), the franchise companies leading the U.S. construction pipeline with the greatest number of new construction projects are Marriott International with 1,286 projects/166,174 rooms, Hilton Worldwide with 1,223 projects/139,742 rooms, and InterContinental Hotels Group (IHG) with 769 projects/77,558 rooms. The construction pipelines for these three franchise companies comprise an impressive 68% of the total construction pipeline projects.

The leading brands by project count in the construction pipeline for each of these three companies are Hilton’s Home2 Suites by Hilton with 402 projects/41,846 rooms, IHG’s Holiday Inn Express with 301 projects/28,852 rooms, and Marriott’s Fairfield Inn with 246 projects/23,653 rooms. These three mid-market brands alone account for 20% of the projects in the total construction pipeline.

Other significant brands in the pipeline for these franchises include Hilton’s Hampton by Hilton, reaching a cyclical peak, with 271 projects/28,311 rooms and Tru by Hilton with 224 projects/21,518 rooms; Marriott’s TownePlace Suites with 204 projects/19,5693 rooms and Residence Inn with 203 projects/25,132 rooms; IHG’s Avid Hotel with 152 projects/13,255 rooms and Staybridge Suites with 122 projects/12,564 rooms.

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S. Hilton opened 45 new hotels/4,923 rooms accounting for 19% of newly opened rooms and IHG opened 25 new hotels in Q3/2,459 rooms accounting for 9% of rooms. Year-to-date, through the end of the third quarter in 2021, Marriott has opened 212 new hotels/28,298 rooms accounting for 32% of new hotels and 33% of new rooms; Hilton has opened 169 new hotels/21,786 rooms, accounting for 25% of new hotels and 26% of newly opened rooms, and IHG opened 98 new hotels/9,828 rooms, accounting for 15% of new hotels and 12% of rooms opened in the U.S.

The LE forecast for new hotel openings in 2021 anticipates that Marriott will open 243 projects/32,944 rooms by year-end. Hilton is expected to open a total of 207 projects/26,056 rooms in 2021, and IHG is on track to open 145 projects/14,451 rooms. In 2022, LE forecasts Marriott will open 245 new hotels/31,470 rooms, IHG will open 204 new hotels/20,737 rooms, and Hilton is expected to open 192 new hotels/22,090 rooms.

Related Stories

Engineers | Nov 27, 2023

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

Giants 400 | Sep 20, 2023

Top 80 Hospitality Facility Construction Firms for 2023

Suffolk Construction, The Yates Companies, STO Building Group, and PCL Construction Enterprises top BD+C's ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 20, 2023

Top 75 Hospitality Facility Engineering Firms for 2023

Jacobs, IMEG, EXP, and Tetra Tech top BD+C's ranking of the nation's largest hospitality facilities sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 20, 2023

Top 130 Hospitality Facility Architecture Firms for 2023

Gensler, WATG, HKS, and JCJ Architecture top BD+C's ranking of the nation's largest hospitality facilities sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Hotel Facilities | Sep 15, 2023

The next phase of sustainability in luxury hotels

The luxury hotel market has seen an increase in green-minded guests looking for opportunities to support businesses that are conscientious of the environment.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

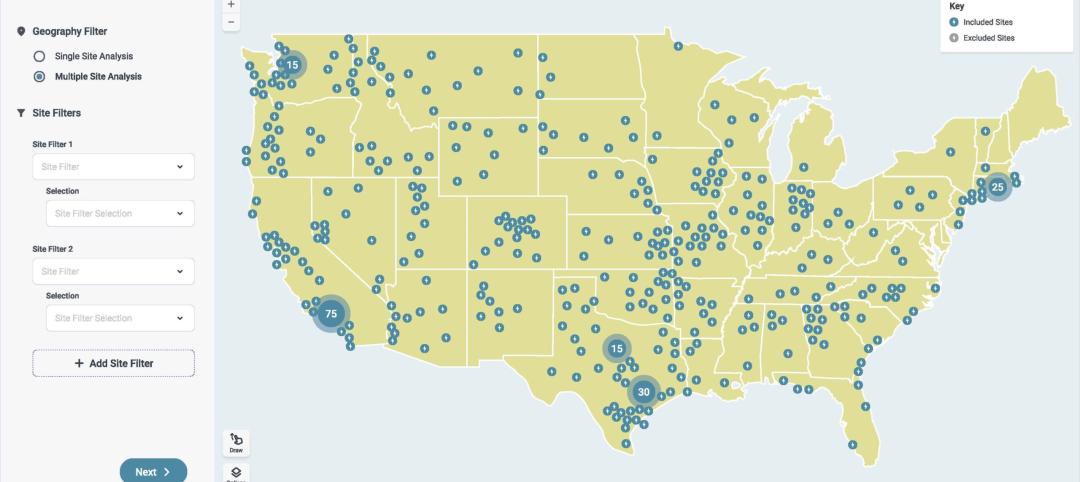

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.