Any way you look at it, the data center market remains one of the healthiest sectors of the nonresidential construction industry. As the growth of cloud computing and mobile technology continues, the need for storage and computing power will expand exponentially.

Cisco predicts global data center traffic to grow threefold and reach a total of 7.7 zettabytes in annual traffic by 2017 (a zettabyte is one billion terabytes, in case you were wondering). The fastest-growing component is cloud traffic, which is expected to expand 4.5-fold from 1.2 zettabytes in 2012 to 5.3 zettabytes by 2017. In fact, by the end of 2014, cloud-based data centers will, for the first time, surpass traditional data centers in terms of total workload, says Cisco.

In its most recent forecast report (http://tinyurl.com/datacenterforecast), technology research firm TechNavio called for the global market for data center construction to register an annual compound growth rate of 21% through 2018. Much of that growth is expected to occur in the colocation facilities segment, as corporations and other data enterprises look to outsource their increasingly complex and costly—and often outdated—data center operations.

The maturation of the modular and containerized data center sector may eventually hinder the growth of traditional data center construction services, according to TechNavio analysts. As data center owners look to expand quickly and get online faster, a growing number are turning to “plug and play” and “data center in a box” solutions in lieu of site-built systems and facilities.

The technology enables faster scaling and installation, and often comes equipped with the required power and cooling solutions, as well as built-in control, monitoring, and management functions to maximize performance.

TOP DATA CENTER SECTOR ARCHITECTURE FIRMS

2013 Data Center Revenue ($)

1 Gensler $25,839,736

2 Corgan 23,560,060

3 HDR 15,150,000

4 Page 13,950,000

5 Sheehan Partners 5,666,072

6 Little 5,450,648

7 RS&H 4,900,000

8 Callison 3,940,188

9 Clark Nexsen 3,186,054

10 Environetics 2,947,119

SEE FULL LIST

TOP DATA CENTER SECTOR ENGINEERING FIRMS

2013 Data Center Revenue ($)

1 Fluor Corporation $243,370,000

2 Jacobs 47,490,000

3 Syska Hennessy Group 41,934,230

4 URS Corp. 25,100,000

5 Vanderweil Engineers 21,588,000

6 Integrated Design Group 13,574,682

7 Parsons Brinckerhoff 12,185,435

8 Environmental Systems Design 10,063,915

9 Arup 9,997,297

10 Highland Associates 8,400,000

SEE FULL LIST

TOP DATA CENTER SECTOR CONSTRUCTION FIRMS

2013 Data Center Revenue ($)

1 Holder Construction $1,124,000,000

2 Turner Construction 512,000,000

3 DPR Construction 506,001,637

4 Structure Tone 400,450,000

5 Mortenson Construction 298,590,000

6 Gilbane 241,967,522

7 Balfour Beatty US 202,427,241

8 Hensel Phelps 177,120,000

9 Hoffman Construction 168,000,000

10 HITT Contracting 136,900,000

SEE FULL LIST

Cisco, Dell, and Huawei are among the hardware manufacturers offering modular and containerized solutions, and are no doubt taking market share from AEC firms, including many of the Giants 300 firms.

Giants 300 coverage of Data Centers is brought to you by Siemens http://w3.usa.siemens.com

Of the 364 AEC firms that completed the BD+C Giants 300 survey, more than a third (36%) reported at least some revenue from data center work in 2013. Thirty-four firms said that at least 10% of their total revenue in 2013 was derived from the data center construction market, and 11 firms relied on the sector for more than a quarter of their business.

Growth of Green

Stricter energy regulations and the rising cost of operating data facilities continue to drive demand for highly energy-efficient spaces. TechNavio expects the construction market for green data centers to grow at an annual rate of 31% between 2013 and 2018.

“The growing concern over reducing the computing costs for companies and data center facilities leads to the adoption of solutions such as natural air cooling and precision data center cooling,” said Faisal Ghaus, Vice President of TechNavio.

Facebook’s prefab concept aims to slash construction time in half

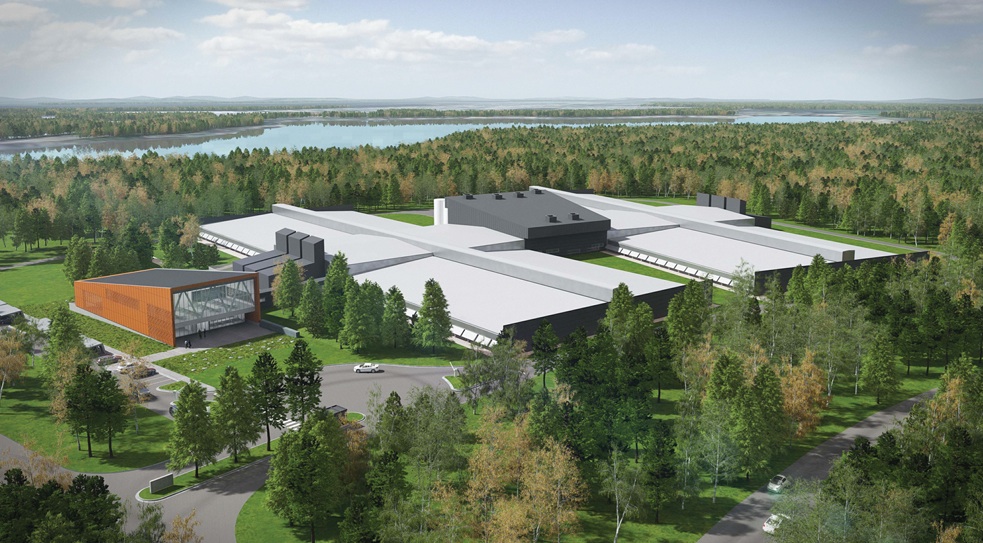

Less than a year after opening its ultra-green, hydropowered data center facility in Luleå, Sweden, Facebook is back at it in Mother Svea with yet another novel approach to data center design. In May, the tech giant broke ground on an expansion to its Luleå facility, which is rated as one of the most energy-efficient data centers in the world, with an average power usage effectiveness (PUE) of 1.05.

With Luleå 2, the company expects to achieve the same energy performance, but with a construction and deployment schedule that is roughly half its typical data center project. To do so, the Building Team is implementing Facebook’s newly developed Rapid Deployment Data Center (RDDC) concept, which utilizes modular and Lean design principles to streamline planning and construction, reduce the amount of materials, and create facilities that are more site-agnostic, according to Marco Magarelli, AIA, Architect, Datacenter R&D with Facebook.

“By deploying pre-manufactured assemblies, a majority of the components can be used interchangeably,” wrote Magarelli in a recent blog post on the RDDC concept. “It’s our hope that by standardizing the designs of our component assemblies, much like we do with OCP servers, we can deploy a unitized data center into almost any region in the world faster, leaner, and more cost effectively.”

Developed through the Facebook-initiated Open Compute Project, which aims to crowdsource data center design, the RDDC approach relies on two core prefab concepts:

Chassis assembly method. Pre-assembled steel frames 12 feet wide and 40 feet long serve as the “chassis,” on which the vital data center components—cable trays, power busways, containment panels, lighting, etc.—are bolted in a factory, much like an auto assembly line.

In May, Facebook broke ground on an expansion to its data center campus in Luleå, Sweden. Using a new prefab construction process, the tech giant expects to build the new data center twice as fast as the first facility. PHOTO: FACEBOOK

The chassis are shipped to the site and mounted atop steel columns. The chassis are attached end to end to create the typical 60-foot-long cold aisle, with 10 feet of aisle space at each end. This series of connected chassis forms a “canopy,” under which the server racks reside.

“Unlike containerized solutions, which are a full volumetric approach that includes a floor, this idea focuses solely on the framework that exists above the racks, to avoid shipping the empty space that will eventually be occupied by the racks,” said Magarelli.

Flat-pack assemblies. This Ikea-like approach neatly packs the walls and ceiling panels into standard, 8-foot modules that are easily transportable to a site on a flatbed trailer without requiring special permits for wide loads. Standard building products like metal studs and preassembled, unitized containment panels are then erected on the site and are fully self-supporting.

The ceiling panels use Epicore metal deck product, which spans the 12-foot width of the cold aisle and racks. This serves the additional duty of carrying the loads of the trays, power bus, and light fixtures below it using a proprietary hanger clip for the threaded rods, according to Magarelli.

“Careful attention was paid to minimizing the number of unique components,” he wrote. “For example, 364 identical wall panels are used in each data hall.”

For more on Facebook’s Rapid Deployment Data Center method, visit: www.opencompute.org/blog/faster-leaner-smarter-better-data-centers.

Read BD+C's full 2014 Giants 300 Report

Related Stories

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Giants 400 | Oct 23, 2023

Top 190 Multifamily Architecture Firms for 2023

Humphreys and Partners, Gensler, Solomon Cordwell Buenz, Niles Bolton Associates, and AO top the ranking of the nation's largest multifamily housing sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Affordable Housing | Oct 20, 2023

Cracking the code of affordable housing

Perkins Eastman's affordable housing projects show how designers can help to advance the conversation of affordable housing.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.

Warehouses | Oct 19, 2023

JLL report outlines 'tremendous potential' for multi-story warehouses

A new category of buildings, multi-story warehouses, is beginning to take hold in the U.S. and their potential is strong. A handful of such facilities, also called “urban logistics buildings” have been built over the past five years, notes a new report by JLL.

Building Materials | Oct 19, 2023

New white papers offer best choices in drywall, flooring, and insulation for embodied carbon and health impacts

“Embodied Carbon and Material Health in Insulation” and “Embodied Carbon and Material Health in Gypsum Drywall and Flooring,” by architecture and design firm Perkins&Will in partnership with the Healthy Building Network, advise on how to select the best low-carbon products with the least impact on human health.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.

Luxury Residential | Oct 18, 2023

One Chicago wins 2023 International Architecture Award

One Chicago, a two-tower luxury residential and mixed-use complex completed last year, has won the 2023 International Architecture Award. The project was led by JDL Development and designed in partnership between architecture firms Goettsch Partners and Hartshorne Plunkard Architecture.

Giants 400 | Oct 17, 2023

Top 130 Sports Facility Architecture Firms for 2023

Populous, Gensler, HOK, and HKS head BD+C's ranking of the nation's largest sports facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.