Between 2013 and February 2018, cumulative investment in construction technology totaled $18 billion, or double the amount invested during the previous five years.

A new analysis of the construction technology ecosystem by McKinsey & Co., the global management consulting firm, identifies where that investment is being directed, how the market is likely to evolve in the next few years, and how the construction and engineering industries can accelerate their transitions into a digital future.

McKinsey has expanded its study to include the entire asset life cycle across more than 2,400 technology solutions companies—from concept and feasibility, to design and engineering, preconstruction, construction, and operations and maintenance. In doing so, McKinsey identifies 38 “use cases” that are spurring the creation of new companies and attracting investment capital.

Among the key trends has been the emergence of constellations of solutions around established use cases. The most prominent include 3D printing, modularization, and robotics; digital twin technology; artificial intelligence (AI) and analytics; and supply chain optimization and marketplaces.

McKinsey sees all of these are being “poised to be transformational for the industry.” AI, in the form of machine learning, is gaining momentum as an overarching use case, particularly in reality capture. “Indeed, by applying machine learning to an ongoing project, schedules could be optimized to sequence tasks and hit target deadlines, and divergences from blueprints could be caught closer to real time and corrected,” the report’s authors write.

While the report foresees only modest market penetration in the immediate future, “the potential impact [of AI] is so large that the industry can no long afford to ignore it.”

As for 3D printing, modularization and robotics, McKinsey’s research finds that consistent use of these techniques, on projects where they are economically feasible, “could boost the sector’s productivity by five- to tenfold.”

In fact, one of the “most exciting” applications of digital twin technology invnolve the seamless integration of 3D models generated by drone imagery.

McKinsey is less sanguine about the near-term growth of supply-chain optimization and marketplaces, observing that it’s still “nascent and limited to North America.”

‘Cross-cutting’ technologies could soar

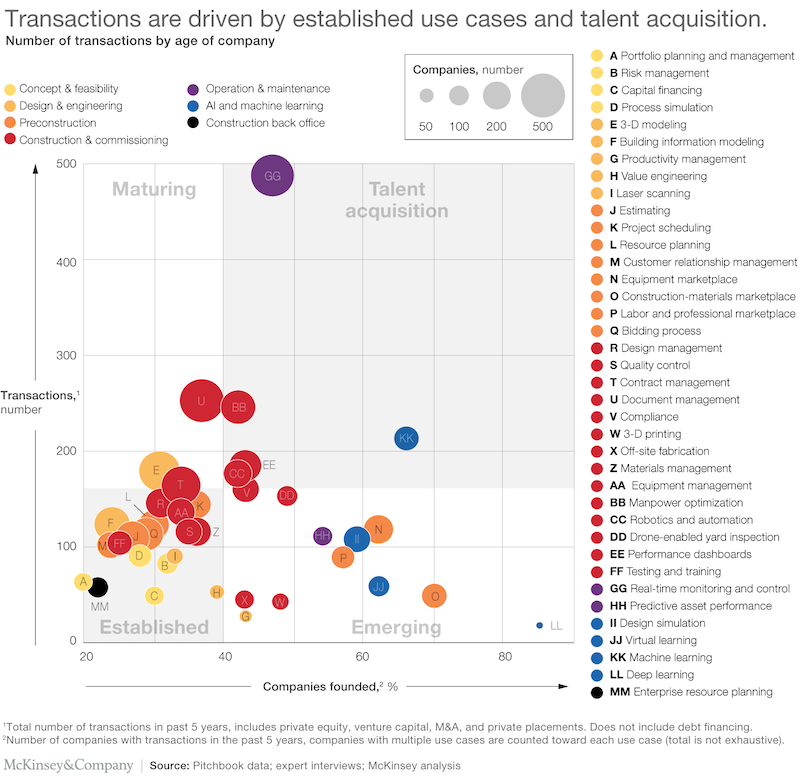

Over the past five years, investments into construction technology have fallen into four quadrants (see chart above), which McKinsey further breaks down by user cases to suggest where future opportunities might be most fertile. Image: McKinsey & Co.

From 2013 to early 2018, there were 908 investment transitions for construction technology, 75% of which involved early-stage venture capital. Late-stage VC was also on the rise, which McKinsey suggests indicated that certain use cases were ready for growth financing.

Construction remains the highest invested phase of the asset life cycle. It is also relatively mature; only one-third of companies in this phase are newcomers. Preconstruction and back-office phases are also garnering large investments.

McKinsey notes that “cross-cutting technologies” are gaining momentum because of their applicability across different stages of the life cycle. These include 3D printing, virtual learning, design simulation, machine learning, and deep learning. “The number of companies founded in this space over the past five years exceeds any other category, and the dollar value of transactions is quickly catching up with the rest of the categories,” the report states.

The report also cites two untapped markets: design/engineering, and concept/feasibility. There are various explanations for this, one being the office-based nature of these phases “means their relevant solutions (such as CAD or BIM) may already be relatively mature and sophisticated.”

Consolidation could spur investment

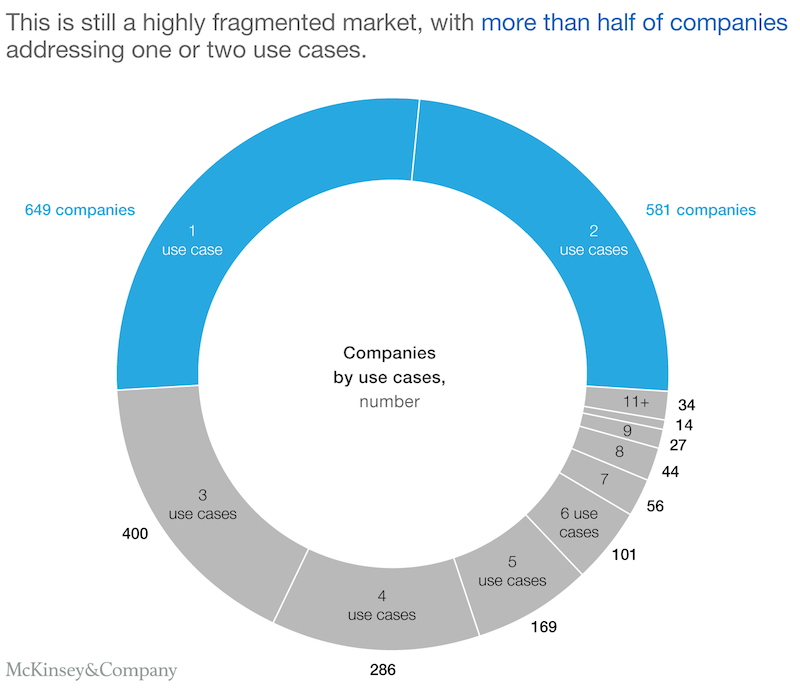

The report states that industry fragmentation is one of the biggest challenges for companies that want to engage with technology solutions. And the lack of use-case integration “is one of the drags on technology adoption at scale.” Consequently, more companies are exploring the potential to consolidation solutions that address multiple use cases.

The field of construction technology is still highly fragmented, and integration of technologies that can be integrated across different uses will present investment opportunities. Image: McKinsey & Co.

McKinsey offers its prescriptions for moving the industry quicker into a digital future, starting with investing in talent, which can increase the odds of digitization success by 2.5 times, the report estimates. Actively engaging with the start-up ecosystem and establishing conditions that make piloting and scaling more likely to succeed can also accelerate the industry’s transformation.

Tech providers need to listen closer to end users and adapt, and proactively plan for integration and consolidation. Owners should enforce a strong and sharable data foundation, align on supportive contract strategies, and identify and focus on critical user cases.

“Gone are the days when the construction industry can ignore the burgeoning set of technology solutions across the asset life cycle,” the report concludes. “We expect investment, competition, and consolidation to continue to accelerate, as use cases and start-ups serving the industry proliferate. As predictions come to life and new capabilities infiltrate the field, team, and office, the winners will be the ones that adapt—sooner rather than later.”

Related Stories

| Aug 11, 2010

Let There Be Daylight

The new public library in Champaign, Ill., is drawing 2,100 patrons a day, up from 1,600 in 2007. The 122,600-sf facility, which opened in January 2008, certainly benefits from amenities that the old 40,000-sf library didn't have—electronic check-in and check-out, new computers, an onsite coffeehouse.

| Aug 11, 2010

BIM school, green school: California's newest high-performance school

Nestled deep in the Napa Valley, the city of American Canyon is one of a number of new communities in Northern California that have experienced tremendous growth in the last five years. Located 42 miles northeast of San Francisco, American Canyon had a population of just over 9,000 in 2000; by 2008, that figure stood at 15,276, with 28% of the population under age 18.

| Aug 11, 2010

Platinum Award: The Handmade Building

When Milwaukee's City Hall was completed in 1896, it was, at 394 feet in height, the third-tallest structure in the United States. Designed by Henry C. Koch, it was a statement of civic pride and a monument to Milwaukee's German heritage. It was placed on the National Register of Historic Places in 1973 and designated a National Historic Landmark in 2005.

| Aug 11, 2010

Great Solutions: Products

14. Mod Pod A Nod to Flex Biz Designed by the British firm Tate + Hindle, the OfficePOD is a flexible office space that can be installed, well, just about anywhere, indoors or out. The self-contained modular units measure about seven feet square and are designed to serve as dedicated space for employees who work from home or other remote locations.

| Aug 11, 2010

Special Recognition: Kingswood School Bloomfield Hills, Mich.

Kingswood School is perhaps the best example of Eliel Saarinen's work in North America. Designed in 1930 by the Finnish-born architect, the building was inspired by Frank Lloyd Wright's Prairie Style, with wide overhanging hipped roofs, long horizontal bands of windows, decorative leaded glass doors, and asymmetrical massing of elements.

| Aug 11, 2010

The pride of Pasadena

As a shining symbol of civic pride in Los Angeles County, Pasadena City Hall stood as the stately centerpiece of Pasadena's Civic Center since 1927. To the casual observer, the rectangular edifice, designed by San Francisco Classicists John Bakewell, Jr., and Arthur Brown, Jr., appeared to be aging gracefully.

| Aug 11, 2010

Great Solutions: Technology

19. Hybrid Geothermal Technology The team at Stantec saved $800,000 in construction costs by embedding geothermal piping into the structural piles at the WestJet office complex in Calgary, Alb., rather than drilling boreholes adjacent to the building site, which is the standard approach. Regular geothermal installation would have required about 200 boreholes, each about four-inches in diameter ...