BD+C: What is your gut telling you about the real estate market?

Michael J. Alter: My hope is that things are bottoming out, but things aren’t going to be good until unemployment drops, rents start firming up, and there’s some absorption in the markets. Capital markets are beginning to return, for high-quality apartment deals and CBD office buildings in major cities like New York, Chicago, and Washington. Nationwide, the value of trophy properties is only at about 17% below their peak. In Chicago, two major office towers recently sold at record prices, so clearly there’s a hunt for institutional-grade assets with credit tenants.

BD+C: Then why aren’t more projects getting financed?

MJA: There’s a tremendous amount of liquidity on the sidelines. Commercial real estate companies and funds raised $13.2 billion in November alone, while the pension funds and foreign capital have also raised their allocations. For investors, there are not a lot of great places to put your money. It’s a risk/reward calculation, although investors worldwide still look at the U.S. as the highest-quality market to be in.

In talking to our clients, we think there’s a significant pent-up demand, projects that they want to do and haven’t pulled the trigger on, but they’re getting ready. Corporations are sitting on $2 trillion of capital. We’re going to start to see them moving ahead on real estate in 2011—not a dramatic burst of activity, but a steady increase. All that gives me cause for optimism.

BD+C: In accepting the NAIOP award on behalf of your company, you noted that “30 million people will join our population in the next decade alone.” What does that mean for the real estate industry?

MJA: Well, first, a lot of that growth will take place in urban centers. By 2050, there will something like 300 million people in U.S. cities, about 75% of our economic output, so there will be a great need for high-tech office buildings that support knowledge work. Then there’s the aging population—about 40 million senior citizens—which creates opportunities in how we house and care for elderly people. There’s going to be tremendous demand for healthcare, particularly in the outpatient arena, due to this increase and also because of the 30 million new people who will be covered under healthcare reform.

In just the last six months, our healthcare division, Alter+Care, has been reporting that every medical provider is rethinking its business model and strategy. Healthcare reform has urged that hospitals move toward an accountable care model, which means co-locating the entire continuum of medical services, from wellness to outpatient services to acute care. They’re jockeying for position in this new paradigm, and they’re thinking about their space needs as a piece of that puzzle.

Hospitals are also buying physician groups, with a new emphasis on primary care. This physician-employed model gives hospitals more control, which will increase the demand for locating medical office space right on hospital campuses. The resolution of all this is going to have a significant impact on the real estate industry.

BD+C: What do your clients say about sustainability?

MJA: We do hear about it from clients, particularly the Fortune 500 companies. It’s an important criterion for them, and they mention it in all RFPs. It’s taken a bit of back seat because of the economy, and it’s not quite as high a priority as it was two years ago, but that is temporary. The case for green can be made in many ways. Consider that energy prices have quadrupled since the 1990s. As a long-time building owner, we had a vested interest in controlling the operating expenses of those buildings, and one way to accomplish that has always related to energy costs. “Green” is only going to continue, and we’re all getting better at bringing the costs down without paying a premium.

I think the capital markets will also start placing a small premium on green buildings, and that will make the cost situation even more favorable.

BD+C: How can architects, construction firms, and engineers work better with a major developer like the Alter Group?

MJA: We have a very small in-house operation for the number of projects we do, and we use a lot of outside service providers. We’re looking for team players, collaborators, people who can work together in a positive way. Some people want to be in charge and tell everyone what to do, and are incapable of the give and take that leads to a successful project. Once we find the right people who are team players and understand the value proposition, then we keep going back to them.

BD+C: From a professional standpoint, what’s your biggest worry?

MJA: A double-dip recession caused by the government stimulus not being replaced by private-sector demand. In the long term, we have to confront our $14 trillion national debt; not doing so will impair our ability to borrow to fund our growth. We have more than $1 trillion worth of commercial real estate loans expected to mature between 2010 and 2013, and that’s a concern. I think properties with cash flow won’t have a problem refinancing, although there may be additional equity requirements on those loans.

Personally, I don’t think we’ll have a double dip, but that doesn’t mean I don’t worry about it.

Comments? Send them to: rcassidy@sgcmail.com.

Related Stories

| Dec 4, 2014

World’s largest eco-resort to open soon in Indonesia

Just under 10 miles away from Singapore, Funtasy Island (yes, that's the real name) is a resort tucked away in the mangrove islands of the Riau archipelago.

| Dec 4, 2014

£175 million 'Garden Bridge' gets the green light to cross the Thames

Westminster Council has approved a £175 million 'Garden Bridge' that will allow pedestrian traffic only. There has been some controversy about this bridge, which is expected to attract seven million visitors annually.

Sponsored | | Dec 3, 2014

Modular Space Showcase: Bringing work-life balance to energy workers in the Bakken region

To meet the demands of the booming energy business, Williston needs to provide homes, recreation centers, restaurants, hotels, and other support facilities for the tidal wave of energy workers relocating to the Bakken Shale area. SPONSORED CONTENT

| Dec 3, 2014

U.S., Canada, and Mexico finalize agreement to recognize architect credentials

The agreement represents over a decade of negotiations, bringing cross-border recognition of professional credentials from concept to reality in the spirit of the North American Free Trade Agreement.

| Dec 3, 2014

35 cities added to Rockefeller Foundation's 100 Resilient Cities Challenge

Chicago, Dallas, and Pittsburgh are among the U.S. cities to join the 100 Resilient Cities Challenge, pioneered by The Rockefeller Foundation.

| Dec 2, 2014

First existing multifamily buildings to earn Energy Star certification unveiled

River City in Chicago is one of 17 existing multifamily properties to earn Energy Star certification, which became available to this sector on Sept. 16 via a scoring system for multifamily properties that Energy Star and Fannie Mae had been developing for three years.

| Dec 2, 2014

Nashville planning retail district made from 21 shipping containers

OneC1TY, a healthcare- and technology-focused community under construction on 18.7 acres near Nashville, Tenn., will include a mini retail district made from 21 shipping containers, the first time in this market containers have been repurposed for such use.

| Dec 2, 2014

Main attractions: New list tallies up the Top 10 museums completed this year

The list includes both additions to existing structures and entirely new buildings, from Frank Gehry's Foundation Louis Vuitton in Paris to Shigeru Ban's Aspen (Colo.) Art Museum.

| Dec 2, 2014

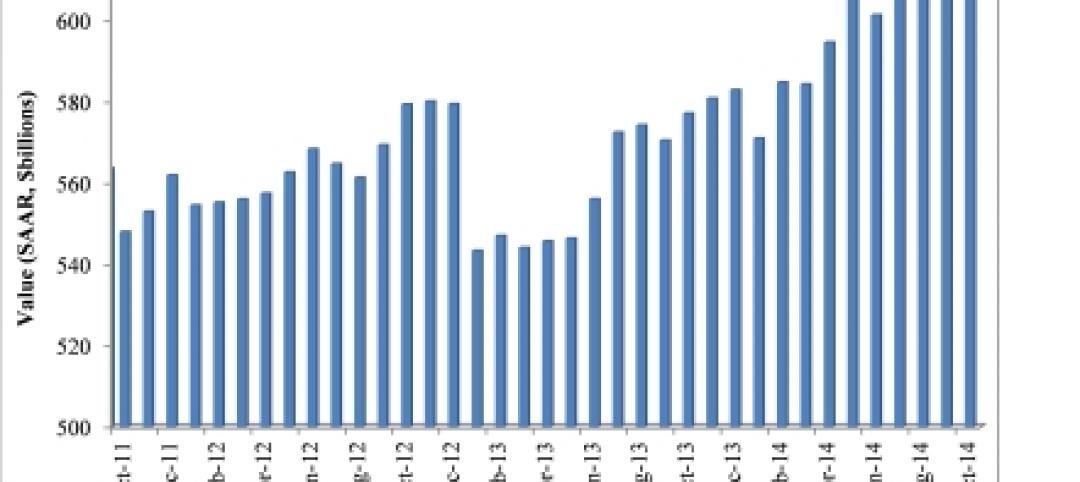

Nonresidential construction spending rebounds in October

This month's increase in nonresidential construction spending is far more consistent with the anecdotal information floating around the industry, says ABC's Chief Economist Anirban Basu.

| Dec 2, 2014

Hoffmann Architects announces promotions

The architecture and engineering firm specializing in the rehabilitation of building exteriors announces the promotion of members of its Connecticut staff.