Over the first half of 2017, the national median rent fluctuated, but it ended up exactly where it began: $1,016 for a one-bedroom. Prices fell from January to March, bottoming out at $1,003 before creeping back up in the spring. In all, the national median rent always stayed within 1.3% of its starting value.

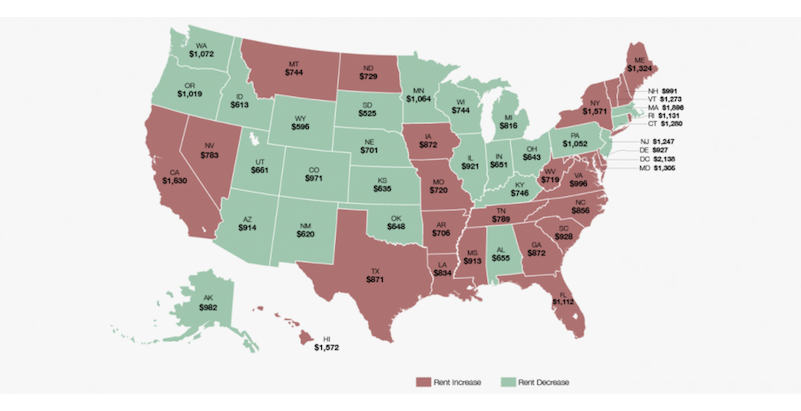

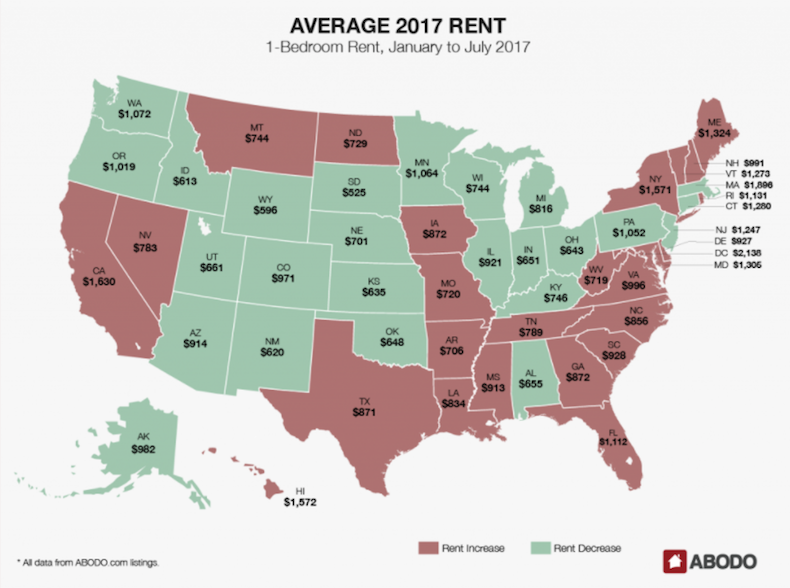

A slight majority of states (26, plus the District of Columbia) saw rental increases over the first six months of 2017, with the largest average percent changes coming in South Carolina (7.3%), Maine (7.3%), Vermont (7.2%), and Rhode Island (7.0%), Abodo's Midyear Rent Report reports. The greatest average decreases were significantly lower: Utah (-4.4%), Oklahoma (-3.3%), Pennsylvania (-2.7%), Connecticut (-2.3%).

The majority of states, 31, saw average changes in rent price of 1.3% or lower.

The states with the highest average rents will surprise no one. The District of Columbia had the highest average rent from January to July, with one-bedrooms going for $2,138 per month. Massachusetts ($1,896), California ($1,630), Hawaii ($1,572), and New York ($1,571) followed. The four states with the lowest average rents were all in the West or Southwest: South Dakota ($525), Wyoming ($596), Idaho ($613), and New Mexico ($620).

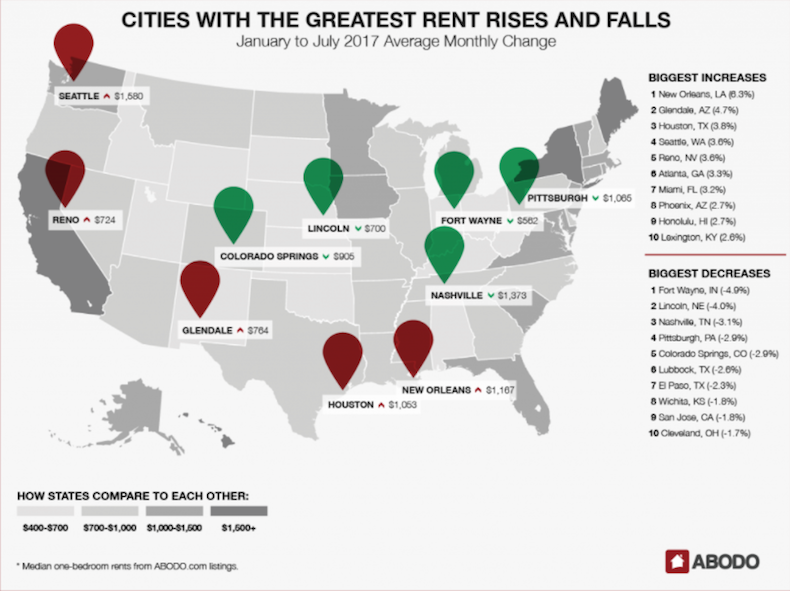

In December, our annual rent report noted that many of the cities with the fastest-growing rents were between the coasts. That trend continued in the first half of 2017: Eight of the top 10 cities for rental hikes were in the South or Southwest. New Orleans led the way, with an average monthly change of 6.3% and an average rent of $1,167. Glendale, Ariz. (4.7%, $764), and Houston (3.8%; $1,053), followed closely behind, with Reno, N.V., Atlanta, Miami, Phoenix, and Lexington, Ky., also making appearances.

The only geographic outliers were Seattle, which saw rents rise an average of 3.6% over the first half of the year, and Honolulu (2.6%).

The biggest drops in rent also continued to veer west and south. Fort Wayne, Ind., saw the largest rent drop, with an average decline of 4.9% per month and an average rent of $562. Lincoln, Neb., where the average rent is $700, experienced an average decline of 4% per month. And booming Nashville, Tenn., where the average one-bedroom rents for $1,373, saw an average drop of 3.1% per month.

From June to July, the biggest rental hike was in Newark, N.J., which saw its one-bedroom rent increase 10.2% to $1,120. Philadelphia (8.5%; $1,305) and Honolulu (8%; $1,654) rounded out the top three. In June, Reno saw its rent rise 6.7% to $832, and New Orleans jumped 5.8% to $1,397, continuing the months-long upward trend that landed them on the list for highest year-to-date change.

For the second month in a row, Buffalo, N.Y., and St. Paul, Minn., experienced the largest drops in rent in the country. This month, the order was reversed: St. Paul leads the way, with a 7.4% decrease to $1,233. Buffalo saw its rent drop 7.2% to $939. Glendale, which over the first six months of 2017 had the second-highest average monthly increase in rent, saw its median one-bedroom decrease 6.8% over the month of June, bottoming out at $833.

The cities with the highest rents are largely unchanged since last month’s report. San Francisco rents dropped $40 to $3,240, but that wasn’t enough to bump the city from its spot atop the rankings. As usual, New York City ($2,913) and San Jose ($2,378) rounded out the top three. The only real movement in the list of the country’s highest rents was near the bottom: Chicago ($1,861) superseded Miami ($1,855) for eighth place.

Nationally, rental prices were relatively stable through the first six months of 2017. Rent is rising in just over half of the nation’s states, and certain cities are seeing sustained increases in rent month to month. Cities where rent was already high—New York, D.C., Los Angeles—are still high, but the most notable rental increases are in growing markets in the South and Southwest, a continuation of a trend we noticed in our 2016 Annual Report.

In the next six months, rental prices in those markets will be a good barometer for how well new development is keeping up with what appears to be continued—and rising—demand for rentals.

Related Stories

Mass Timber | Jun 10, 2024

5 hidden benefits of mass timber design

Mass timber is a materials and design approach that holds immense potential to transform the future of the commercial building industry, as well as our environment.

Lighting | Jun 10, 2024

LEDs were nearly half of the installed base of lighting products in the U.S. in 2020

Federal government research shows a huge leap in the penetration of LEDs in the lighting market from 2010 to 2020. In 2010 and 2015, LED installations represented 1% and 8% of overall lighting inventory, respectively.

Libraries | Jun 7, 2024

7 ways to change 'business as usual': The Theodore Roosevelt Presidential Library

One hundred forty years ago, Theodore Roosevelt had a vision that is being realized today. The Theodore Roosevelt Presidential Library is a cutting-edge example of what’s possible when all seven ambitions are pursued to the fullest from the beginning and integrated into the design at every phase and scale.

Education Facilities | Jun 6, 2024

Studio Gang designs agricultural education center for the New York City Housing Authority

Earlier this month, the City of New York broke ground on the new $18.2 million Marlboro Agricultural Education Center (MAEC) at the New York City Housing Authority’s Marlboro Houses in Brooklyn. In line with the mission of its nonprofit operator, The Campaign Against Hunger, MAEC aims to strengthen food autonomy and security in underserved neighborhoods. MAEC will provide Marlboro Houses with diverse, community-oriented programs.

Office Buildings | Jun 6, 2024

HOK presents neurodiversity research and design guidelines at SXSW 2024

Workplace experts share insights on designing inclusive spaces that cater to diverse sensory processing needs.

Architects | Jun 4, 2024

HED and Larson Incitti Architects merge, combine Denver staff

HED, a leading national architecture and engineering firm, today announced a merger with award-winning, Denver-based Larson Incitti Architects (LIA). The merger combines LIA's staff with HED's Denver office, significantly expanding the local team and leveraging community relationships to create new opportunities across multiple market sectors.

Airports | Jun 3, 2024

SOM unveils ‘branching’ structural design for new Satellite Concourse 1 at O’Hare Airport

The Chicago Department of Aviation has revealed the design for Satellite Concourse 1 at O’Hare International Airport, one of the nation’s business airports. Designed by Skidmore, Owings & Merrill (SOM), with Ross Barney Architects, Juan Gabriel Moreno Architects (JGMA), and Arup, the concourse will be the first new building in the Terminal Area Program, the largest concourse area expansion and revitalization in the airport’s almost seven-decade history.

Office Buildings | Jun 3, 2024

Insights for working well in a hybrid world

GBBN Principal and Interior Designer Beth Latto, NCIDQ, LEED AP, ID+C, WELL AP, share a few takeaways, insights, and lessons learned from a recent Post Occupancy Evaluation of the firm's Cincinnati, Ohio, office.

Multifamily Housing | Jun 3, 2024

Grassroots groups becoming a force in housing advocacy

A growing movement of grassroots organizing to support new housing construction is having an impact in city halls across the country. Fed up with high housing costs and the commonly hostile reception to new housing proposals, advocacy groups have sprung up in many communities to attend public meetings to speak in support of developments.

MFPRO+ News | Jun 3, 2024

New York’s office to residential conversion program draws interest from 64 owners

New York City’s Office Conversion Accelerator Program has been contacted by the owners of 64 commercial buildings interested in converting their properties to residential use.