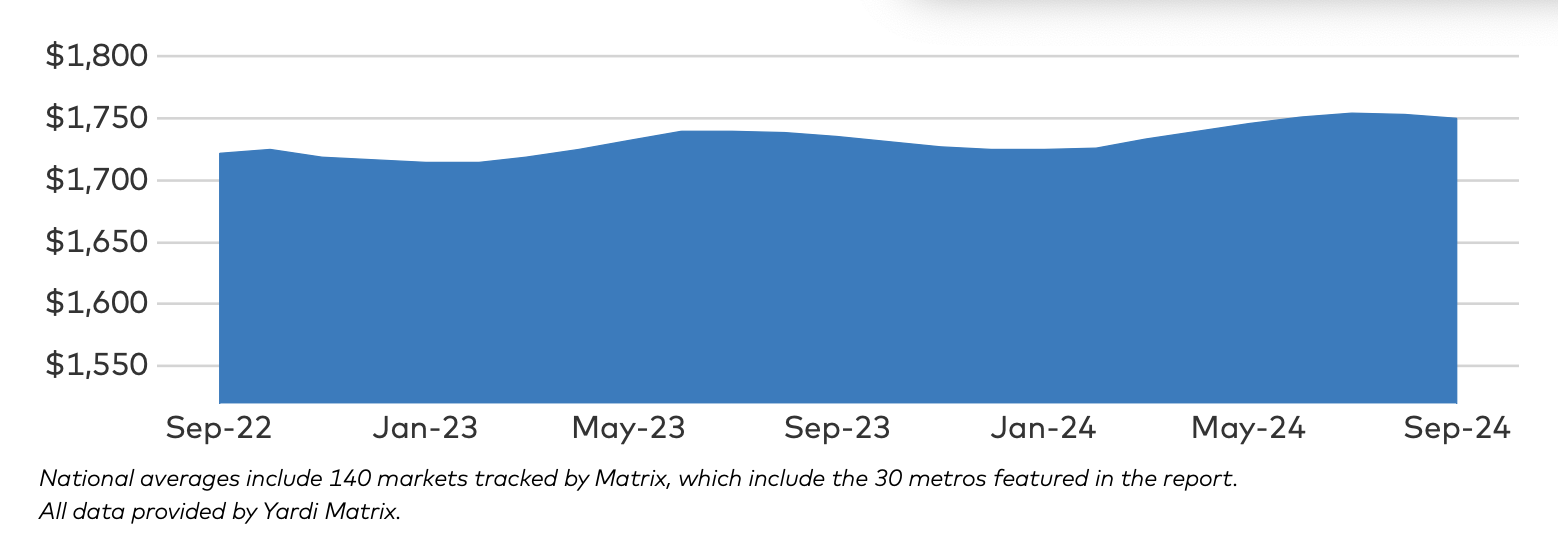

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent. The Yardi Matrix Multifamily National Report finds that advertised rents fell slightly in September due to seasonality and supply growth in the Sun Belt.

Recent economic news like interest rate cuts and robust GDP and job growth have given the multifamily market a “shot in the arm,” the report states. “Supply growth remains the bright line determining advertised rent growth.”

This is the third consecutive month that multifamily rent has dropped. Among major cities, New York, N.Y., saw the biggest rent increase (5.4% year-over-year), followed by Kansas City, Mo., (4.2% YoY). Secondary markets like Indianapolis, Ind., and Boston, Mass., also saw strong growth. In contrast, many Sun Belt cities experienced falling rents, with Austin, Texas, leading the decline at –4.9 percent.

National Average Rents

Nationwide, multifamily rents decreased by $3 month-over-month in September. This decline was entirely due to the Lifestyle segment, which saw rents fall by $6 to $2,065. The Renter-by-Necessity segment was unchanged overall, recording strong growth in high-cost, low-supply markets.

Related Stories

MFPRO+ News | Oct 22, 2024

Project financing tempers robust demand for multifamily housing

AEC Giants with multifamily practices report that the sector has been struggling over the past year, despite the high demand for housing, especially affordable products.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

Adaptive Reuse | Sep 12, 2024

White paper on office-to-residential conversions released by IAPMO

IAPMO has published a new white paper titled “Adaptive Reuse: Converting Offices to Multi-Residential Family,” a comprehensive analysis of addressing housing shortages through the conversion of office spaces into residential units.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Adaptive Reuse | Aug 29, 2024

More than 1.2 billion sf of office space have strong potential for residential conversion

More than 1.2 billion sf of U.S. office space—14.8% of the nation’s total—have strong potential for conversion to residential use, according to real estate software and services firm Yardi. Yardi’s new Conversion Feasibility Index scores office buildings on their suitability for multifamily conversion.

Adaptive Reuse | Aug 22, 2024

6 key fire and life safety considerations for office-to-residential conversions

Office-to-residential conversions may be fraught with fire and life safety challenges, from egress requirements to fire protection system gaps. Here are six important considerations to consider.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

MFPRO+ Research | Aug 6, 2024

Matrix multifamily report for July shows ‘hopeful signs’

The multifamily market is showing strength in many ways, according to the July 2024 Matrix Multifamily National Report by Yardi Matrix.

MFPRO+ New Projects | Jul 31, 2024

Shipping containers converted into attractive, affordable multifamily housing in L.A.

In the Watts neighborhood in Los Angeles, a new affordable multifamily housing project using shipping containers resulted in 24 micro-units for formerly unhoused residents. The containers were acquired from a nearby port and converted into housing units at a factory.