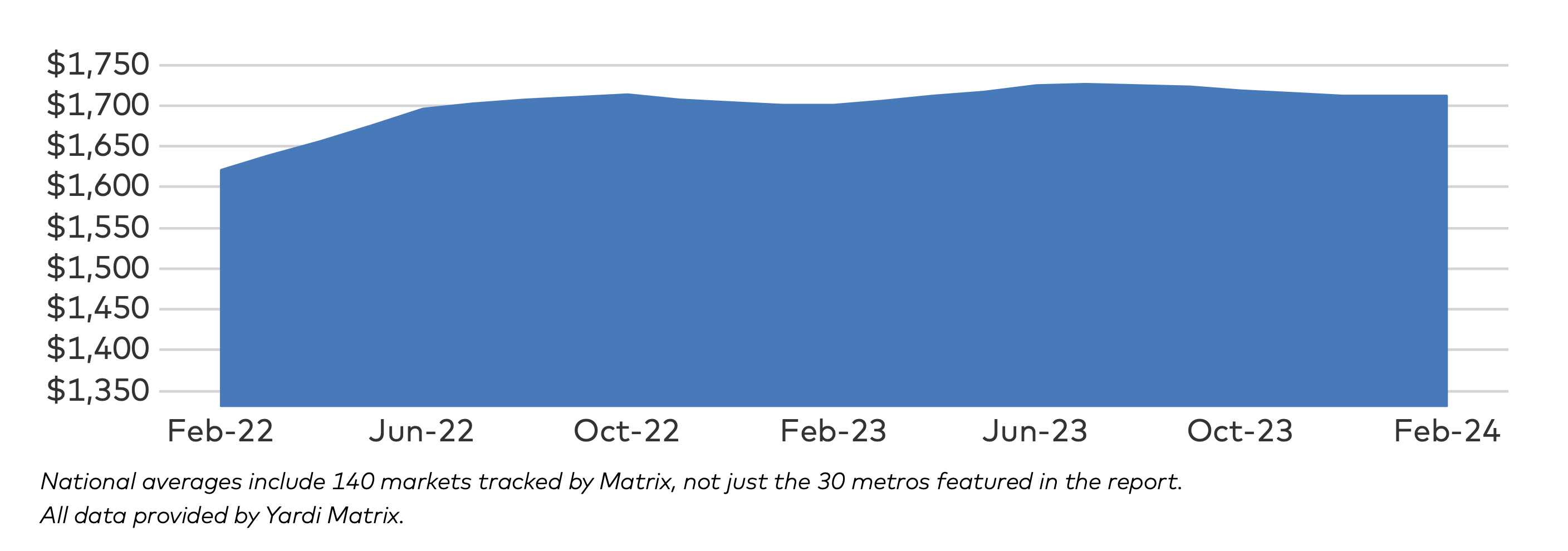

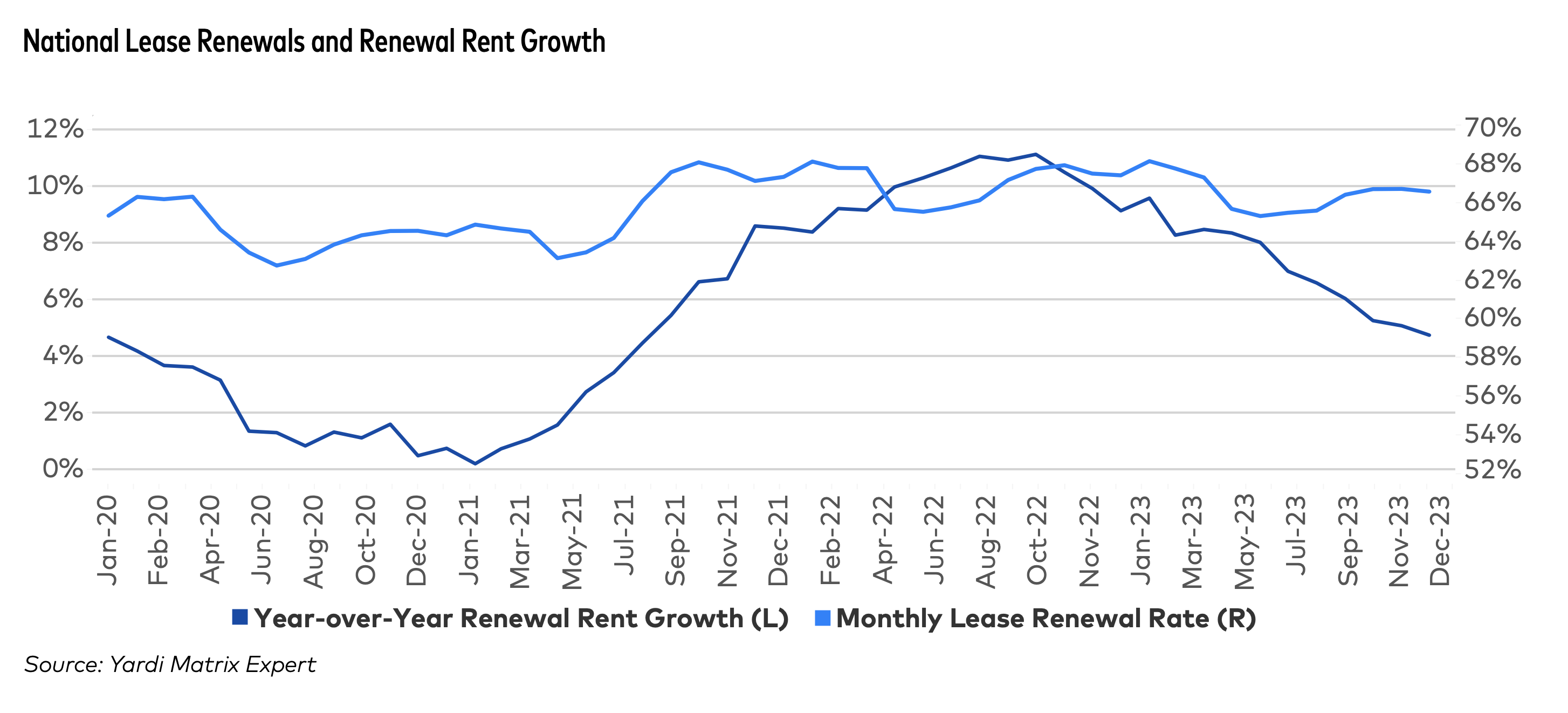

National asking rents posted their first increase in over seven months in February, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year (YoY), while occupancy decreased 60 basis points YoY to 94.5% as of January.

Markets in the Northeast and Midwest continued to register rent increases, in contrast to rent contractions in high-supply Sun Belt markets. Of Yardi Matrix's top 30 metros, 13 posted rent declines, and five were down by three percent or more YoY. Occupancy was positive only in San Francisco, up 0.1%.

National Average Multifamily Rents

Yardi Matrix Multifamily Rent Report for February 2024

Rent prices for the Renter-by-Necessity (RBN) segment were up 0.1% while luxury Lifestyle rentals stayed flat. The biggest dips were in Austin, Texas, and Raleigh, N.C. Rents in both segments dipped in these cities (down 0.4% in RBN and 0.6% in Lifestyle for Austin; down 0.4% in RBN and 0.5% in Lifestyle for Raleigh). Most other markets remained stagnant or saw minor fluctuations.

New apartment construction seems to be cooling the rental market in some areas. Cities with a recent surge in new units, like Austin, Miami, and Charlotte, are experiencing the steepest declines in rent and occupancy. Conversely, cities with less construction are seeing healthy rent growth. In fact, out of eight major cities with minimal new construction over the past year, only Las Vegas has seen rents decrease.

While multifamily rents generally show signs of stability, factors including supply, demand, regional metrics and affordability will determine the market's 2024 performance. Occupancy is likely to continue to decline, with one million new rental units expected to come online through the end of 2025. Already, heavy deliveries in Sun Belt and Southwest metros have eroded rent growth, with more construction underway.

"While high-demand markets are likely to record weak rent growth over the next year or two, the seeds of a rebound have been planted, as starts are declining and deliveries will drop in 2026 and 2027," states the report.

Gain more insight in the new Yardi Matrix National Multifamily Report.

Yardi Matrix offers the industry's most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, student housing, vacant land, industrial, office, retail and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

RELATED

- Multifamily rent growth rate unchanged at 0.3%

- Multifamily rent remains flat at $1,710 in January

- Multifamily housing starts and permitting activity drop 10% year-over-year

About Yardi

Yardi develops industry-leading software for all types and sizes of real estate companies across the world. With over 9,000 employees, Yardi is working with our clients to drive significant innovation in the real estate industry. For more information on how Yardi is Energized for Tomorrow, visit yardi.com.

Related Stories

Sustainability | Feb 7, 2024

9 states pledge to accelerate transition to clean residential buildings

States from coast to coast have signed a joint agreement to accelerate the transition to pollution-free residential buildings by significantly expanding heat pump sales to meet heating, cooling, and water heating demand in coming years.

Multifamily Housing | Feb 5, 2024

Wood Partners transfers all property management operations to Greystar

Greystar and Wood have entered into a long-term agreement whereby Greystar will serve as property manager for all current and future Wood developed and owned assets.

Luxury Residential | Jan 30, 2024

Lumen Fox Valley mall-to-apartments conversion completes interiors

Architecture and interior design firm Morgante Wilson Architects (MWA) today released photos of its completed interiors work at Lumen Fox Valley, a 304-unit luxury rental community and mall-to-apartments conversion.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Senior Living Design | Jan 24, 2024

Former Walgreens becomes affordable senior living community

Evergreen Real Estate Group has announced the completion of Bellwood Senior Apartments. The 80-unit senior living community at 542 25th Ave. in Bellwood, Ill., provides independent living options for low-income seniors.

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Modular Building | Jan 19, 2024

Virginia is first state to adopt ICC/MBI offsite construction standards

Virginia recently became the first state to adopt International Code Council/Modular Building Institute off-site construction standards.

Mixed-Use | Jan 19, 2024

Trademark secures financing to develop Fort Worth multifamily community

National real estate developer, investor, and operator, Trademark Property Company, has closed on the land and secured the financing for The Vickery, a multifamily-led mixed-use community located on five acres at W. Vickery Boulevard and Hemphill Street overlooking Downtown Fort Worth.