NELSON, the Philadelphia-based interior design firm celebrating its 40th anniversary this year, has merged with two other firms, Cope Linder Architects and KA Architecture, to position itself as a full-service architectural and design outfit across multiple nonresidential building types.

The combinations became effective on June 1.

Founded in 1977, NELSON has steadily expanded for more than 15 years, primarily through acquisitions. In the past two years alone, it bought EHS Design and Marvin Stein Associates in Seattle, AAI in San Jose, and VeenendaalCave in Atlanta.

John “Ozzie” Nelson, Jr., NELSON’s Chairman and CEO, tells BD+C that his company’s marriages with Cope Linder and KA are the first of a series of mergers that NELSON plans to announce this year. Nelson says his company in 2017 would double its revenue to around $200 million and its workforce to “north of 1,200” from 625 at the start of the year.

Nelson and Ian Cope, AIA, LEED AP, Principal with Cope Linder Architects, had been talking, on and off, for 27 months about bringing their respective companies together. Cope says his firm had also been approached by two other suitors—including a Canada-based engineering firm—which it ultimately rebuked, he says, because it feared it might lose its identity with clients “who are concerned about all of this massive absorption of AEC firms” going on in the industry.

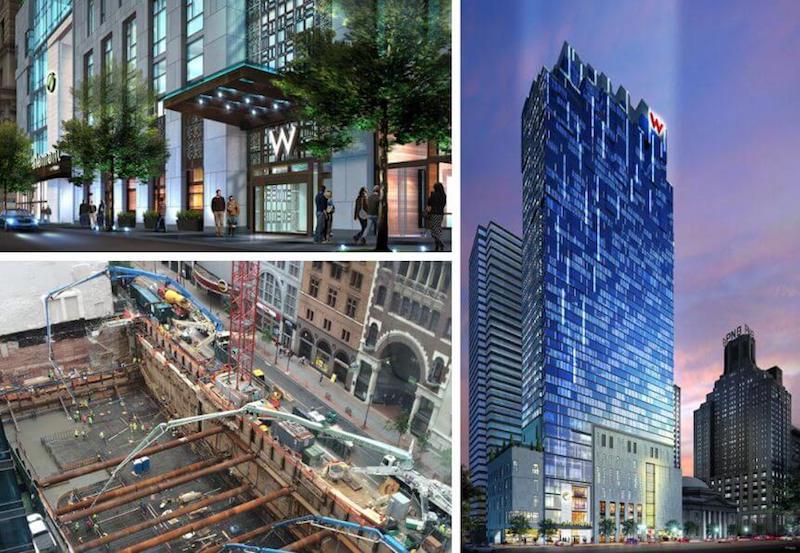

The addition of 50-year-old Cope Linder, also based in Philadelphia, makes NELSON that city’s third-largest studio, with more than 125 employees there. Cope Linder is best known for its work in the commercial, hospitality, gaming, and entertainment sectors. One of the first projects to be completed under the combined company will be the 51-story, 773,000-sf W and Element Hotel in Philadelphia, which opens next year.

Craig Wasserman, RA, Executive Vice President at KA Architecture, says his firm has been predominantly a core and shell builder and planner. It has tried to diversity on its own, “but it never worked out,” he explains. The merger with NELSON, on the other hand, “is the perfect compliment,” and allows KA to go to market as a full-service firm. “We’ve been telling our clients about this merger, and their reaction has been fantastic,” says Wasserman.

Cleveland-based KA Architecture—which was founded in 1960 and, prior to the merger, was into its third generation of ownership—has lent its design services to, among other projects, retail centers, mixed-used developments, and hospitality. Its merger with KA represents Nelson’s third location in the Midwest. The 1.3-million-sf Liberty Center in San Francisco will be the first major project completed under the new brand KA Architecture, A Nelson brand. (KA is the Executive Architect on this project.)

KA and Cope Linder are also forming a core-and-shell practice within NELSON, says Wasserman. Nelson states the combinations place NELSON more competitively into the high-rise architecture market.

The mergers also allow NELSON to launch a newly formed Hospitality Practice, and to beef up its Retail Practice.

Merging for the right reasons

Diversification is certainly one of the drivers behind NELSON’s acquisitive streak. For example, it is close to announcing another acquisition of a firm in New York that surveys and inspects buildings. Under Title 11, buildings over six stories high are required to be surveyed every five years. The firm NELSON would acquire already handles 800 of the 14,500 buildings in New York that fall under that regulation.

NELSON also runs a $13 million MEP engineering firm under a separate brand. But Nelson has never been a believer in combining architecture with other disciplines, such as engineering or building surveying, under one roof. He thinks the better solution to integrate vertically is to create holding companies to run those businesses separately, as it will the core-and-shell entity.

“Culture trumps everything else” when it comes to merging companies, says Nelson, speaking from experience. “It’s important for companies to look at the complete nature of coming together, and to be realistic.” He observes that, too often, smaller firms want to merge with larger firms just to take advantage of their marketing and sales clout without giving enough thought to how such a move might impact their employees and customers.

Nelson confirms that the managements of Cope Linder and KA are remaining with the company. He says NELSON looks for acquisition partners whose managements want to stay on with the combined firm.

When asked why so much AEC consolidation seems to be happening all of a sudden, Nelson says that relationships between firms and their clients don’t matter as much as they used to. “Everything has become a beauty competition,” and size, he says, has become a more important criterion to be considered for certain projects.

In the future, he says that NELSON will be looking to strengthen its position in Texas and the Washington, D.C. market.

Related Stories

Sponsored | BD+C University Course | Jan 17, 2024

Waterproofing deep foundations for new construction

This continuing education course, by Walter P Moore's Amos Chan, P.E., BECxP, CxA+BE, covers design considerations for below-grade waterproofing for new construction, the types of below-grade systems available, and specific concerns associated with waterproofing deep foundations.

Sponsored | Performing Arts Centers | Jan 17, 2024

Performance-based facilities for performing arts boost the bottom line

A look at design trends for “budget-wise” performing arts facilities reveals ways in which well-planned and well-built facilities help performers and audiences get the most out of the arts. This continuing education course is worth 1.0 AIA learning unit.

Giants 400 | Jan 15, 2024

Top 130 Hospital Facility Architecture Firms for 2023

HKS, HDR, Stantec, CannonDesign, and Page Southerland Page top BD+C's ranking of the nation's largest hospital facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Airports | Jan 15, 2024

How to keep airports functional during construction

Gensler's aviation experts share new ideas about how to make the airport construction process better moving forward.

Adaptive Reuse | Jan 12, 2024

Office-to-residential conversions put pressure on curbside management and parking

With many office and commercial buildings being converted to residential use, two important issues—curbside management and parking—are sometimes not given their due attention. Cities need to assess how vehicle storage, bike and bus lanes, and drop-off zones in front of buildings may need to change because of office-to-residential conversions.

MFPRO+ News | Jan 12, 2024

As demand rises for EV chargers at multifamily housing properties, options and incentives multiply

As electric vehicle sales continue to increase, more renters are looking for apartments that offer charging options.

Student Housing | Jan 12, 2024

UC Berkeley uses shipping containers to block protestors of student housing project

The University of California at Berkeley took the drastic step of erecting a wall of shipping containers to keep protestors out of a site of a planned student housing complex. The $312 million project would provide badly needed housing at the site of People’s Park.

Giants 400 | Jan 12, 2024

Top 10 Casino Architecture Firms for 2023

JCJ Architecture, HBG Design, Gensler, and WATG top BD+C's ranking of the nation's largest casino architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Senior Living Design | Jan 11, 2024

Designing for personal technology is crucial for senior living facilities

Today’s seniors are increasingly tech savvy. It isn’t enough to give senior living residents a pre-determined bundle of technology and assume that they’ll be satisfied.

Giants 400 | Jan 11, 2024

Top 40 Convention Center Architecture Firms for 2023

TVS, Populous, Arcadis North America, Gensler, and EUA top BD+C's ranking of the nation's largest convention center and event facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.