Demand for multistory logistics centers is increasing in cities around the country that are looking to provide “last mile” ecommerce delivery to urban populations while using the least amount of costly land possible.

But vertical logistics centers have their own operational complexities that include inventory and fleet management, vehicular parking, and staying abreast of the latest transportation modes and technologies.

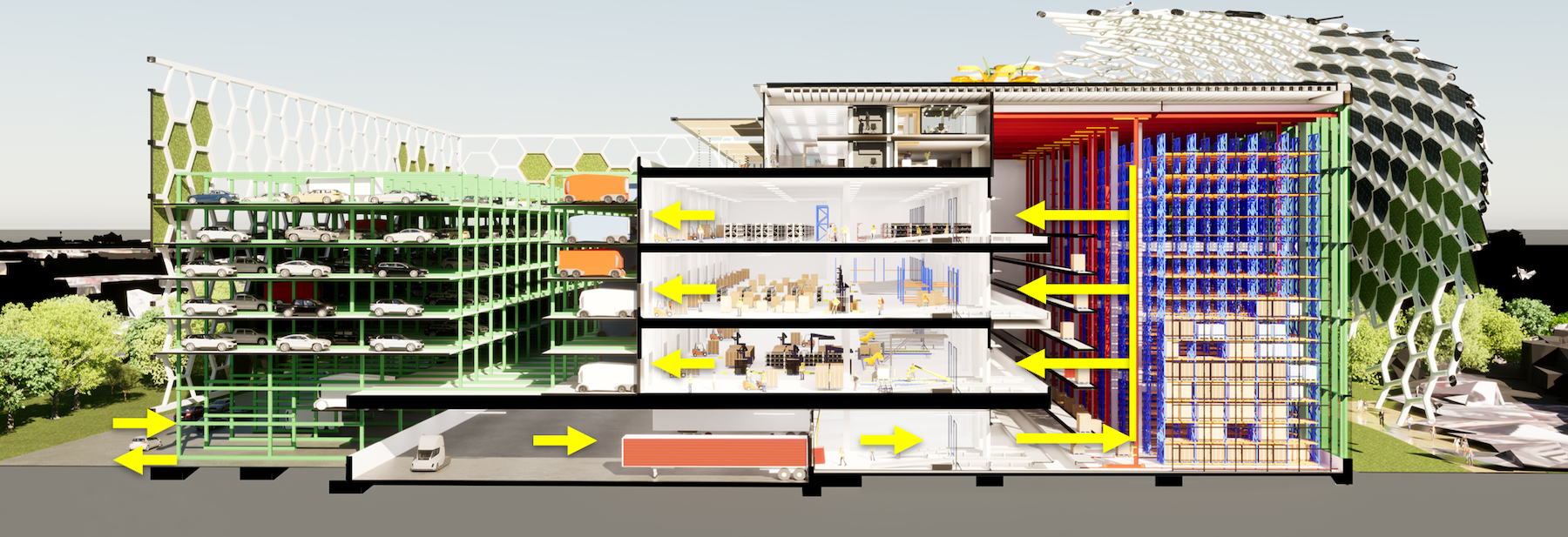

The national design firm Ware Malcomb recently presented a design concept for a Logistics Building of the Future at a conference in Jersey City, N.J., conducted by NAIOP, the Commercial Real Estate Development Association. This concept, which the firm is calling a “thought exercise,” places a premium on technology driven efficiency and coordination. The concept also pays heed to reducing the building’s carbon footprint through a combination of natural and mechanical solutions.

The question being answered by this design concept, says Matt Brady, LEED AP, an Architect and Executive Vice President at Ware Malcomb’s office in Irvine, Calif., is how to fit more products into a facility while realizing the greatest efficiency. “The through-put is the game changer,” he says.

Automation drives efficiency

This hypothetical logistics center is a five-story building (including its roofdeck) that would sit on 4.6. acres in San Francisco. Ware Malcomb collaborated with several industry leaders to devise this concept, including Jones Lang LaSalle, DH Property Holdings (a leading developer of urban infill industrial facilities), Suffolk Construction (for building costs), and Parkmatic, which provides space-controlling automated parking racks.

Brady says computer-driven systems play a big role in the logistics center’s operations: they coordinate arrivals so that trailers can be precision-parked into the facility’s docks; they organize and stage the storage of goods in the building’s tall warehouse so inventory can be retrieved quicker; and in partly automated packing areas, loads of goods are created to be placed into smaller delivery vans, the drivers for which are assigned automatically.

One of the big problems for vertical logistics center in urban settings is finding enough space for parking. Brady notes that in New York, trailer and van drivers sometimes end up parking blocks from existing facilities. Ware Malcomb’s design concept stacks employee vehicles in racks so delivery vans can fit into the center and aren’t idling elsewhere. Brady acknowledges that parking becomes more of a challenge when vehicles are electric and take time to recharge.

Ware Malcomb’s concept is multimodal and assumes electric vehicles and delivery drones. “Flying vehicles aren’t here yet, but warehouses need to be ready for them,” he explains.

A greener distribution center

The design concept also shows options to reduce the logistics center’s carbon footprint. For example, the concept envisions a honeycombed skin that generates wind and cools the building’s exterior surface. The concept also incorporates sustainable features such as agricultural air filtration, wind turbines, angled solar cells, photoreactor algae-filled glass, rainwater collection, and 3D-printed flexible infrastructure.

Brady says the feedback from developers so far has been positive, and at least one developer is interested “in doing something like this.” An ecommerce company has expressed interest in using Ware Malcomb’s design concept as part of a charrette about industrial buildings in general.

Ware Malcomb sees its concept as leading to speculative development, ideally for a single tenant per building so that there’s just one systems operator. Brady says that the point of this exercise is not to get developers to copy the concept as much as it is to prepare them for what might be coming. “Occupiers are evolving fast, and developers need to keep up,” he says.

Brady also believes that while new construction of industrial buildings has been leveling off, demand is a function of the economy. “Based on people we talk to, there’s still a lot of room for ecommerce growth.”

Related Stories

Giants 400 | Oct 11, 2023

Top 100 Industrial Construction Firms for 2023

ARCO Construction, Clayco, Walbridge, and Gray Construction top the ranking of the nation's largest industrial facility sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 11, 2023

Top 90 Industrial Sector Engineering Firms for 2023

Jacobs, IPS, CRB Group, and Burns & McDonnell head the ranking of the nation's largest industrial facility sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 11, 2023

Top 100 Industrial Sector Architecture Firms for 2023

Ware Malcomb, Arcadis, Stantec, and Gresham Smith top the ranking of the nation's largest industrial facility sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Industrial Facilities | Oct 11, 2023

Industrial construction slows, but longer-term demand will fuel development

Two reports assess the industrial sector’s future, including opportunities for multistory urban logistics centers.

Building Materials | Oct 2, 2023

Purdue engineers develop intelligent architected materials

Purdue University civil engineers have developed innovative materials that can dissipate energy caused by various physical stresses without sustaining permanent damage.

Giants 400 | Oct 2, 2023

Top 50 Data Center Construction Firms for 2023

Turner Construction, Holder Construction, HITT Contracting, DPR Construction, and Fortis Construction top BD+C's ranking of the nation's largest data center sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 2, 2023

Top 60 Data Center Engineering Firms for 2023

Jacobs, Burns & McDonnell, WSP, EXP, and Alfa Tech head BD+C's ranking of the nation's largest data center sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 2, 2023

Top 30 Data Center Architecture Firms for 2023

Corgan, HDR, Gensler, Page Southerland Page, and HED top BD+C's ranking of the nation's largest data center sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Industrial Facilities | Sep 6, 2023

Georgia-Pacific pushes forward on construction of newest industrial building in Tennessee

The 900,000-sf manufacturing/warehousing facility will support the company’s disposable tableware brands when it opens next year.