Despite a significant increase to existing building stock in 2022, the national vacancy rate for industrial space in the U.S. fell below 4 percent.

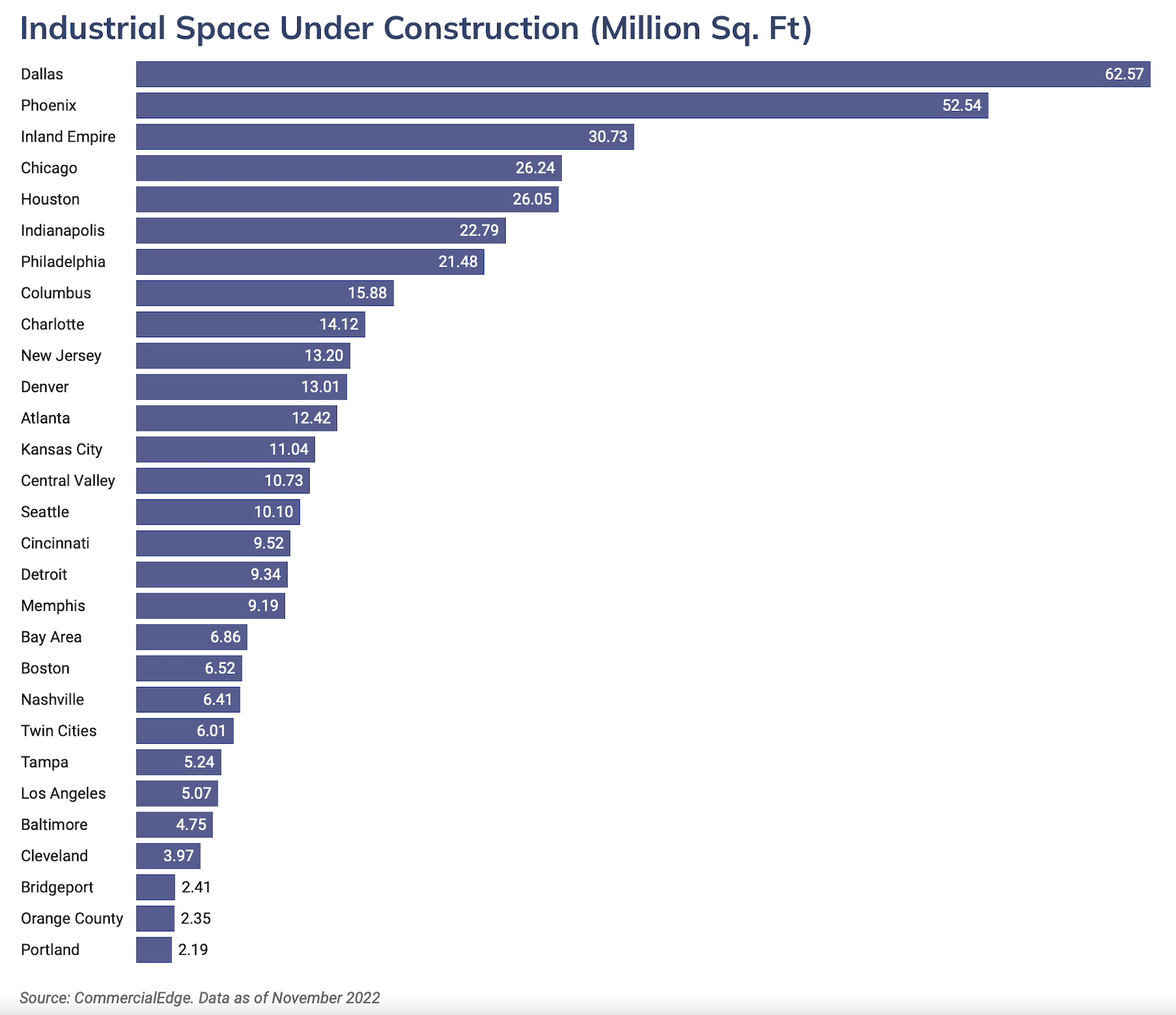

At the end of last November, there were 742.3 million sf of industrial space under construction, representing 4 percent of total existing inventory, according to Commercial Edge’s National Industrial Report, which it released on December 21. Dallas and Phoenix are the two top construction markets for this sector. And nationwide, another 684.5 million sf of industrial space are in their planning stages.

However, new construction is barely keeping up with leasing demand, as the vacancy rate in the 30 largest industrial markets tracked by Commercial Edge stood at 3.8 percent at the end of November. The Report asserts that the biggest challenge for developers is finding suitable land in port markets like California’s Inland Empire, Los Angeles, and New Jersey. But even non-port markets like Nashville and Columbus, Ohio, are experiencing extremely low vacancy rates.

The top 30 markets, through November, recorded aggregate property sales of $78.8 billion. While sales have cooled a bit nationally, the average sales price of $116 per sf in the first two months of the fourth quarter was still nearly 18 percent higher than the same period in 2021.

A huge building for a tight New York market

With these market dynamics as a backdrop, the real estate investment and development firm Turnbridge Equities announced earlier this month the topping out of Bronx Logistics Center, the largest industrial development in New York City.

Nestled in the borough’s Hunts Point industrial area, this Class A 1.3-million-sf, multilevel complex on 14.2 acres (assembled from five properties) consists of 585,000 sf of total warehouse space with 32-ft ceiling heights and 40- by 40-ft column spacing, 730,000 sf of parking space (25 percent of which is electric-vehicle ready with charging stations), 48 loading docks, and 72 drive-in doors.

The building’s rooftop solar panels will generate three megawatts of energy. The site includes a CSX freight railway spur, providing tenants with potential direct rail access, and is located less than two miles from the Hunts Point Food Distribution Center, which generates over $3 billion of annual economic activity.

When it’s completed in the second quarter of 2023, the Bronx Logistics Center will serve the entire New York metropolitan area and beyond. It is a five-minute drive from Manhattan’s Upper West Side, and has convenient access to Interstates 95, 87, 295, and 278.

Arco Design/Build Industrial is the designer and general contractor on this project. “We provided a high level of risk mitigation for our client by locking in construction costs prior to going through all of the design documents,” Arco states on its website. Turnbridge Equities, which owns the building, and the project’s equity partner Dune Real Estate Partners, retained JLL as the leasing agent. (As of mid December, no tenants had committed to leasing space.)

While Turnbridge didn’t release the cost of this project, The Real Deal reported that Turnbridge paid $174 million to acquire the land in 2018 and more recently secured $381 million in construction financing and debt refinancing from KKR.

Once completed, the Bronx Logistics Center’s size will exceed the 1-million-sf industrial development of Innova Property Group and Square Mile Capital Management. The borough’s industrial inventory accounts for about 17 million sf of space. The Bronx Times reports that only 1.6 percent of New York City’s industrial space is available for lease.

Related Stories

Industrial Facilities | Jul 26, 2022

As industrial sector sizzles, investors watch impact of inflation and interest rates

Demand continues to top supply, especially on the coasts, according to latest CommercialEdge report.

Urban Planning | Jul 19, 2022

The EV charger station market is appealing to investors and developers, large and small

The latest entry, The StackCharge, is designed to make recharging time seem shorter.

Multifamily Housing | Jun 21, 2022

Two birds, one solution: Can we solve urban last-mile distribution and housing challenges at the same time?

When it comes to the development of both multifamily housing and last-mile distribution centers, particularly in metropolitan environments, each presents its own series of challenges and hurdles. One solution: single-use structures.

Industrial Facilities | Jun 17, 2022

A new Innovation Center in Wyoming focuses on finding sustainable ways to use coal

The 10-acre site is part of the area’s R&D push.

Self-Storage Facilities | May 19, 2022

A steady increase in new self-storage space is meeting growing need in large metros and their suburbs

Rent Café’s study projects a 9 percent bump in the nation’s existing inventory.

Adaptive Reuse | May 18, 2022

An auto plant in Detroit to get a retread as mixed-use housing

Fisher 21 Lofts could be the largest minority-led redevelopment in the city’s history.

Industrial Facilities | Apr 30, 2022

CapRock Partners taps into industrial space demand

The investment firm is committed to building 15 million sf of warehouses.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Industrial Facilities | Apr 6, 2022

Development underway for Missouri’s largest logistics park

Hunt Midwest envisions 27 buildings will be completed over the next 10 years.

Industrial Facilities | Apr 1, 2022

Robust demand strains industrial space supply

JLL’s latest report finds a shift toward much larger buildings nearer urban centers, which fetch higher rents.