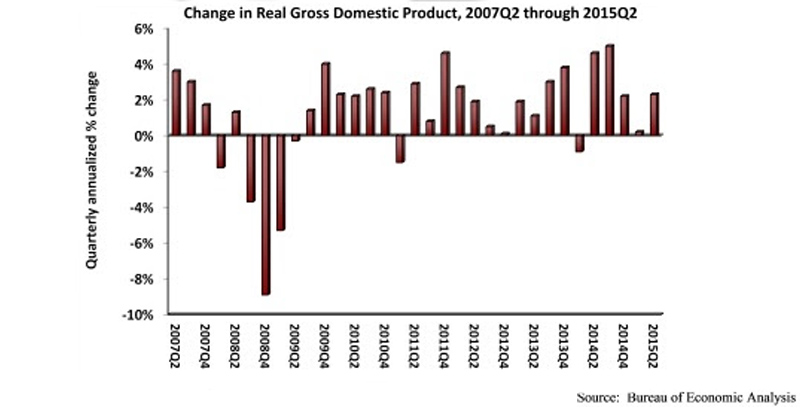

Nonresidential fixed investment fell by 0.6% during the second quarter after expanding by 1.6% during the first quarter, according to the July 30 real gross domestic product (GDP) report by the Bureau of Economic Analysis (BEA).

For the economy as a whole, real GDP expanded by 2.3% (seasonally adjusted annual rate) during the second quarter following a 0.6% increase during the year's first quarter. Note that the first quarter estimate for nonresidential fixed investment was revised upward from -3.4% annualized growth.

"In the first half of 2015, both the broader economy and nonresidential investment lost the momentum they had coming into the year," said Associated Builders and Contractors Chief Economist Anirban Basu. "Rather than indicating renewed progress in terms of achieving a more robust recovery, today's GDP release indicates that a variety of factors helped to stall investment in nonresidential structures. There are many viable explanations, including a weaker overall U.S. economy, a stronger U.S. dollar, decreased investment in structures related to the nation's energy sector, soft public spending, and uncertainty regarding monetary policy and other abstracts of public policy. While the expectation is that the second half of the year will be better, unfortunately not much momentum is being delivered by the year's initial six months.

"Perhaps the most salient facet of this GDP release was the revisions," said Basu. "The BEA revised the first quarter estimate upward from -0.2% to 0.6% annualized growth. This is not surprising; many economists insisted that the economy did not shrink in the first quarter. However, the BEA also downwardly revised growth figures from the fourth quarter of 2011 to the fourth quarter of 2014. Over that period, GDP increased at an average annual rate of 2.1%, 0.3 percentage points lower than previously thought. These revisions could be a function of the agency's ongoing effort to tackle residual seasonality, a pattern in which seasonal adjustments led to repeated first quarter slowdowns. It will take a few more quarters to understand the full impact of the improved seasonal adjustments."

Performance of key segments during the first quarter:

- Investment in nonresidential structures decreased at a 1.6% rate after decreasing at a 7.4% rate in the first quarter.

- Personal consumption expenditures added 1.99% to GDP after contributing 1.19% in the first quarter.

- Spending on goods grew 1.1% from the first quarter.

- Real final sales of domestically produced output – minus changes in private inventories – increased 2.5% for the second quarter after a 2.5% increase in the first quarter.

- Federal government spending decreased 1.1% in the second quarter after increasing by 1.1% in the first quarter.

- Nondefense spending decreased 0.5% after expanding by 1.2% in the previous quarter.

- National defense spending fell 1.5% after growing 1% in the first quarter.

- State and local government spending grew 2% during the second quarter after a decrease of 0.8% in the first.

To view the previous GDP report, click here.

Related Stories

| Jul 19, 2013

BIM 2.0: AEC firms share their vision for the great leap forward in BIM/VDC implementation [2013 Giants 300 Report]

We reached out to dozens of AEC firms that made our annual BIM Giants lists and asked one simple question: What does BIM 2.0 look like to you? Here’s what they had to offer.

| Jul 19, 2013

Reconstruction Sector Construction Firms [2013 Giants 300 Report]

Structure Tone, DPR, Gilbane top Building Design+Construction's 2013 ranking of the largest reconstruction contractor and construction management firms in the U.S.

| Jul 19, 2013

Reconstruction Sector Engineering Firms [2013 Giants 300 Report]

URS, STV, Wiss Janney Elstner top Building Design+Construction's 2013 ranking of the largest reconstruction engineering and engineering/architecture firms in the U.S.

| Jul 19, 2013

Reconstruction Sector Architecture Firms [2013 Giants 300 Report]

Stantec, HOK, HDR top Building Design+Construction's 2013 ranking of the largest reconstruction architecture and architecture/engineering firms in the U.S.

| Jul 19, 2013

Best in brick: 7 stunning building façades made with brick [slideshow]

The Brick Industry Association named the winners of its 2013 Brick in Architecture Awards. Here are seven winning projects that caught our eye.

| Jul 19, 2013

Construction lags other sectors, but momentum is building: JLL report

Although the construction recovery continues to lag other sectors as well as the overall U.S. economy, the industry is finally seeing a rebound. Commercial real estate giant Jones Lang LaSalle recently released its Summer 2013 Construction Highlights report, which found that there are some sectors (such as energy and high-tech) driving demand for construction, while a few major cities are starting to record increased levels of speculative office building developments.

| Jul 19, 2013

Must see: 220 years of development on Capitol Hill in one snazzy 3D flyover video

The Architect of the Capitol this week released a dramatic video timeline of 220 years of building development on Capitol Hill.

| Jul 18, 2013

Top Local Government Sector Construction Firms [2013 Giants 300 Report]

Turner, Clark Group, PCL top Building Design+Construction's 2013 ranking of the largest local government sector contractor and construction management firms in the U.S.

| Jul 18, 2013

Top Local Government Sector Engineering Firms [2013 Giants 300 Report]

STV, URS, AECOM top Building Design+Construction's 2013 ranking of the largest local government sector engineering and engineering/architecture firms in the U.S.

| Jul 18, 2013

Top Local Government Sector Architecture Firms [2013 Giants 300 Report]

Stantec, HOK, IBI Group top Building Design+Construction's 2013 ranking of the largest local government sector architecture and architecture/engineering firms in the U.S.