Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

| Aug 8, 2013

Top Science and Technology Sector Architecture Firms [2013 Giants 300 Report]

HDR, Perkins+Will, HOK top Building Design+Construction's 2013 ranking of the largest science and technology sector architecture and architecture/engineering firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Construction Firms [2013 Giants 300 Report]

Skanska, DPR, Suffolk top Building Design+Construction's 2013 ranking of the largest science and technology sector contractors and construction management firms in the U.S.

| Aug 8, 2013

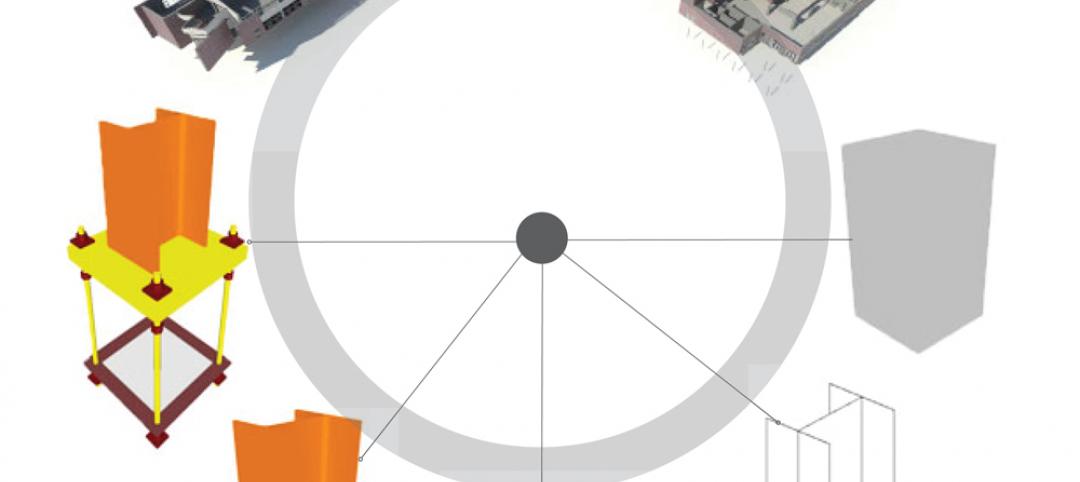

Level of Development: Will a new standard bring clarity to BIM model detail?

The newly released LOD Specification document allows Building Teams to understand exactly what’s in the BIM model they’re being handed.

| Aug 8, 2013

Vertegy spins off to form independent green consultancy

St. Louis-based Vertegy has announced the formation of Vertegy, LLC, transitioning into an independent company separate from the Alberici Enterprise. The new company was officially unveiled Aug. 1, 2013

| Aug 5, 2013

Top Retail Architecture Firms [2013 Giants 300 Report]

Callison, Stantec, Gensler top Building Design+Construction's 2013 ranking of the largest retail architecture and architecture/engineering firms in the United States.

| Aug 5, 2013

Top Retail Engineering Firms [2013 Giants 300 Report]

Jacobs, AECOM, Henderson Engineers top Building Design+Construction's 2013 ranking of the largest retail engineering and engineering/architecture firms in the United States.

| Aug 5, 2013

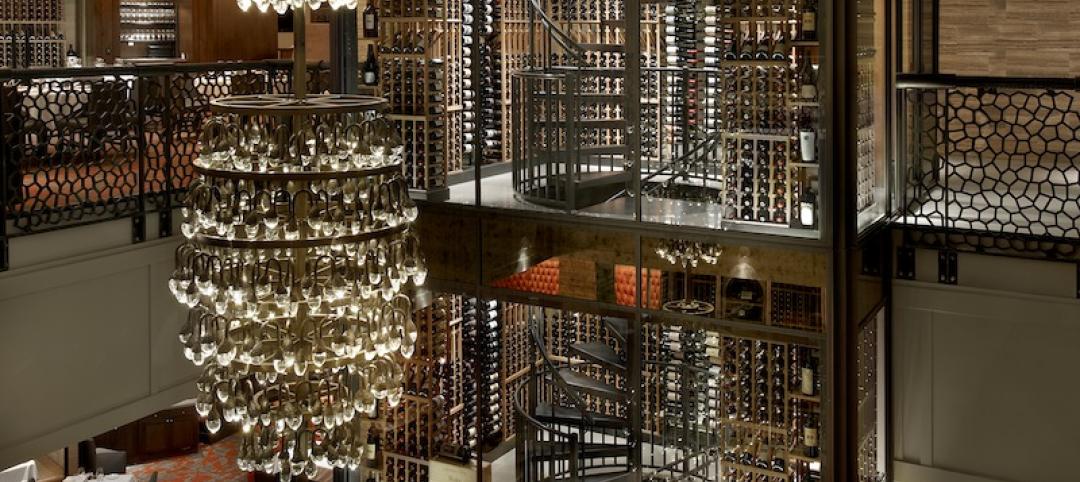

Retail market shows signs of life [2013 Giants 300 Report]

Retail rentals and occupancy are finally on the rise after a long stretch in the doldrums.

| Aug 5, 2013

Top Retail Construction Firms [2013 Giants 300 Report]

Shawmut, Whiting-Turner, PCL top Building Design+Construction's 2013 ranking of the largest retail contractor and construction management firms in the United States.

| Aug 2, 2013

Michael Baker Corp. agrees to be acquired by Integrated Mission Solutions

Michael Baker Corporation (“Baker”) (NYSE MKT:BKR) announced today that it has entered into a definitive merger agreement to be acquired by Integrated Mission Solutions, LLC (“IMS”), an affiliate of DC Capital Partners, LLC (“DC Capital”).

| Jul 31, 2013

Hotel, retail sectors bright spots of sluggish nonresidential construction market

A disappointing recovery of the U.S. economy is limiting need for new nonresidential building activity, said AIA Chief Economist, Kermit Baker in the AIA's semi-annual Consensus Construction Forecast, released today. As a result, AIA reduced its projections for 2013 spending to 2.3%.