Realtors who practice commercial real estate have reported an increase in annual gross income for the third year in a row, signaling the market is on the road to recovery. According to the National Association of Realtors 2013 Commercial Member Profile, transactions and sales volume have also increased since last year.

The study shows median annual gross income for 2012 was $90,200, an increase from $86,000 in 2011 and is at its highest level since 2008. Brokers and appraisers reported the highest annual gross income while sales agents reported the lowest.

The study’s results represent Realtors who practice commercial real estate; these NAR members conduct all or part of their activity in commercial sales, leasing, brokerage and development for land, office and industrial space, multifamily and retail buildings, as well as property management.

“The commercial market is showing signs of improvement, which is reflected in the positive trends in income, transactions and sales volume reported by our Realtor commercial members,” said NAR President Gary Thomas, broker-owner of Evergreen Realty in Villa Park, Calif. “This is a hopeful sign for the future. Realtors who practice commercial real estate build communities by facilitating investment and promoting the sale and lease of commercial space. There’s no doubt that commercial market improvements will help spur economic recovery and growth for our nation.”

Commercial members completed a median of eight transactions in 2012, up from last year. The median sales volume also increased from last year and was $2,507,700. Brokers typically had higher sales transaction volumes than agents. The median dollar value of sales transactions was $433,600 and the median square footage was 10,400.

Similar to the median sales volume, the median lease transaction volume increased this year by more than $70,000. In 2012 commercial members reported a median lease transaction volume of $476,400. Twenty-one percent of commercial members did not have a leasing transaction in 2012. The median dollar value of lease transactions was $169,100 and the median square footage was 4,200.

Commercial members who manage properties typically managed 40,000 square feet, representing 15 total spaces. They also typically managed 16,000 total office square feet, representing six total offices.

A majority of commercial members, 63 percent, reported they derive more than half of their annual income from the real estate industry. Thirty percent of respondents did not derive any income from commercial real estate leasing in 2012. Only 32 percent derived at least half to all of their income from leasing property. A large percentage, 85 percent, of commercial members earned at least some personal income from commercial real estate investments.

Sixty percent of NAR’s commercial members are brokers. Licensed sales agents were the next largest segment at 25 percent. Most commercial members reported working in a firm that is local and 58 percent work within an office that has a mix of commercial and residential brokers and agents.

Investment sales proved to be the most popular business specialty among commercial members. Identified by the highest proportion of members as their primary business specialty, investment sales was also the top ranked secondary specialty area. Land sales and retail leasing followed closely behind.

The typical commercial member has been in commercial real estate for 15 years and involved in real estate in some capacity for 25 years. The median length of membership in NAR among commercial members was 17 years. With a median age of 59, commercial members are also predominately male. However, women are slowly coming into the business; 33 percent of those with two or fewer years’ experience are female, and sales agents have the largest representation of women with 29 percent.

The NAR 2013 Commercial Member Profile was based on a survey of 1,796 commercial practitioners. Income and transaction data are for 2012, while other data represent member characteristics in 2013.

The National Association of Realtors, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries.

Related Stories

| Apr 8, 2013

Most daylight harvesting schemes fall short of performance goals, says study

Analysis of daylighting control systems in 20 office and public spaces shows that while the automatic daylighting harvesting schemes are helping to reduce lighting energy, most are not achieving optimal performance, according to a new study by the Energy Center of Wisconsin.

| Apr 6, 2013

Lord, Aeck & Sargent and Urban Collage merge

In a move that brings full-service planning expertise to its already well-established architecture practice, Lord, Aeck & Sargent (LAS) has merged with Urban Collage (UC), one of the largest urban and campus planning and design firms in the Southeast. Combining these firms’ talents was made official today. UC plans to retain its name for the foreseeable future.

| Apr 6, 2013

First look: GlaxoSmithKline's double LEED Platinum office

GlaxoSmithKline and Liberty Property Trust/Synterra Partners transform the work environment with the opening of Five Crescent Drive

| Apr 5, 2013

Bangkok gets a leaning tower, that may topple

A seven-story apartment tower under construction in Bangkok has started to tilt and is on the verge of toppling.

| Apr 5, 2013

Snøhetta design creates groundbreaking high-tech library for NCSU

The new Hunt Library at North Carolina State University, Raleigh, incorporates advanced building features, including a five-story robotic bookBot automatic retrieval system that holds 2 million volumes in reduced space.

| Apr 5, 2013

'My BIM journey' – 6 lessons from a BIM/VDC expert

Gensler's Jared Krieger offers important tips and advice for managing complex BIM/VDC-driven projects.

| Apr 5, 2013

Commercial greenhouse will top new Whole Foods store in Brooklyn

Whole Foods and partner Gotham Greens will create a 20,000-sf greenhouse atop one of the retailer's Brooklyn supermarkets. Expected to open this fall, the facility will supply produce to nine Whole Foods stores in metro New York City.

| Apr 5, 2013

Projected cost for Apple's Campus 2 balloons to $5 billion

Campus 2, Apple Inc.'s proposed ring-shaped office facility in Cupertino, Calif., could cost $5 billion to build, according to a report by Bloomberg.

| Apr 5, 2013

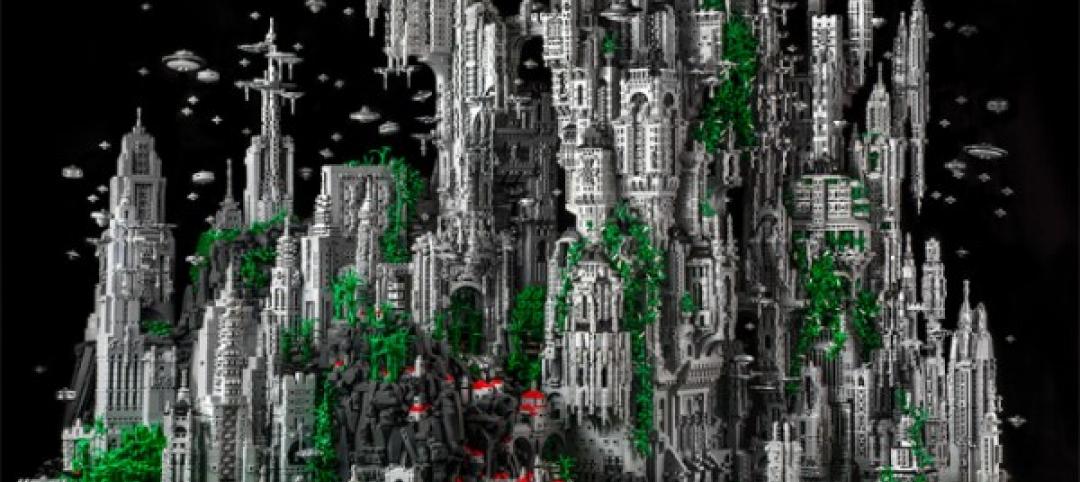

Extreme LEGO: Wondrous micro city built out of 200,000 blocks

Master LEGO builder Mike Doyle unveils his latest creation, an out-of-this-world micro city that celebrates peaceful alien contact.

| Apr 3, 2013

AIA CES class: Sealant repairs that last – hybrid sealants for building restoration

It is hard to talk about restoration without talking about sustainability. This two-hour interactive online course discusses the role that restoration can and does play in the arena of sustainability, and specifically the role that sealants play in sustainable design and repair.