Realtors who practice commercial real estate have reported an increase in annual gross income for the third year in a row, signaling the market is on the road to recovery. According to the National Association of Realtors 2013 Commercial Member Profile, transactions and sales volume have also increased since last year.

The study shows median annual gross income for 2012 was $90,200, an increase from $86,000 in 2011 and is at its highest level since 2008. Brokers and appraisers reported the highest annual gross income while sales agents reported the lowest.

The study’s results represent Realtors who practice commercial real estate; these NAR members conduct all or part of their activity in commercial sales, leasing, brokerage and development for land, office and industrial space, multifamily and retail buildings, as well as property management.

“The commercial market is showing signs of improvement, which is reflected in the positive trends in income, transactions and sales volume reported by our Realtor commercial members,” said NAR President Gary Thomas, broker-owner of Evergreen Realty in Villa Park, Calif. “This is a hopeful sign for the future. Realtors who practice commercial real estate build communities by facilitating investment and promoting the sale and lease of commercial space. There’s no doubt that commercial market improvements will help spur economic recovery and growth for our nation.”

Commercial members completed a median of eight transactions in 2012, up from last year. The median sales volume also increased from last year and was $2,507,700. Brokers typically had higher sales transaction volumes than agents. The median dollar value of sales transactions was $433,600 and the median square footage was 10,400.

Similar to the median sales volume, the median lease transaction volume increased this year by more than $70,000. In 2012 commercial members reported a median lease transaction volume of $476,400. Twenty-one percent of commercial members did not have a leasing transaction in 2012. The median dollar value of lease transactions was $169,100 and the median square footage was 4,200.

Commercial members who manage properties typically managed 40,000 square feet, representing 15 total spaces. They also typically managed 16,000 total office square feet, representing six total offices.

A majority of commercial members, 63 percent, reported they derive more than half of their annual income from the real estate industry. Thirty percent of respondents did not derive any income from commercial real estate leasing in 2012. Only 32 percent derived at least half to all of their income from leasing property. A large percentage, 85 percent, of commercial members earned at least some personal income from commercial real estate investments.

Sixty percent of NAR’s commercial members are brokers. Licensed sales agents were the next largest segment at 25 percent. Most commercial members reported working in a firm that is local and 58 percent work within an office that has a mix of commercial and residential brokers and agents.

Investment sales proved to be the most popular business specialty among commercial members. Identified by the highest proportion of members as their primary business specialty, investment sales was also the top ranked secondary specialty area. Land sales and retail leasing followed closely behind.

The typical commercial member has been in commercial real estate for 15 years and involved in real estate in some capacity for 25 years. The median length of membership in NAR among commercial members was 17 years. With a median age of 59, commercial members are also predominately male. However, women are slowly coming into the business; 33 percent of those with two or fewer years’ experience are female, and sales agents have the largest representation of women with 29 percent.

The NAR 2013 Commercial Member Profile was based on a survey of 1,796 commercial practitioners. Income and transaction data are for 2012, while other data represent member characteristics in 2013.

The National Association of Realtors, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries.

Related Stories

Office Buildings | Nov 2, 2023

Amazon’s second headquarters completes its first buildings: a pair of 22-story towers

Amazon has completed construction of the first two buildings of its second headquarters, located in Arlington, Va. The all-electric structures, featuring low carbon concrete and mass timber, help further the company’s commitment to achieving net zero carbon emissions by 2040 and 100% renewable energy consumption by 2030. Designed by ZGF Architects, the two 22-story buildings are on track to become the largest LEED v4 Platinum buildings in the U.S.

Sustainability | Nov 1, 2023

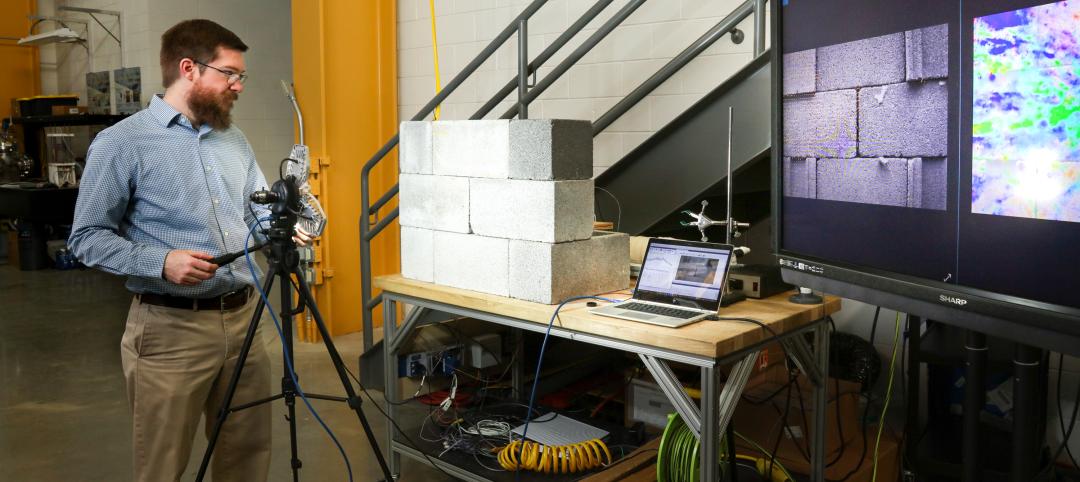

Researchers create building air leakage detection system using a camera in real time

Researchers at the U.S. Department of Energy’s Oak Ridge National Laboratory have developed a system that uses a camera to detect air leakage from buildings in real time.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sustainability | Nov 1, 2023

Tool identifies financial incentives for decarbonizing heavy industry, transportation projects

Rocky Mountain Institute (RMI) has released a tool to identify financial incentives to help developers, industrial companies, and investors find financial incentives for heavy industry and transport projects.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

Office Buildings | Oct 30, 2023

Find Your 30: Creating a unique sense of place in the workplace while emphasizing brand identity

Finding Your 30 gives each office a sense of autonomy, and it allows for bigger and broader concepts that emphasize distinctive cultural, historic or other similar attributes.

Giants 400 | Oct 30, 2023

Top 170 K-12 School Architecture Firms for 2023

PBK Architects, Huckabee, DLR Group, VLK Architects, and Stantec top BD+C's ranking of the nation's largest K-12 school building architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 100 K-12 School Construction Firms for 2023

CORE Construction, Gilbane, Balfour Beatty, Skanska USA, and Adolfson & Peterson top BD+C's ranking of the nation's largest K-12 school building contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 80 K-12 School Engineering Firms for 2023

AECOM, CMTA, Jacobs, WSP, and IMEG head BD+C's ranking of the nation's largest K-12 school building engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.